JAIIB PPB Important Questions #4 | JAIIB PPB | JAIIB 2024 Online Classes | JAIIB Oct 2024

Summary

TLDRThe video script discusses guidelines for banks and NBFCs on handling credit card disputes raised by customers, emphasizing the need for a response within 30 days. It also covers recommendations by the RBI to reduce misuse of credit cards, including issuing cards with photographs and implementing advanced verification methods. Further, the script touches on factors considered for home loan offers, the impact of interest rate types on total interest paid over the loan tenure, and conditions for financing the construction of a house on one's own plot or land. Lastly, it addresses the valuation guidelines for land used as collateral for financing, highlighting the importance of current market prices and development costs.

Takeaways

- 😀 Banks and NBFCs must respond to customer disputes on credit card bills within a maximum period of 30 days from the complaint.

- 🏦 If a dispute is raised by the customer, banks and NBFCs should provide an explanation and documentary evidence to the customer.

- 🚔 In cases where the dispute is not resolved within 30 days, customers have the option to escalate their complaint to the Banking Ombudsman.

- 🛡 To reduce misuse of credit cards, RBI has recommended issuing cards with photographs, signature verification, and advanced methods like biometrics and EMV.

- 🏠 When considering home loans, factors such as the individual's age profile, repayment capacity, repayment track record, property location, and verification reports are considered.

- 🏢 For home loans, the interest rate type (fixed or floating) significantly affects the total interest paid over the tenure of the loan.

- 💼 The quantum of loan provided to a customer depends on their gross monthly income, net monthly income, and the cost of the house.

- 🏡 Banks have conditions that must be met for financing the construction of a house on a plot or land, including obtaining necessary approvals and certificates within a specified time.

- 🚫 Banks are prohibited from providing finance for certain types of projects, such as those for government or semi-government offices, regardless of their corporate status.

- 🏔 When a land is used as collateral security for a loan, its valuation should be based on the acquisition price, development costs, and current market price.

Q & A

What should a bank or NBFC do when a customer disputes a credit card bill according to the Arab guidelines?

-According to the guidelines, if a customer disputes a credit card bill, the bank or NBFC should immediately reverse the charges and investigate the dispute, providing an explanation and documentary evidence to the customer within a maximum period of 30 days from the complaint.

What actions should be taken by banks to reduce misuse of credit cards as recommended by the RBI?

-The RBI has recommended several actions such as issuing cards with cardholder photographs, using biometric verification, and advanced methods like EMV (Europay, Mastercard, and Visa) to reduce misuse of credit cards.

How does tokenization of credit card transactions work and what is its role in securing payments?

-Tokenization in credit card transactions involves replacing sensitive card details with a unique series of numbers or tokens. This process is done to secure payments by ensuring that the actual card details are not exposed during the transaction process, thereby reducing the risk of fraud.

What factors are considered by banks when offering home loans to individuals?

-Banks consider various factors such as the individual's social status and political connections, age profile, repayment capacity, repayment track record, property location, and verification reports when offering home loans.

How do interest rate types affect the total interest paid over the tenure of a home loan?

-Fixed interest rates lead to variable total interest payments as they remain unchanged throughout the loan tenure, while floating interest rates result in higher total interest payments due to fluctuations with market landing rates, affecting the total interest paid.

What is the role of credit history and credit score in determining the terms of a home loan?

-A customer's credit history and score play a significant role as they help determine the loan approval process, the interest rate charged, and the security of the loan. A good repayment record and a high credit score can lead to a lower interest rate and a more favorable loan term.

What conditions apply when financing the construction of a house on a plot or land owned by the borrower?

-Banks have specific conditions such as obtaining a completion certificate within three months of construction completion and falling within the bank's recall of the entire loan cost and other usual bank charges if the certificate is not obtained within the stipulated time.

What are the prohibited purposes for which banks are not permitted to grant finance?

-Banks are not permitted to grant finance for the construction of government offices, semi-government offices, or any project undertaken by public sector entities regardless of their corporate status.

How should the valuation of land be conducted when financing land acquisition by a bank?

-The valuation of land for financing purposes should be based on the acquisition price and should include any development costs. The valuation should also consider the current market price of the property.

