บทที่ 3 ดอกเบี้ยและมูลค่าของเงิน ep.1

Summary

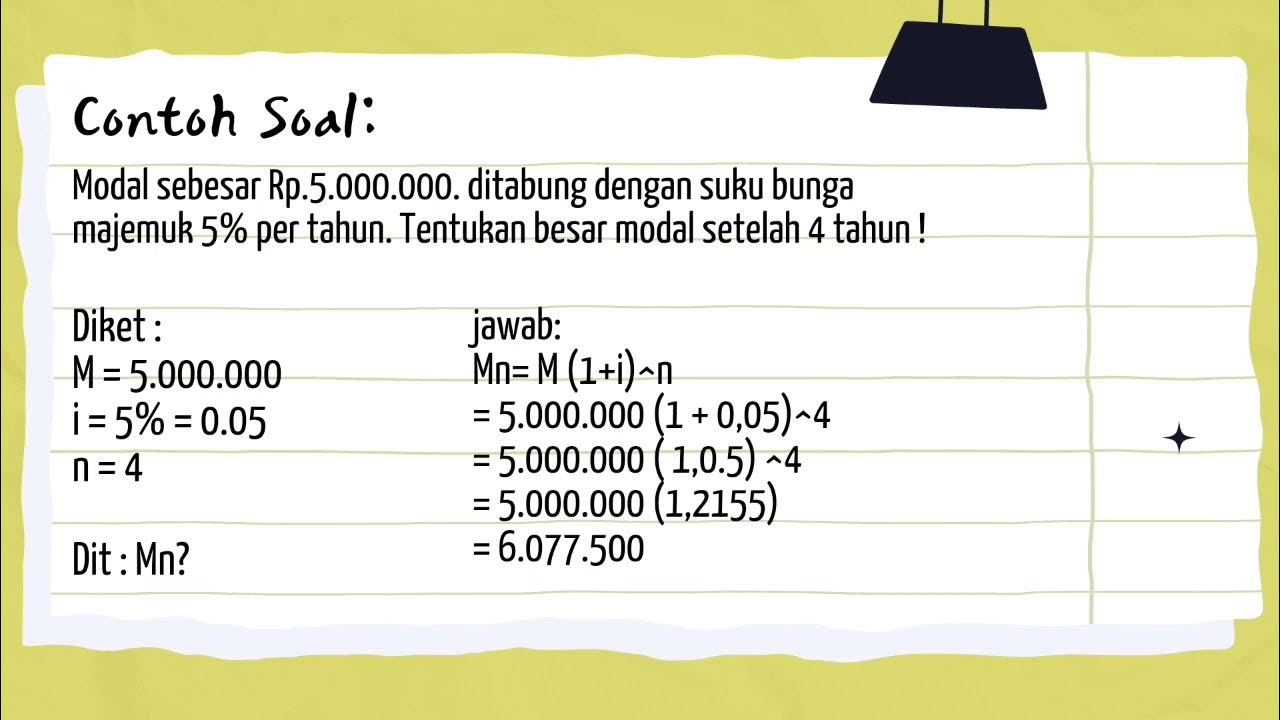

TLDRIn this lesson, the instructor teaches compound interest, focusing on the formula used to calculate the future value of money deposited in a bank with compound interest. Through a practical example, the instructor explains how interest is compounded quarterly and how to calculate the total amount after a set number of years. The lesson covers key elements such as principal amount, interest rate, compounding periods, and time. The calculation is demonstrated with a 5,000 THB deposit at 6% interest compounded every 3 months for 5 years, resulting in a final amount of approximately 60,734.75 THB.

Takeaways

- 😀 Compound interest is the focus of the lesson, specifically how interest is compounded quarterly.

- 😀 The script explains the formula for calculating compound interest: A = P(1 + r/k)^(kn), where P is the principal, r is the annual interest rate, k is the number of compounding periods per year, and n is the number of years.

- 😀 The concept of compound interest is clarified: interest is calculated on both the principal and the accumulated interest from previous periods.

- 😀 In the given example, a 5,000 Baht deposit earns 6% annual interest, compounded quarterly, over 5 years.

- 😀 To apply the compound interest formula, the interest rate (r) must be converted to a decimal, so 6% becomes 0.06.

- 😀 The number of compounding periods (k) is calculated based on the compounding frequency. For quarterly compounding, k equals 4 (4 quarters in a year).

- 😀 The duration of 5 years is used as the value for n, which represents the number of years the money is invested.

- 😀 The formula for the example is applied with P = 5,000 Baht, r = 0.06, k = 4, and n = 5, resulting in an overall multiplier of 1.015 raised to the power of 20.

- 😀 After calculating the compounded interest, the final result is approximately 60,734.02 Baht after 5 years.

- 😀 The script emphasizes that when answering, the result should either be given exactly (without rounding) or approximated to the nearest Baht, depending on the context (e.g., for exams).

Q & A

What is compound interest?

-Compound interest is interest calculated on both the initial principal and the accumulated interest from previous periods. It grows the total value of the deposit more quickly compared to simple interest, as the interest is added to the principal and then earns more interest in subsequent periods.

What are the key variables in the compound interest formula?

-The key variables are 'P' (principal amount), 'I' (interest rate), 'R' (interest rate as a decimal), 'k' (number of times interest is compounded per year), and 'n' (number of years the money is invested or borrowed for).

How do you convert a percentage interest rate into a decimal?

-To convert a percentage interest rate into a decimal, divide the percentage by 100. For example, 6% becomes 0.06.

How is the number of times interest is compounded per year ('k') determined?

-The value of 'k' is determined by how often the interest is compounded within a year. For example, if interest is compounded every 3 months, then 'k' is 4, as there are 4 quarters in a year.

In the given example, how many times is the interest compounded each year?

-In the given example, the interest is compounded quarterly, which means interest is compounded 4 times a year ('k' = 4).

What is the formula for calculating compound interest?

-The formula for compound interest is: A = P * (1 + R/k)^(k * n), where 'A' is the amount of money accumulated after interest, 'P' is the principal amount, 'R' is the annual interest rate, 'k' is the number of times interest is compounded per year, and 'n' is the number of years.

How do you calculate the total amount after compound interest for a deposit of 50,000 baht at 6% interest compounded quarterly for 5 years?

-Using the formula A = P * (1 + R/k)^(k * n), substitute P = 50,000, R = 0.06, k = 4, and n = 5. After performing the calculations, you get A ≈ 67,340.75 baht.

What does 'n' represent in the compound interest formula?

-'n' represents the number of years the money is invested or borrowed for. In the example, 'n' is 5, as the deposit is made for 5 years.

What is the significance of rounding in financial calculations?

-Rounding is significant because financial transactions often deal with specific currency units. In the example, the final result is rounded to two decimal places to reflect the currency's precision, i.e., baht and satang.

How does the compounding frequency ('k') affect the final amount?

-The more frequently interest is compounded, the more interest is earned. A higher compounding frequency (e.g., quarterly or monthly) will result in a higher final amount, as interest is calculated more often on the accumulated balance.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

BUNGA MAJEMUK (Matematika Ekonomi) by Dwika Rahmi Hidayanti

Bunga Majemuk || Materi Mtk wajib kelas 11 ( kurikulum merdeka)

Zins & Zinsrechnung (ohne Zinseszins)

BUNGA MAJEMUK APLIKASI DERET GEOMETRI MATEMATIKA WAJIB KELAS XI KURIKULUM MERDEKA VIDEO 2

Compound Interest (Problem Solving) - Number Sense 101

X - ALL - MATEMATIKA - Bunga Tunggal Dan Majemuk

5.0 / 5 (0 votes)