How to be smart with your capital-gain tax now

Summary

TLDRThe video script from Ed Money's YouTube channel explains the revamped capital gains tax rules following the Union Budget for FY25. It simplifies the new tax rates for various investments, including mutual funds, stocks, real estate, and bonds, highlighting the increased short-term tax rate and the revised long-term tax rates. The script also addresses the removal of indexation benefits and the changes in taxation for debt funds, hybrid funds, and unlisted investments, aiming to clarify the implications for investors.

Takeaways

- 📊 The 2024 Union Budget has significantly reformed capital gains tax rules, impacting various asset classes including mutual funds, stocks, real estate, and bonds.

- 📈 The holding period for long-term capital gains has been revised to 12 months for equity shares and 24 months for other assets, simplifying the classification of short-term and long-term gains.

- 💼 The short-term capital gains tax rate for equity shares and equity-oriented funds has been increased from 15% to 20%, affecting high net worth individuals.

- 📉 Long-term capital gains tax rates have been standardized to 12.5% for all asset categories, with an exemption limit raised from 1 lakh to 1.25 lakh for equity shares with Securities Transaction Tax (STT) paid.

- 🚫 The indexation benefit, which adjusts gains against inflation, has been removed for certain assets to simplify tax computation for taxpayers and the tax administration.

- 🔄 There is now parity in taxation between resident and non-resident assesses, leveling the playing field for tax liabilities.

- 🏢 The budget corrected an oversight regarding debt-oriented funds, clarifying that they must invest at least 65% in debt and money market instruments to be considered as such for tax purposes.

- 📉 Tax implications for equity funds have changed, with short-term gains taxed at 20% and long-term gains at 12.5%, with an exemption limit of 1.25 lakh for long-term gains.

- 🏦 For debt funds, the tax treatment depends on the purchase date, with funds bought after April 1, 2023, taxed at the slab rate irrespective of the holding period.

- 🏠 Real estate taxation has been altered, with properties held for 24 months or more now subject to a 12.5% long-term capital gains tax, and shorter periods taxed at the slab rate.

- 🌐 The budget has also impacted the taxation of other mutual funds, such as gold and silver funds, and international funds, with changes to holding periods and tax rates.

Q & A

What major change did the union budget for FY25 bring to capital gains taxation?

-The union budget for FY25 overhauled the entire capital gains taxation, simplifying the holding periods to 12 months for real estate securities and 24 months for other assets, revising tax rates, and removing indexation benefits for certain assets, among other changes.

What is the revised short-term capital gains tax rate for equity shares and equity-oriented mutual funds?

-The short-term capital gains tax rate for equity shares, units of equity-oriented mutual funds, and units of business trusts has been increased from 15% to 20%.

What is the new long-term capital gains tax rate for all categories of assets?

-The new long-term capital gains tax rate is proposed to be 12.5% for all categories of assets, up from the previous rates of 10% for STT paid equity shares and 20% with indexation for other assets.

How has the tax exemption limit for long-term capital gains changed?

-The limit of tax exemption for long-term capital gains has been increased from 1 lakh to 1.25 lakh, applicable only in the case of equity shares where Securities Transaction Tax (STT) has been paid.

Why was the indexation benefit removed for certain assets?

-The indexation benefit was removed to ease the computation of capital gains for taxpayers and tax administration, making the tax calculation process simpler.

What is the impact of the new tax rules on equity funds?

-The new tax rules have increased the short-term capital gains tax to 20% and long-term capital gains tax to 12.5% for equity funds, with an exemption limit of 1.25 lakh on long-term gains.

How does the budget affect the taxation of debt funds bought before and after 1st April 2023?

-Debt funds bought after 1st April 2023 are taxed at the slab rate irrespective of the holding period. For those bought before this date, the tax depends on the selling date, with different rules applying before and after the budget day of 23rd July 2024.

What are the tax implications for hybrid funds under the new budget?

-Equity-oriented hybrid funds are taxed like equity funds, with a 1.25 lakh exemption on long-term gains. Debt-oriented hybrid funds are taxed like debt funds, and those with equity exposure between 35% and 65% have varying tax rates depending on the selling date and holding period.

How have the taxation rules for unlisted stocks been revised in the budget?

