Best and Worst 0DTE Options Strategies | Zero Days to Expiration Crash Course Ep. 1

Summary

TLDRThis video script delves into the intricacies of zero days to expiration (zero DT) options, a popular research topic in 2023. The presenter examines the tradable viability of zero DT options compared to traditional duration options, using a case study on SPX intraday options from February 21st. The analysis covers statistics like high and low prices, opening price multiples, and hourly swings, revealing the high risk and potential for significant gains or losses inherent in zero DT options. The discussion highlights the importance of understanding market volatility and the strategic timing of trades to maximize profits while minimizing risks.

Takeaways

- 📈 Zero Days to Expiration (DTE) options have gained popularity in 2023 due to their high volume, strikes, and liquidity.

- 📉 The VIX index does not account for zero DTE options, but the forward slash VX does, ensuring volatility measures remain accurate.

- 🔍 The study focused on SPX intraday options, specifically on February 21st, which had a one percent intraday move, making it a relevant day for analysis.

- 📊 Intraday options price data was recorded for zero DTE, one day, seven days, 14 days, 21 days, and 58 days, analyzing high and low prices, opening price percentages, and largest one-hour swings.

- 💰 Trading zero DTE options is often about buying premium, but the argument is made that selling premium might be more strategic.

- 📉 Zero DTE options lose all their value when the market moves against them, unlike longer-dated options which only modestly decline.

- 💹 The largest hourly swing in zero DTE options can be significant, with a 91% loss observed in the study, highlighting the high risk involved.

- 🚀 Buying puts on zero DTE options can yield high returns, such as 255% in the case of a market sell-off, but this requires precise timing.

- 🌐 Gamma risk in zero DTE puts is approximately eight times that of 30 to 60 day options, indicating a much higher exposure to market moves.

- 💡 The rich premium of zero DTE options does not necessarily mean they should be sold; their high gamma exposure can be beneficial in certain market conditions.

- 🌟 Zero DTE options are appealing for small capital investors looking for large wins, but they come with the risk of significant losses if the market moves against them.

Q & A

What is the main focus of the research discussed in the video?

-The research focuses on zero days to expiration (zero DT) options, exploring their tradable viability and comparing them with typical duration options.

Why has there been a significant interest in zero DT options in 2023?

-The interest in zero DT options has grown due to their increasing volume, strikes, and liquidity.

What is the significance of the VIX and forward slash VX in relation to zero DT options?

-While the VIX does not take zero DT options into account, the forward slash VX does, which means that volatility measures used by traders are accurate.

Why was February 21st chosen as the day for the intraday options study?

-February 21st was chosen because it had a one percent move intraday, making it a relevant day for analyzing the performance of zero DT options.

What were the specific options analyzed in the study on February 21st?

-The study analyzed at-the-money put and call options for the SPX based on opening prices, with zero DT, one day, seven days, 14 days, 21 days, and 58 days to expiration.

What statistics were computed in the study for each expiration?

-The study computed the high and low prices, the percent of the opening price, the comparison of opening prices as a multiple of zero DT prices, and the largest swing in one hour for each expiration.

Why might traders consider buying zero DT options?

-Traders might buy zero DT options to buy premium, aiming for large gains relative to a small capital investment.

What is the risk associated with zero DT options when the market moves against the trader?

-Zero DT options can lose all their value when the market moves against the trader, unlike typical 30 to 60 day options which may only decline modestly.

How did the zero DT options perform in terms of the largest hourly swing on February 21st?

-The zero DT options lost 91 percent of their value in the largest hourly swing, highlighting the high risk associated with these options.

What is the potential downside of trading zero DT options?

-The potential downside is the high risk and the rich premium they carry, which can lead to significant losses if the market moves against the trader.

What is the future plan for the research on zero DT options?

-The researchers plan to continue the series by observing zero DT options on days where the market makes huge moves to see if the results change.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

The Top 3 0 DTE Options Trading Strategies

🌲SPX 0DTE Iron Butterfly Risk Free Walkthrough

Gamma Blast Strategy | Expiry Jackpot Strategy | Zero - Hero Trade

CBOE's 0DTE Gamma Paper | SpotGamma

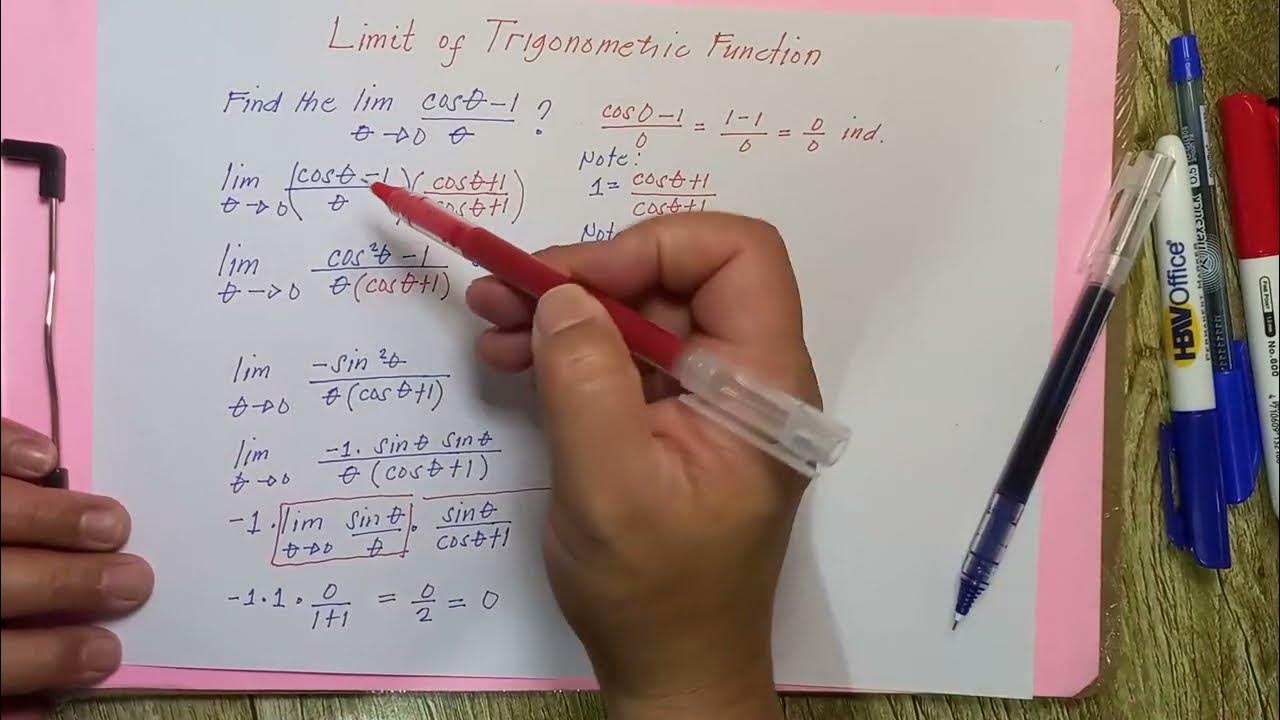

Limit of cosØ-1 over Ø as Ø approaches 0 is 0 I Special limit of Trigonometric Functions

Top Inexpensive Flipper Zero Alternatives

5.0 / 5 (0 votes)