Why The U.S. Is Failing At Its Economic Goals

Summary

TLDRThe U.S. Federal Reserve's dual mandate of stabilizing prices and maximizing employment is a balancing act that can be challenging. The script explores the tension between controlling inflation through interest rates and promoting job growth, which can be at odds. It discusses the historical context of the dual mandate, the Fed's tools like interest rate adjustments, and the debate among economists about the feasibility and effectiveness of this dual approach. Some argue for a return to a single mandate focusing on price stability, while others suggest expanding the mandate to include financial stability and income inequality. The summary highlights the complexity of central banking policy and its impact on the economy.

Takeaways

- 🏛️ The Federal Reserve's dual mandate focuses on stabilizing prices and maximizing employment, which can be challenging to balance.

- 📈 The Fed uses interest rates as a tool to control inflation; higher rates can decrease borrowing and spending, while lower rates can stimulate the job market.

- 💼 Some economists argue that it's impossible to maximize employment without causing inflation, suggesting a fundamental trade-off.

- 🌐 The dual mandate was formalized in the Federal Reserve Act of 1977, adding a focus on employment to the central bank's responsibilities.

- 💡 The Fed's strategy involves cutting interest rates during recessions to stimulate the economy or raising rates to curb inflation.

- 🏦 Central banks without a dual mandate, like the European Central Bank, focus solely on inflation, which can lead to different monetary policies.

- 🔍 The effectiveness of the dual mandate is influenced by economic conditions and broader trends, and it's subject to debate among economists.

- 🤔 Critics suggest that the Fed should revert to a single mandate focusing on price stability, arguing it promotes long-term economic stability.

- 💰 The Fed's policies can have different impacts on various income groups, with some arguing that a focus on price stability overlooks the needs of lower-income households.

- 🌱 For real economic growth and wealth, the emphasis should be on innovation, productivity, and efficiency, rather than just monetary policy adjustments.

Q & A

What is the dual mandate of the Federal Reserve?

-The dual mandate of the Federal Reserve consists of two key responsibilities: stabilizing prices and maximizing employment.

How does the Federal Reserve control price stability?

-The Federal Reserve controls price stability primarily through the use of interest rates. High inflation can be addressed by raising rates to decrease borrowing, while low interest rates can stimulate the job market by allowing companies to borrow cheap money and create more jobs.

What is the trade-off between low inflation and unemployment in the long term?

-In the long term, there is a trade-off where efforts to maximize employment can ignite price pressures, making it challenging to achieve both low inflation and low unemployment simultaneously.

Why did the Federal Reserve adopt a dual mandate?

-The dual mandate was adopted in the late 1970s when the federal government added a second mandate to address acute joblessness. The Federal Reserve Act of 1977 was passed by Congress to include this mandate.

How does the Federal Reserve respond to recessions?

-In response to recessions, the Federal Reserve typically cuts interest rates to stimulate consumption, investment, and spending, which can help combat unemployment.

What is the difference between the Federal Reserve's dual mandate and other central banks' mandates?

-Unlike the Federal Reserve's dual mandate, some other central banks have a narrower focus, primarily targeting inflation without addressing employment, such as the European Central Bank.

What is the role of the Federal Reserve's Open Market Committee (FOMC) in implementing the dual mandate?

-The FOMC, made up of members from the Fed's Board of Governors and Regional Reserve Bank presidents, meets to review financial and economic data and votes on whether to raise or lower interest rates, using the dual mandate as a guide to weigh objectives.

Why is it challenging for the Federal Reserve to balance the dual mandate objectives?

-Balancing the dual mandate is challenging because actions taken to reduce inflation, such as raising interest rates, can lead to higher unemployment, which is counter to the goal of maximizing employment.

What are some criticisms of the Federal Reserve's dual mandate?

-Some criticisms include the difficulty of measuring maximum sustainable employment, the potential for the Fed to keep interest rates too low for too long leading to inflationary pressures, and the mandate's lack of consideration for how rising costs affect lower-income households.

What alternative viewpoints are there regarding the Federal Reserve's mandate?

-Some experts suggest the Fed should return to a single mandate focusing on price stability, while others propose expanding the mandate to include financial stability, reducing income inequality, or addressing climate change.

How can the Federal Reserve's mandate be changed?

-The Federal Reserve's mandate can only be changed through legislative action by Congress, which would require a new law to alter the mandate.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