-For unlisted stocks, if sold before 24 months of holding, the gains are taxed at the slab rate, and if sold after 24 months, a tax of 12.5% is applied on the gains. The indexation benefit has been removed, and there is no exemption limit for long-term gains.

What changes have been made to the taxation of listed bonds and debentures?

-For listed bonds and debentures, the holding period to qualify for long-term taxation of 12.5% has been reduced to 12 months. For unlisted bonds, the tax is at the applicable slab rate regardless of the holding period.

What are the tax implications for REITs and InvITs under the new budget?

-For listed REITs and InvITs, the taxation is now similar to stocks, with a 1.25 lakh exemption on long-term capital gains. For unlisted REITs and InvITs, there is no exemption, and the holding period must be at least 24 months to qualify as long-term investments.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Comprehensive Analysis of Union Budget 2024 | Initiatives, Schemes and Statistics Explained

Budget 2024 : Biggest mistake of the Modi govt? | Complete analysis

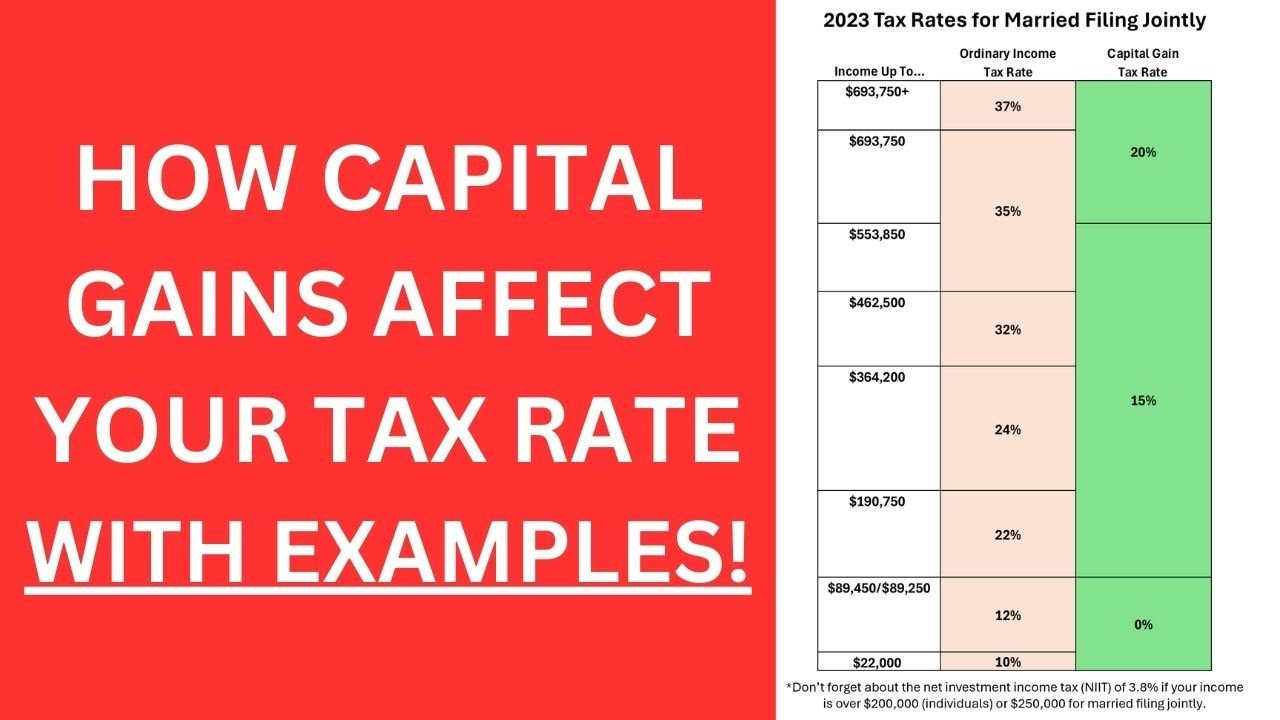

NEW! - Can Capital Gains Push Me Into a Higher Tax Bracket?

How the rich avoid paying taxes

how long term capital gain tax rule will benefits or become curse real estate

Indian Budget 2024 EXPLAINED in 10 minutes | Real Winners & Losers

5.0 / 5 (0 votes)