Бізнес рахунок ФОПа - нюанси використання! Що заборонено? Карта ключ? Чи обов'язково відкривати?

Summary

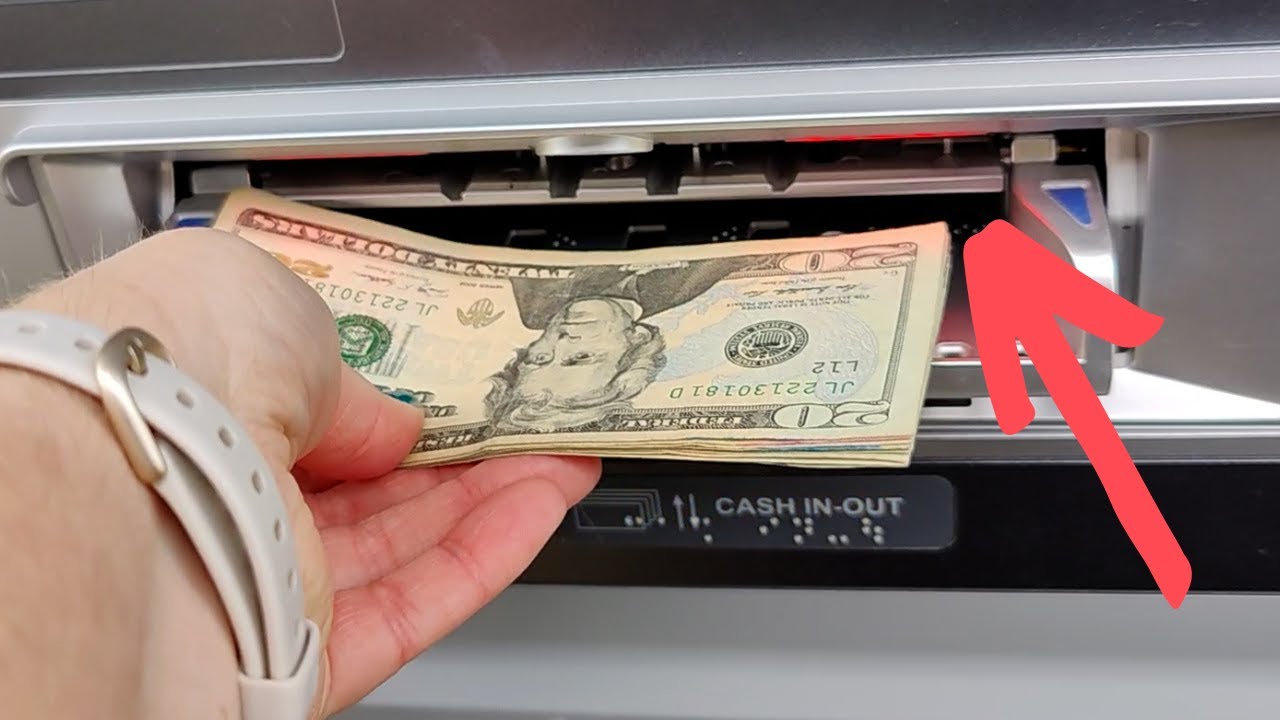

TLDRThe video script by a tax consultant, Mikhail Smakovich, addresses the proper use of a cash register for entrepreneurs, the distinction between a cash register and a 'FOP' account, and the use of a 'key card'. It explains the necessity of a FOP account for non-cash transactions, the importance of correctly specifying payment purposes, and the application of fiscal checks. The script also discusses the limitations and proper methods for withdrawing cash, transferring funds, and depositing personal money into a FOP account, emphasizing compliance with tax regulations to avoid penalties.

Takeaways

- 😀 The video discusses proper use of a business account for entrepreneurs, including the use of a key card and the difference between it and a FOP (Financial Operations Profile) account.

- 🔑 It clarifies that there is no direct requirement to open a business account immediately after establishing a FOP, but it is necessary if non-cash income is received.

