Coal India Q1FY25 Earnings Today, Expect Margin To Remain Largely Flat | CNBC TV18

Summary

TLDRCoal India is set to release its financial results, with expectations of a flat top line and a potential 2% decline in earnings. The operational numbers show a 5-1.5% volume increase, but the top line remains flat due to lower e-auction pricing. Analysts estimate a profit of around 8,000 crores with a margin of 28.5%. The focus will be on pricing trends, particularly in e-auctions, power demand, and any plans for the company's cash reserves. A potential price hike will be closely monitored.

Takeaways

- 📈 Coal India's Top Line is expected to be flat despite a 5-1/2% increase in volumes.

- 📉 There might be a 2% decline in Coal India's bitter number.

- 💼 Profit numbers are anticipated to be around 8,000 crores.

- 🔍 Realizations are expected to be lower due to pressure on e-auction pricing.

- 🔔 The street is prepared for lower blended realizations offsetting any volume gains.

- 📉 Margins are expected to compress due to weak pricing, with estimates suggesting a decline of 30-35%.

- 📚 Volumes are expected to be slightly higher, which may offset some of the realization decline.

- 💼 The margin number is projected to be around 28-1/2%.

- 🔎 Analysts will be closely watching the pricing trends, especially in e-auctions, power demand, and any cash initiatives.

- ⚠️ There is a possibility of a price hike that needs to be monitored closely.

Q & A

What is the expected financial performance of Coal India for the upcoming report?

-The financial performance of Coal India is anticipated to show a flat top line with a possible decline of around 2%. The profit numbers are expected to be around 8,000 crores.

Why is the top line of Coal India expected to be flat despite an increase in volumes?

-The top line is expected to be flat because although volumes are up by approximately 5.5%, realizations are expected to be down due to pressure on e-auction pricing.

What is the impact of e-auction pricing on Coal India's financials?

-E-auction pricing is under pressure, leading to lower blended realizations, which offset any positive impact from increased volumes on the top line.

How are the margins expected to be affected by the weak pricing?

-Margins are expected to compress due to weak pricing, with an estimated decline of around 30 to 35% in e-auction prices.

What is the expected margin percentage for Coal India in the upcoming report?

-The expected margin percentage for Coal India is around 28.5%.

What operational factors are expected to offset the impact of low realizations?

-The increase in volumes is expected to partly offset the impact of low realizations from e-auctions, providing some operating leverage.

What are the key areas of focus for investors in Coal India's upcoming report?

-Investors should focus on how pricing is shaping up, particularly in e-auctions, the state of power demand, and any plans regarding cash in the books.

Is there any expectation of a price hike in Coal India's operations?

-There is a possibility of a price hike that investors will need to track closely.

What is the significance of the upcoming numbers for Tata Steel and Coal India?

-The upcoming numbers for both Tata Steel and Coal India are significant as they are expected to provide insights into the performance of these companies during a busy financial reporting period.

What are the expectations regarding cash management in Coal India's upcoming report?

-Investors will be looking for information on how Coal India plans to manage its cash, especially considering the potential impact of lower realizations on cash flow.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

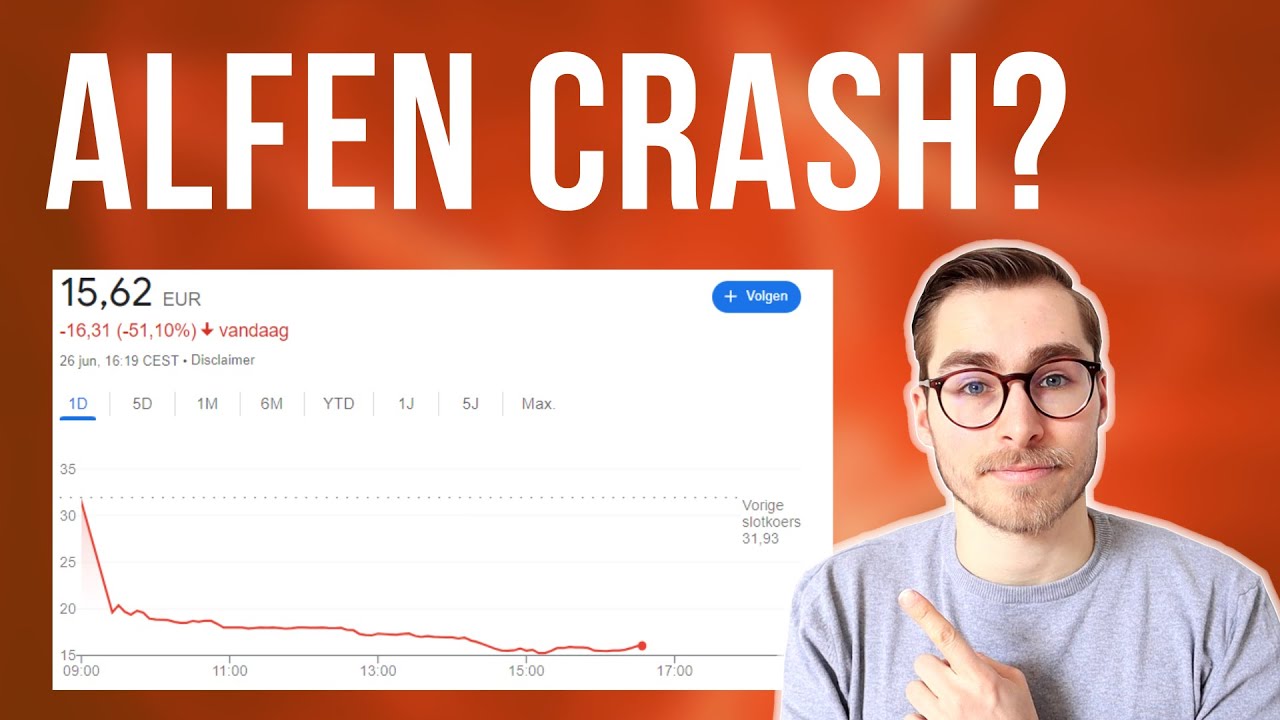

Wat is er aan de hand met ALFEN?

The end of Palantir? (Why $PLTR is down and keeps dropping?)

TESLA Stock - TSLA Earnings Movement

Should You Buy Palantir Stock Before 2025? | PLTR Stock Analysis | PLTR Stock Prediction |

Monthly Market Outlook (August 2024) by Prateek Agrawal

Expect EBITDA & Margin To Be Better By The End Of This Year: Mankind Pharma | CNBC TV18

5.0 / 5 (0 votes)