Session 5 - 08 What is a BAS

Summary

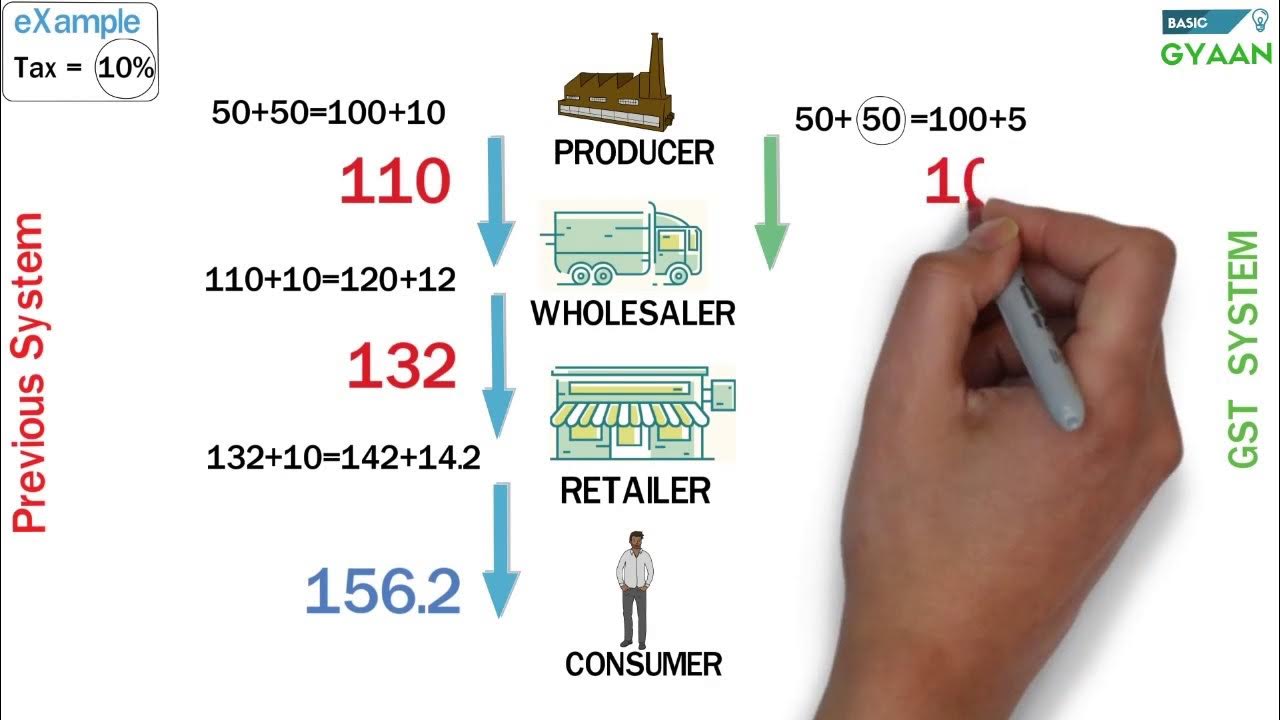

TLDRThe video script discusses Australia's Goods and Services Tax (GST), which is a 10% tax on most goods, services, and other items sold or consumed within the country. It clarifies that not all items are subject to GST, with some being 'GST-free' and others 'excluded'. The script also introduces the Business Activity Statement (BAS), a form lodged online by businesses to report tax obligations, including GST, pay-as-you-go withholding, installments, and other taxes such as fringe benefits tax. It mentions additional taxes like wine equalization and luxury car tax but indicates they are not the focus of the current discussion.

Takeaways

- 📊 GST is a broad-based tax of 10% levied on most goods, services, and other items sold or consumed in Australia.

- ❗ Not all goods and services in Australia are subject to GST; some are 'GST-free', and others are 'excluded' from GST.

- 📆 A Business Activity Statement (BAS) is a form submitted to the Australian Taxation Office by registered business entities to report their tax obligations.

- 💻 The BAS is now typically lodged online, rather than submitting physical forms.

- 💼 BAS includes reporting on GST, pay as you go (PAYG) withholding, which is the amount deducted from employees' salaries.

- 🚗 Pay-as-you-go installments are advance payments for company tax for the upcoming financial year.

- 🍷 The BAS also covers fringe benefits tax, which targets non-salary benefits such as paying for employees' children's school fees.

- 🚗 Wine equalization tax, luxury car tax, and fuel tax credits are part of the BAS, although they may not be relevant to all businesses.

- 🔍 There will be a future session dedicated to GST, providing more detailed information on the topic.

- 👀 The speaker hints at the complexity of GST and the potential for future discussions to clarify and explore the topic in depth.

Q & A

What is GST?

-GST stands for Goods and Services Tax. It is a broad-based tax of 10% on most goods, services, and other items sold or consumed in Australia.

Are all goods and services in Australia subject to GST?

-No, not all goods and services attract GST. Some are 'GST-free', and others are 'excluded' from GST, which means they do not fall under the tax.

What is a BAZ?

-A BAZ, or Business Activity Statement, is a form submitted to the Australian Taxation Office by registered business entities to report their tax obligations.

How is the BAZ submitted to the Australian Taxation Office?

-The BAZ is lodged online by registered business entities, rather than submitting physical forms.

What does the BAZ include in its reporting?

-The BAZ includes reporting on GST, Pay As You Go (PAYG) withholding, PAYG installments, Fringe Benefits Tax, Wine Equalization Tax, Luxury Car Tax, and fuel tax credits.

What is PAYG withholding?

-PAYG withholding is the amount deducted from an employee's gross salary, which is a form of tax withheld at the source of income.

What are PAYG installments?

-PAYG installments refer to the company tax that is paid in advance for the next financial year.

What is Fringe Benefits Tax and why was it introduced?

-Fringe Benefits Tax is a tax on additional benefits provided to employees, such as school fees for their children, introduced by the government to regulate payments made in lieu of salary.

What is the Wine Equalization Tax?

-The Wine Equalization Tax is a specific tax mentioned in the BAZ reporting, although the script does not provide details about its application or purpose.

What is the Luxury Car Tax?

-The Luxury Car Tax is another specific tax included in the BAZ reporting, but the script does not elaborate on its specifics.

What are fuel tax credits and why are they mentioned in the script?

-Fuel tax credits are mentioned in the script as part of the BAZ reporting, but they are stated to not be a concern at the moment, suggesting they are not the focus of the current discussion.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

PPN (1)

GST Easy Explanation (Hindi)

Apa Itu Pajak Masukan dan Pajak Keluaran dalam PPN? - ConTAXtual Eps 9

Goods Transport Agency under GST | What is GTA | Taxability | Exemptions | RCM for GTA | POS

GST Explained In Telugu - Complete Details About GST In Telugu | Advantages Of GST | @KowshikMaridi

Massive GST Fraud unveiled in Delhi | Know all about it | UPSC

5.0 / 5 (0 votes)