- 💼 The video emphasizes the importance of correctly specifying the purpose of payment when receiving non-cash payments to avoid tax issues.

- 📈 It explains different methods of receiving non-cash payments, such as post-terminals, internet acquiring, and issuing accounts for customers to make payments.

- 🚫 The presenter warns against the temptation to provide the key card number for direct payments, as it is meant for the entrepreneur to spend the non-cash income, not receive it.

- 💰 Banks set limits on transactions using the key card to prevent misuse, such as a monthly limit of 30,000 UAH in PrivatBank.

- 🚷 The video advises against depositing personal money into the FOP account as it can be considered as personal income and taxed accordingly.

- 🛒 It mentions the possibility of using the key card for cash withdrawals with certain limits and fees, and the importance of monitoring these transactions for compliance.

- 💡 The presenter shares a personal strategy for avoiding cash withdrawal fees by transferring money from the key card to a universal card without a fee.

- 📊 The video touches on the topic of transferring money from the FOP account to personal accounts, debunking the myth that it must be done after tax payment.

- 🏦 The importance of keeping business and personal finances separate is highlighted, and the video provides guidance on how to handle various financial transactions for entrepreneurs.

Q & A

What is the main topic of the video script?

-The main topic of the video script is the proper use of a business account for entrepreneurs, including the difference between a business account and a cash account, how to deposit personal money into a cash account, and how to withdraw cash without fees.

What is a 'FOP' in the context of the script?

-In the context of the script, 'FOP' refers to a type of business entity in Ukraine, which is a small business owner or an individual entrepreneur.

Why might an entrepreneur need to open a business account?

-An entrepreneur might need to open a business account to receive non-cash payments, which is a requirement if they have non-cash income that needs to be deposited into the FOP account.

What is the purpose of a 'Key Card' mentioned in the script?

-The 'Key Card' is used to access the funds on the FOP account. It is designed for the entrepreneur to spend the non-cash income received on the FOP account, not for receiving payments.

What are the limitations regarding the use of the Key Card for receiving payments?

-The Key Card is not intended for receiving payments. Banks set limits on transactions made using the Key Card to receive money, and exceeding these limits can lead to blocked transactions and possible financial monitoring by the bank.

How should an entrepreneur correctly accept non-cash payments?

-An entrepreneur should ensure that payments are made with the correct payment purpose indicated. For example, if providing design services, the payment should be indicated as such and not for an unrelated item like a refrigerator.

Is it necessary to issue a fiscal receipt when accepting non-cash payments on a FOP account?

-It depends on the situation. If the payment is made directly to the FOP account based on the account details, a fiscal receipt may not be required. However, for internet acquiring, a fiscal receipt must be issued.

What are the common methods for accepting non-cash payments mentioned in the script?

-The script mentions several methods, including post-terminals, internet acquiring, and creating payment links or QR codes for customers to pay through.

What is the recommended way to withdraw large amounts of cash from a Key Card without incurring high fees?

-The script suggests transferring money from the Key Card to a universal card without a fee, then to a payment card with a withdrawal fee of 50 UAH, allowing for large cash withdrawals with minimal fees.

What are the daily and monthly limits for cash withdrawal from a Key Card according to the script?

-The daily limit for cash withdrawal from a Key Card is 100,000 UAH, and there is a monthly limit of 500,000 UAH, beyond which the bank may require additional documentation.

Can an entrepreneur deposit personal money into a FOP account to pay taxes or suppliers?

-Yes, an entrepreneur can deposit personal money into a FOP account to cover expenses such as taxes or payments to suppliers, and it is not considered an income of the FOP.

How should an entrepreneur withdraw money from a FOP account to a personal account?

-An entrepreneur can withdraw money from a FOP account to a personal account by transferring funds through a service like Privat24 or a business cabinet, without the need to pay taxes on the amount first.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)