What's in an Equity Research Report?

Summary

TLDRThis tutorial video explains the components and structure of equity research reports, contrasting them with stock pitches. It emphasizes the focus on recent company updates, mainstream views, and specific target prices in research reports. The video also covers the differences in detail and rigor between investment theses, catalysts, and risk factors in stock pitches versus equity research reports, using examples from real and created reports.

Takeaways

- 📈 Equity research reports are comprehensive analyses of a company's financial health and future prospects, focusing on providing insights to investors and institutions.

- 🎯 A key difference between stock pitches and equity research reports is the level of conviction and detail; stock pitches are more assertive with specific catalysts and risks, while equity reports are more generalized.

- 📊 Equity research reports typically include sections on company background, investment thesis, catalysts, valuation, and investment risks, with a balanced approach rather than extreme views.

- 📉 Unlike stock pitches, equity research reports usually avoid detailing worst-case scenarios, focusing more on the positive aspects and potential of the company.

- 💼 The reports are often used by banks and financial institutions to promote trading activity in the stocks they cover, aiming to provide value to their clients and generate commissions.

- 📝 Recent results and announcements are given significant weight in equity research reports, as they provide timely updates that are crucial for investors making immediate decisions.

- 🔢 The reports often include specific target prices, which are precise figures that the analysts predict the stock price will reach, differing from the broader valuation ranges used in stock pitches.

- 📉 Equity research analysts tend to align with the mainstream views, avoiding extreme opinions that could potentially harm the bank's credibility and relationship with institutional clients.

- 💭 The investment thesis, catalysts, and risk factors in equity research are presented in a supportive manner to the overall recommendation, rather than being the core of the argument as in stock pitches.

- 📚 Understanding the structure and rationale behind equity research reports is crucial for anyone looking to work in financial analysis or investment banking, as it forms the basis of many case study tasks and interviews.

Q & A

What is the primary focus of an equity research report?

-An equity research report primarily focuses on providing detailed analysis and recommendations about a company's stock, including its current performance, future prospects, and potential risks.

How does an equity research report differ from a stock pitch?

-An equity research report is a more comprehensive and less biased analysis compared to a stock pitch. It includes a broader range of information such as company background, industry data, and detailed valuation, while a stock pitch focuses on strong views about a company's mispricing and specific catalysts that could significantly change the stock price.

What are the typical sections found in an equity research report?

-Typical sections in an equity research report include an update on the company, a rating (buy, sell, or hold), a price target, recent results and announcements, investment thesis, catalysts, valuation, and risk factors.

Why do equity research reports rarely include a worst-case scenario section?

-Equity research reports rarely include a worst-case scenario because the goal is generally to promote the companies being covered, rather than to speculate on extreme negative outcomes.

What is the significance of target prices in equity research reports?

-Target prices in equity research reports are specific price points at which analysts believe a stock will trade within a certain time frame, typically 12 months. They are used to provide a clear investment recommendation.

How do equity research reports handle investment risks?

-Equity research reports handle investment risks by mentioning potential risks but without assigning specific dollar values or share price impacts. This is done to cover the analysts in case their recommendations do not pan out as expected.

What is the role of recent results and announcements in an equity research report?

-Recent results and announcements play a significant role in equity research reports as they provide timely updates on a company's performance and can influence short-term stock price movements.

Why are views in equity research reports typically not far outside the mainstream?

-Views in equity research reports are typically not far outside the mainstream because analysts are less motivated to take extreme positions, and banks want to maintain credibility and trading volume with institutional clients.

How does the structure of an equity research report compare to that of a stock pitch?

-An equity research report is structured to provide a detailed and balanced analysis, including company background and industry data, while a stock pitch is structured to persuade with a strong investment thesis, catalysts, and risk mitigation strategies.

What are the implications of assigning specific target prices in equity research reports?

-Assigning specific target prices in equity research reports implies a level of precision that may not be warranted, as valuation is inherently uncertain. It can lead to a false sense of accuracy and may not reflect the range of possible outcomes.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How to Write Effective Report and Essay | Talent and Skills HuB

Materi 11: Penulisan Karya Ilmiah 2; Sistematika Karya Ilmiah

Myob Accounting Perusahaan Jasa - Laporan Keuangan, Backup & Restore

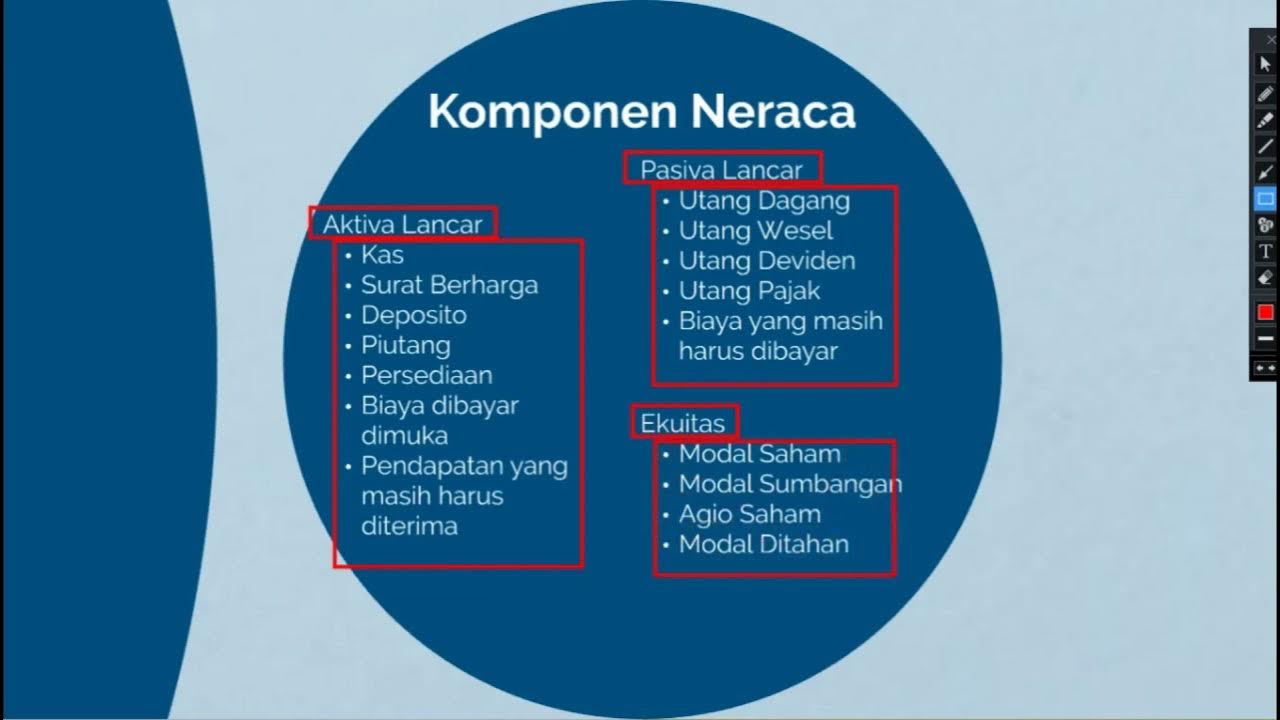

VIDEOAULA | Composição Patrimonial (Elementos e contas)| Profa.-Tutora Kessyane Horbucz

Video Pembelajaran Jenis Laporan keuangan

UNNES Laporan Keuangan Konsolidasi pada Akuisisi : Metode Ekuitas 2

5.0 / 5 (0 votes)