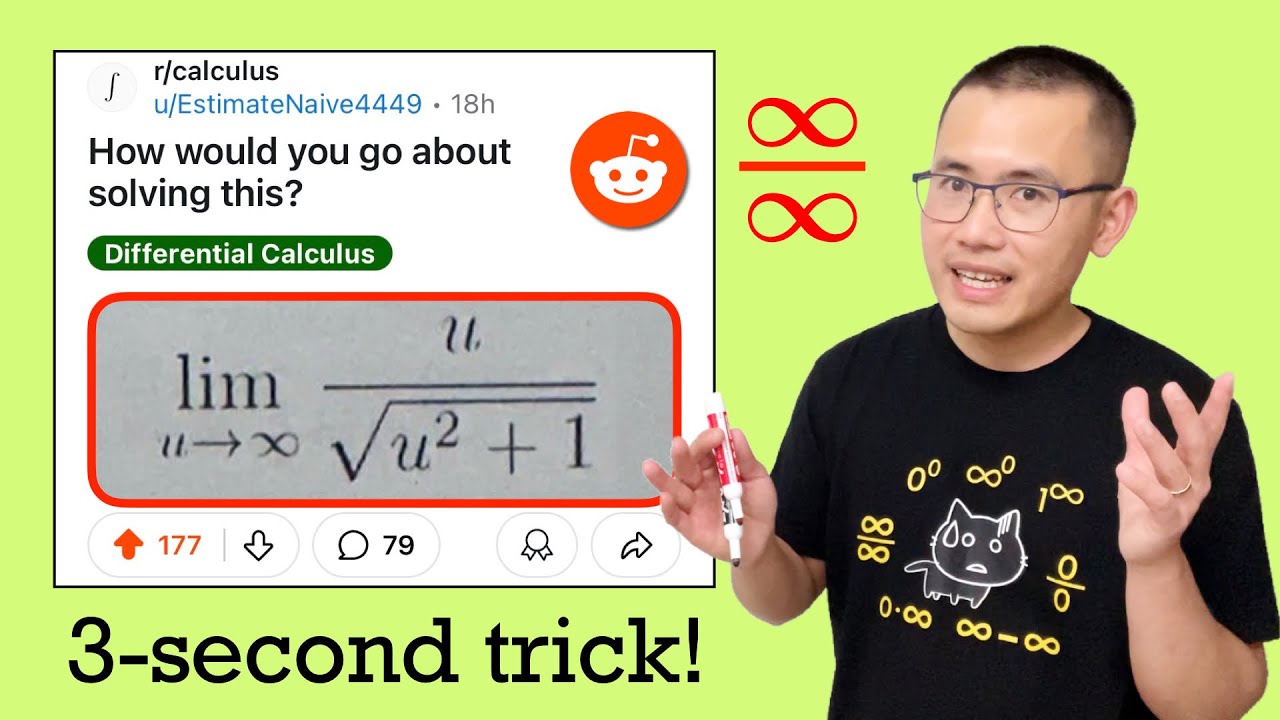

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

Embedded Linux | Introduction To U-Boot | Beginners

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

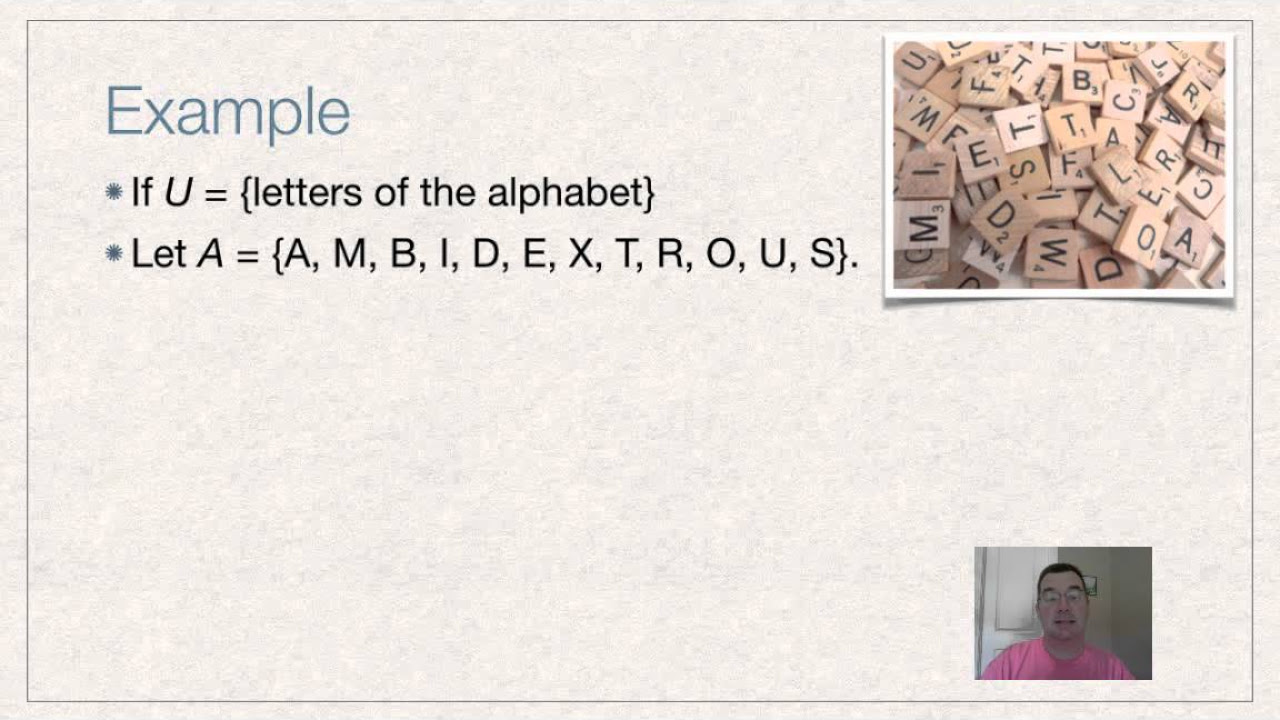

Complements of Sets

Kalah 6-0 dari Korea Utara, Timnas Indonesia U17 Gagal ke Semifinal Piala Asia

TIMNAS INDONESIA U17 KALAH SEGALANYA DARI KORUT DAN TERSINGKIR DARI PIALA ASIA!

5.0 / 5 (0 votes)