What is the significance of the RBI's guidelines in the context of credit card disputes and home loans?

-The RBI's guidelines are significant as they provide a framework for banks and NBFCs to handle customer disputes effectively and securely, ensuring customer protection and reducing the risk of fraud in credit card transactions and home loans.

How can individuals prepare for the RBI exam by utilizing the discussed topics and questions?

-Individuals can prepare for the RBI exam by thoroughly reading the concepts in the RBI's study material, practicing questions related to those concepts, and ensuring they have a clear understanding of both to achieve perfect communication and preparation.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

क्रेडिट कार्ड बिल भरण्यासाठी सर्वोत्तम दिवस | Best Day to Pay Credit Card Bill for 800+ Credit Score

BANKING OMBUDSMAN SCHEME | IMP SCHEMES | GENERAL BANKING TERMS

Win EVERY Chargeback? Expert Hack Revealed

SC allows banks to charge 30% interest rates on credit card dues | By Ankit Agrawal

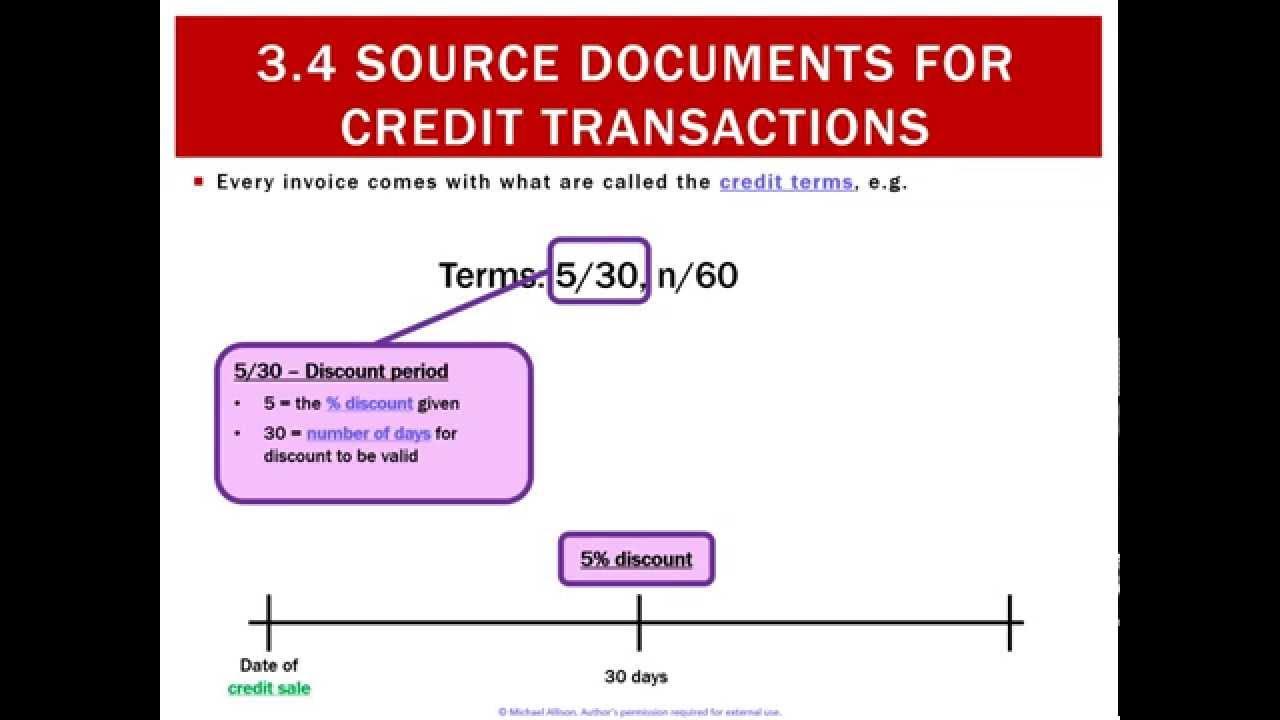

3.4 Source Documents for Credit Transactions

Capítulo 7 - Estruturas de seleção encadeada II

5.0 / 5 (0 votes)