Fundamentals of Accountancy, Business and Management 2 for Grade 12 - Module 1 (Chapter 1/Week 1)

Summary

TLDRThis web class by Teacher Jeans delves into the fundamentals of accountancy, focusing on the statement of financial position, also known as the balance sheet. It explains the components of assets, liabilities, and equity, and their classification into current and non-current items. The lesson guides students through preparing a balance sheet for a single proprietorship, emphasizing the importance of this financial statement in assessing a company's financial health and predicting future earnings.

Takeaways

- 📚 The video script is a lesson on the fundamentals of accountancy, focusing on the statement of financial position, also known as the balance sheet.

- 🔍 The balance sheet presents the financial position of an entity at a specific date and helps assess the financial health and trends of a business over time.

- 💼 It is crucial for identifying the entity's liquidity, financial, credit, and business risks, and for comparing with competitors' financial statements.

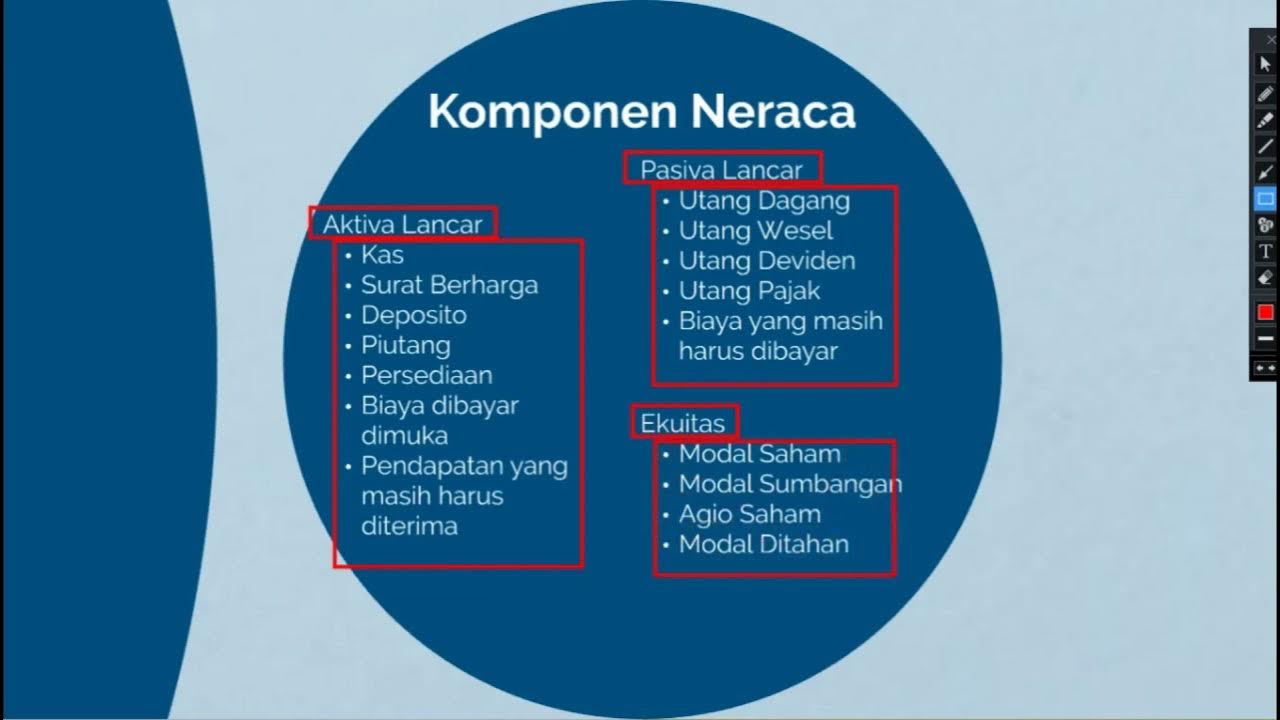

- 📈 The statement of financial position consists of assets, liabilities, and equity, reflecting what the business owns, owes, and the residual interest belonging to the owners.

- 🏦 Assets can be classified as current (to be realized within one year) or non-current (long-term assets held over one fiscal year).

- 💰 Current assets include cash, cash equivalents, accounts receivable, and inventories, while non-current assets include property, plant, equipment, intangible assets, and investment properties.

- 📋 Liabilities are obligations that can be current (to be settled within one year) or non-current (not expected to be liquidated within one year).

- 🏢 Examples of current liabilities include accounts payable, notes payable, and taxes payable, while non-current liabilities may include long-term loans and bonds payable.

- 📊 Equity for a sole proprietorship is referred to as owner's equity, reflecting the net effect of investments, withdrawals, net income or loss, and other adjustments.

- 📝 Preparing a statement of financial position involves presenting a heading with the entity's name, statement title, and reporting period, followed by assets, liabilities, and owner's equity.

- 📊 The statement can be presented in report form (vertical format) or account form (horizontal format), with a double rule to indicate the final figures.

Q & A

What is the purpose of the statement of financial position in business?

-The statement of financial position, also known as the balance sheet, presents the financial position of an entity at a given date, helping users assess the financial health or soundness of the company or business, and identifying underlying trends in the financial position of the firm.

How does the statement of financial position help in assessing a company's risks?

-The statement of financial position can help in determining the state of the entity's liquidity risk, financial risk, credit risk, and business risk, especially when used in conjunction with other financial statements of the entity or its competitors.

What are the three main components of the statement of financial position?

-The three main components of the statement of financial position are assets, liabilities, and equity.

What is the accounting equation that represents the relationship between assets, liabilities, and equity?

-The accounting equation is Assets = Liabilities + Equity, which shows that the total assets of a business must be equal to the sum of its liabilities and equity.

What is the difference between current and non-current assets?

-Current assets are those expected to be realized within one year from the reporting date, while non-current assets are long-term assets that a company expects to hold over one fiscal year.

Why is cash considered a current asset?

-Cash is considered a current asset because it can be readily converted within one year and can be used to pay short-term obligations, including bills and coins in hand, bank accounts, and operating funds.

What are some examples of current assets other than cash?

-Examples of current assets other than cash include cash equivalents, accounts receivable, notes receivable, trading securities, and inventories.

How are property, plant, and equipment (PPE) presented in the statement of financial position?

-PPE are presented in the statement of financial position after deducting the related accumulated depreciation, as they are depreciated over their estimated useful life, except for land, which is not depreciated.

What are the two main forms of presenting the statement of financial position?

-The two main forms of presenting the statement of financial position are the report form, which lists assets first followed by liabilities and owner's equity, and the account form, which has assets on the left side and liabilities and owner's equity on the right side.

How is the owner's equity calculated in a sole proprietorship?

-In a sole proprietorship, owner's equity is calculated as the net result of the owner's investments, withdrawals, net income or loss for the year, and other adjustments from the beginning balance of owner's equity.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

The Financial Statements & their Relationship / Connection | Explained with Examples

Statement of Financial Position (SOFP) | Laporan Posisi Keuangan | Akuntansi Keuangan Menengah

Vid # 5 BUSINESS MANAGEMENT ACCOUNTING Module 3 Part 1

The KEY to Understanding Financial Statements

Video Pembelajaran Jenis Laporan keuangan

Accounting Basics Explained Through a Story

5.0 / 5 (0 votes)