The Pros and Cons of Working in Financial Risk Management

Summary

TLDRThis video explores the role of a Financial Risk Manager, a career often overlooked in finance. Highlighting its intellectual and financial rewards, work-life balance, and lower stress levels compared to trading, the speaker shares insights from personal experience at JP Morgan and a hedge fund. They discuss the pros and cons, including job security, career progression, and the potential for less exciting tasks like regulatory work.

Takeaways

- 🏦 The role of a Financial Risk Manager is often overlooked but can be intellectually and financially rewarding with a good work-life balance.

- 🕒 Work hours in risk management are generally reasonable, with no late nights or weekend work, though crisis periods may require longer hours.

- 📉 Risk management is less stressful compared to trading roles, as risk managers are not directly responsible for the profit and loss of trades.

- 🔒 Job security is relatively high for risk managers, as their role is crucial in managing and mitigating risks, especially in unpredictable market conditions.

- 💼 Career progression in risk management can lead to senior roles such as managing director or chief risk officer, or transitioning to trading roles with enhanced market knowledge.

- 🛠️ The skills required for risk management are often acquired on the job, with a bachelor's degree in finance, economics, or a quantitative field being a good starting point.

- 📈 Risk managers use various tools and metrics like Value at Risk (VaR), stress tests, and the Greeks to analyze and monitor market risks.

- 🔍 The job involves interesting research and analysis, providing a top-down view of market activities and risks, which traders may not see.

- 📉 Some downsides include less exciting aspects like regulatory work, dealing with tech issues, and potential disagreements between traders and the risk team.

- 💰 Compensation in risk management may not be as high as in revenue-generating roles like trading, but offers a better work-life balance and less stress.

- 🌆 The role often requires living in major financial hubs with a high cost of living, which may not suit everyone's lifestyle preferences.

Q & A

What is the primary role of a Financial Risk Manager?

-A Financial Risk Manager's primary role is to analyze and manage the risks associated with financial markets and trading activities, ensuring that the risks taken by traders are within acceptable limits and do not jeopardize the financial health of the institution.

Why might the work-life balance in a risk management role be better compared to other finance roles?

-The work-life balance in a risk management role might be better because, unlike traders who may work late or on weekends due to market fluctuations, risk managers typically have more predictable hours and are not directly responsible for generating revenue through trades.

What are some of the less stressful aspects of working in risk management according to the script?

-Risk management is less stressful because managers do not have to worry about overnight market movements impacting their portfolios or job security as much as traders do. Their job is not on the line with every market fluctuation, allowing them to have more peace of mind outside of work.

How does job security differ between risk managers and traders?

-Job security for risk managers tends to be better than for traders. Traders' jobs are largely dependent on their ability to generate profits, which is highly unpredictable. Risk managers, on the other hand, have roles that are essential for the stability of the institution and are less likely to be affected by market volatility.

What are some common career progression paths for a risk manager?

-Common career progression paths for a risk manager include rising through the ranks to become a managing director at a bank or a senior risk manager at a hedge fund, transitioning to a trading role, or moving into other parts of finance such as investment banking or asset management.

What kind of educational background is typically required for a role in risk management?

-A bachelor's degree in Finance, Economics, or a quantitative field like Math or Statistics is typically required for a role in risk management. However, for more specialized roles, such as financial risk modeling or covering exotic derivative products, a quantitative graduate degree may be beneficial or required.

What are some of the key risk analysis tools and measures mentioned in the script?

