Money and Credit | 10 Minutes Rapid Revision | Class 10 SST

Summary

TLDRThis educational video script delves into the importance of money and credit in an economy. It explains the evolution of money from a bartering system to modern forms like currency notes, coins, and bank deposits. The script further explores various sources of credit, how credit operates in different situations, and the role of terms of credit. It also discusses formal and informal sources of credit in India, emphasizing the significance of self-help groups in providing affordable credit options. The video aims to educate viewers on the complexities of money and credit, encouraging financial literacy and responsible borrowing practices.

Takeaways

- 😀 Money serves as a medium of exchange, facilitating transactions by acting as an intermediary.

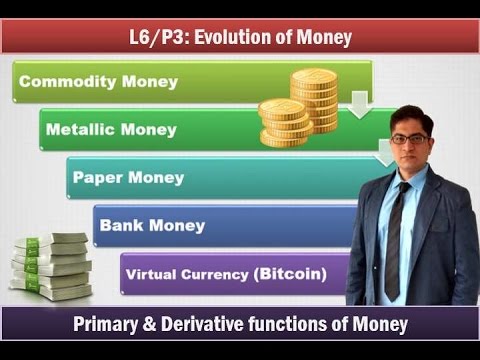

- 📈 The evolution of money includes forms like coins, currency notes, and deposits with banks, which are used to meet demands and needs.

- 🏦 Banks play a crucial role in the economy by accepting deposits and extending loans, thus creating a cycle of economic activity.

- 💼 Credit is essential for economic growth, providing individuals and businesses with the funds needed to invest and produce goods or services.

- 🔍 Different sources of credit exist, including formal institutions like banks and cooperatives, and informal sources such as money lenders and friends or relatives.

- 📊 The terms of credit are important and include the interest rate, repayment terms, and any collateral that might be required.

- 🌐 In India, there is a significant divide between the formal and informal credit sectors, with the latter often charging high interest rates and lacking regulation.

- 🏡 Rural households in India are more likely to rely on informal credit sources due to the lack of access to formal credit institutions and the documentation they require.

- 🤝 Self-help groups can play a vital role in providing affordable credit to their members, promoting financial discipline, and reducing the reliance on exploitative informal credit sources.

- 🌟 The Grameen Bank of Bangladesh, initiated by Muhammad Yunus, is a prominent example of a self-help group model that has empowered many economically.

Q & A

What is the primary function of money as discussed in the script?

-Money serves as a medium of exchange, allowing for the purchase of goods without the need for barter.

What are the modern forms of money mentioned in the script?

-Modern forms of money include currency notes, coins, deposits with banks, and bank activities.

How does the script describe the role of banks in the economy?

-Banks accept deposits, extend loans, and create demand deposits, which can be withdrawn by demand. They also offer facilities like checks and make a profit from the interest rate difference between what they pay to depositors and what they charge borrowers.

What is the significance of credit as explained in the script?

-Credit is essential as it allows for the purchase of goods and services now with the promise to pay later. It plays a crucial role in economic activity and development.

What are the different sources of credit mentioned in the script?

-The script mentions formal sources like banks and cooperatives, and informal sources such as money lenders, friends, and relatives.

How does the script differentiate between formal and informal credit sources?

-Formal credit sources have regulated terms and are supervised by authorities like the RBI, while informal sources are unregulated and may involve exploitation and high interest rates.

What role do self-help groups play in providing credit as discussed in the script?

-Self-help groups create a collective pool of savings among members and provide loans to each other at lower interest rates, avoiding exploitation and improving financial discipline.

Why do rural households often resort to informal credit sources according to the script?

-Rural households often lack the necessary documentation required by formal credit sources, leading them to informal sources despite the risks.

What is the Grameen Bank model mentioned in the script, and who is its founder?

-The Grameen Bank model is a microfinance model started by Muhammad Yunus in Bangladesh, which provides financial services to the poor, particularly in rural areas.

How does the script suggest improving access to credit for rural households?

-The script suggests that banks should expand their reach to rural areas and ensure that credit is accessible not only to the rich and profit-making businesses but also to the poor to promote economic activity and national development.

What is the importance of terms of credit as highlighted in the script?

-Terms of credit include the conditions and agreements made when a loan is taken, such as the interest rate, repayment mode, and collateral. These terms are crucial for both the lender and the borrower to understand their obligations and rights.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)