(월급날)2023귀속 연말정산 시스템 매뉴얼

Summary

TLDRThe script provides a step-by-step guide on how to use the year-end tax settlement service on the 월급날 (Salary Day) platform. It instructs users to log in, change their initial password, and confirm personal information. The process includes uploading documents for previous jobs, registering dependents, and uploading necessary tax documents from the National Tax Service. Users can also input details directly from the tax office and check housing loan deductions if applicable. The platform offers a review and finalization of the input data, with a clear emphasis on the importance of accurate information for tax settlement.

Takeaways

- 📅 Access the year-end settlement tutorial by typing 'text hyphen rephone co.kr' in the address bar and clicking the start button.

- 🔍 In case of lost login information, use the ID or password recovery feature.

- 🔑 The initial password is the first six digits of your resident registration number, which should be changed upon first login.

- ✅ Agree to the personal information usage consent form to proceed with the service.

- 👤 Review and update your personal information if necessary, ensuring it matches reality.

- 🏢 Input information about previous employers if applicable, uploading relevant tax documents and proof of income.

- 👨👩👧👦 Register and review dependents in the dependents tab, checking the applicable deduction conditions.

- 📄 Upload the National Tax Service PDF file obtained from HomeTax to the electronic documents tab.

- 📋 Enter or modify details from the National Tax Service in the 'Input/Modify' section.

- 🏠 If you have housing loan interest, ensure to check the relevant deduction conditions.

- 📱 Use the 'Mobile File Upload' button to upload supporting documents from your phone if available.

- 🔄 In the 'Result Inquiry' tab, you can change or confirm personal information, and if needed, initialize all entries.

Q & A

What is the first step to access the year-end settlement service?

-The first step is to type 'https://rephon.co.kr' in the address bar and press enter to access the website.

How does one log in to the year-end settlement service?

-Log in by entering your ID and password. If lost, use the 'Find ID' or 'Find Password' feature. The initial password is the first six digits of your resident registration number, which should be changed upon the first login.

What is required to proceed to the next step of the service?

-You must agree to the personal information usage policy by checking the box and pressing confirm to proceed.

How can you check and update your personal information?

-You can review and update your personal information by selecting the appropriate option, and if necessary, you can change it to reflect current details.

What should you do if you have a previous workplace?

-Click the 'Add Previous Workplace' button and upload the necessary documents such as the labor income withholding certificate and proof of income.

How can you register dependents for tax deductions?

-Go to the 'Dependent' tab, register your dependents, and check the dependents from the previous year's settlement. Ensure the dependents' resident registration numbers are correct and check the applicable deduction conditions.

What is the purpose of uploading the National Tax Service's PDF file?

-The purpose is to input the necessary information from the National Tax Service's documents, such as income details and tax payments, to facilitate the year-end settlement process.

What should you do if you have housing loan interest deductions?

-Check the 'Housing Loan Interest Deduction' condition if applicable. Only those who meet the criteria can receive the deduction.

How can you upload supporting documents using your phone?

-If you have the supporting documents saved on your phone, click the 'Mobile File Upload' button. You will receive a notification message on KakaoTalk, and you can then select the relevant deduction item and upload the files.

What happens if you need to modify the information after the initial online submission?

-You can click the 'Reset' button for a complete initial reset or modify specific entries as needed.

What is the final outcome of the year-end settlement process?

-The final outcome is the confirmed amount that reflects the employer's input results. The year-end settlement review result is the final amount determined after the '월급날' (Payday) reviews.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

CARA BUAT BUKTI POTONG PPH 21 KARYAWAN DAN LAPOR SPT MASA PPH 21 DI CORETAX MULAI 2025

Tutorial Efiling 2022: Cara Lapor Pajak SPT Tahunan Secara Online Penghasilan Dibawah Rp 60 Juta

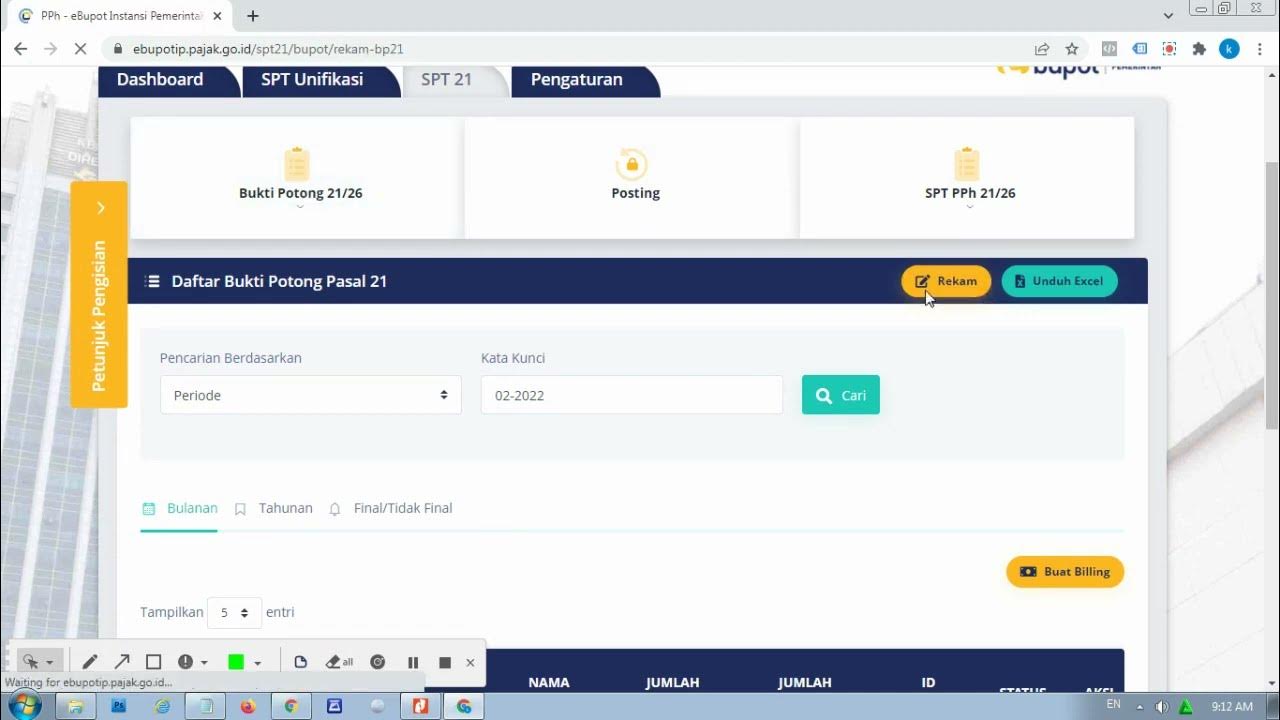

Tata Cara input PPh 21 di E-Bupot dan Pelaporannya

Cara Lapor SPT Tahunan PPh Orang Pribadi Pengusaha UMKM | Tutorial Lengkap

How do I add a tax to my business tax account?

Curso Básico Contpaqi Nómina. Como dar de alta a un empleado.

5.0 / 5 (0 votes)