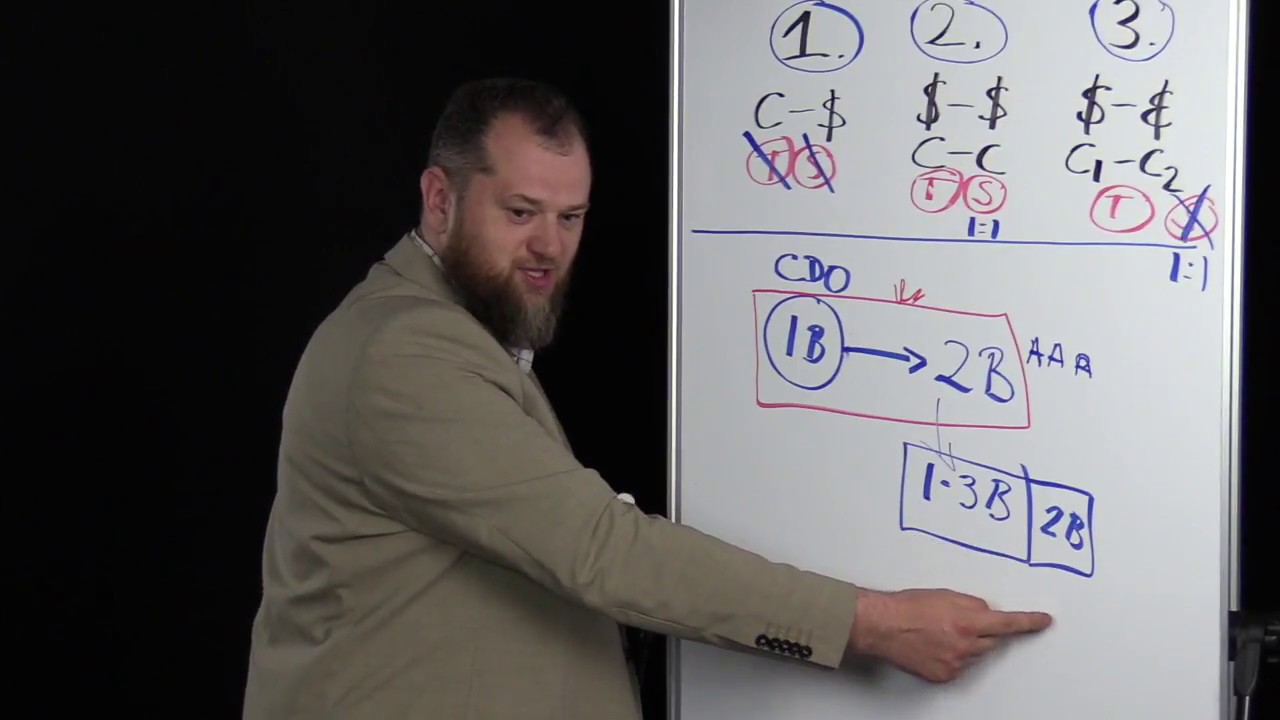

-Key risk analysis tools and measures mentioned include Value at Risk (VaR), stress tests, and the Greeks (Delta, Gamma, Vega, etc.). VaR measures tail risk, stress tests evaluate potential losses under specific market conditions, and the Greeks quantify an investment's sensitivity to various risk factors.

How does the role of a risk manager at a hedge fund differ from that at a bulge bracket bank?

-At a hedge fund, a risk manager might engage in less regulatory work and more market-related research and analysis. They may also have the opportunity to develop tools directly useful to their team, which can make the role more interesting and rewarding compared to a similar role at a bulge bracket bank.

What are some of the downsides of a career in risk management mentioned in the script?

-Some downsides include less exciting parts of the job such as regulatory work and dealing with tech issues, potentially lower compensation compared to revenue-generating roles, being limited to living in high-cost metropolitan areas due to the nature of financial hubs, and the perpetual tension between traders and the risk team.

How does the compensation structure differ between a bank and a hedge fund for risk managers?

-In a bank, risk managers may receive a lower percentage of their base salary as a bonus compared to traders. At a hedge fund, compensation is more closely linked to personal performance and the fund's performance, which can result in larger bonuses but may also mean less guaranteed salary upfront.

What is the potential tension between traders and the risk team, and how can it affect the work environment?

-The tension arises because traders are incentivized to maximize revenue, which may involve taking on more risk, while the risk team focuses on minimizing potential risks to the business. This can lead to disagreements, especially if a trade is deemed too risky by the risk team. However, a healthy balance is necessary to ensure both revenue generation and risk management.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

BIG 4 EXIT OPPORTUNITIES FOR TAX

How to Become an FP&A Analyst

MANAJEMEN RISIKO KEUANGAN || TUGAS SESI 1|| SHARLA TWO DILLA

Terrorism and finance: connecting the dots | Edidiong Bassey | TEDxUniversityofKent

Wisdom behind Prohibition of Riba (interest) - Case study GFC | Almir Colan

【DD道場】PE補完戦略-メザニン、NAVファイナンス、ディストレスト~それぞれのリスクの考え方~

5.0 / 5 (0 votes)