It's Happening Again and Nobody’s Talking About It

Summary

TLDRThe video compares the current AI boom to the dot-com bubble of the late 1990s, exploring the excitement, risks, and potential of AI investments. It highlights the massive spending by tech giants like Amazon, Microsoft, and Nvidia, driving the AI race forward, while also discussing the unsustainable nature of some investments. The script urges viewers to stay cautious, emphasizing diversification, long-term investment strategies, and staying calm during market fluctuations. It suggests that while AI companies hold significant potential, overvaluation and reliance on rapid progress pose risks, making careful investing crucial.

Takeaways

- 😀 The dot-com bubble of the late 1990s was driven by overconfidence and hype around internet companies, similar to the current AI investment boom.

- 😀 AI is being treated as a once-in-a-lifetime investment opportunity, but this could be reminiscent of the dot-com bubble, where overvaluation and speculation led to a market crash.

- 😀 The 'Magnificent Seven' (Amazon, Microsoft, Alphabet, Meta, Apple, Tesla, and Nvidia) are the dominant forces behind the current AI boom, collectively making up a significant portion of the S&P 500.

- 😀 These companies are heavily investing in AI, with billions allocated to AI technologies, including autonomous driving, smart assistants, data centers, and supercomputers.

- 😀 Global AI spending is projected to reach $500 billion by 2026, while spending on electricity demand could exceed $3 trillion by 2030.

- 😀 The geopolitical race between the US and China to dominate AI is creating massive investments and further inflating the AI market's value.

- 😀 While AI has the potential for massive profits, there are concerns about whether it will deliver on expectations quickly enough to justify its current stock prices.

- 😀 The AI industry is heavily reliant on a complex network of companies (Nvidia, Oracle, OpenAI) that are passing money between each other, inflating revenues and potentially creating artificial demand.

- 😀 AI companies like OpenAI are currently losing money despite being valued at billions, which raises questions about their ability to generate sustainable profits in the future.

- 😀 The rapid pace of AI improvement is at risk of hitting a 'data wall' by 2027, which could slow progress and lead to a collapse in market expectations.

- 😀 To navigate potential market downturns, investors should focus on automatic investments, diversification across asset types, and long-term strategies rather than trying to time the market or chase speculative trends.

Q & A

What was the main lesson learned from the 1990s dot-com bubble?

-The main lesson is that overconfidence and hype can lead to unsustainable bubbles. While the internet was undoubtedly the next big thing, the overvaluation and speculative nature of many companies caused the bubble to burst, resulting in significant financial losses for investors.

Why does the speaker compare the current AI boom to the 1990s dot-com bubble?

-The speaker compares the AI boom to the dot-com bubble because both involve immense hype, high investor expectations, and companies being valued based on potential rather than actual profits. There's a fear that the current AI boom could follow a similar trajectory, where inflated valuations could eventually lead to a market correction.

What are the 'magnificent seven' companies, and why are they significant?

-The 'magnificent seven' refers to Amazon, Microsoft, Alphabet (Google), Meta (Facebook), Apple, Tesla, and Nvidia. These companies are significant because they dominate the AI space, and their performance and investments are heavily influencing the overall stock market, especially the S&P 500 index.

How much money are the 'magnificent seven' companies predicted to invest in AI this year?

-The 'magnificent seven' are expected to invest a total of $330 billion in AI this year. This includes investments from companies like Tesla ($5 billion), Apple ($10.7 billion), Meta ($60 billion), Google ($75 billion), Microsoft ($80 billion), and Amazon ($100 billion).

What is the significance of the AI 'arms race' between the US and China?

-The AI 'arms race' between the US and China is significant because both countries view AI as crucial to global dominance. The outcome of this race could shape the future of technology, economics, and international power. The intense investment in AI from both nations underscores its strategic importance.

What is the concern about AI companies and their ability to generate profits?

-The concern is that AI companies, despite being valued highly, are not generating enough revenue to justify their stock prices. For example, OpenAI is valued at $500 billion but is making only $12 billion in revenue, and it is losing money every month. This raises doubts about the sustainability of their valuations.

What is the 'AI money machine' that the speaker refers to?

-The 'AI money machine' refers to the complex relationships between companies like Microsoft, OpenAI, Nvidia, and Oracle, where money circulates between them to boost revenue and stock prices. The issue is that this circular flow might artificially inflate the market value of these companies without generating real profits.

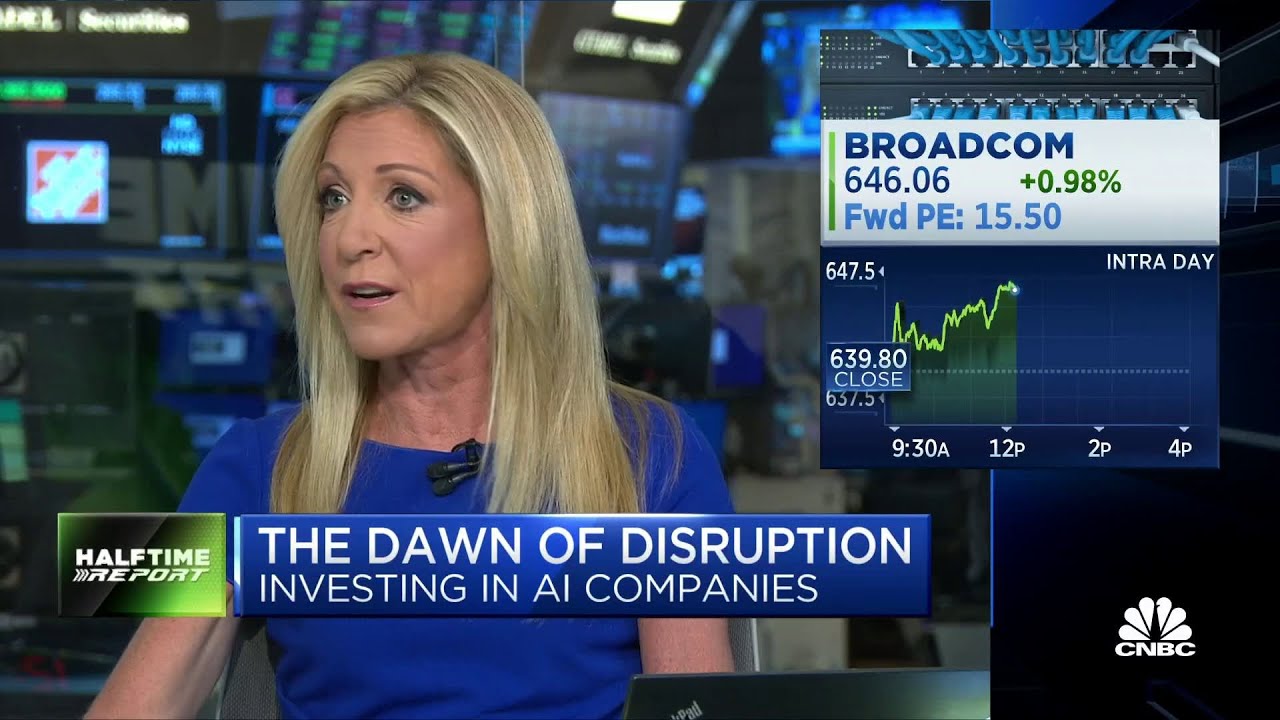

What role does Nvidia play in the AI ecosystem, and why is it a key beneficiary?

-Nvidia is a key beneficiary because it designs the chips that power AI models. These chips are in high demand from companies like Microsoft, Meta, Google, and OpenAI. Nvidia's share price has risen dramatically since the launch of AI technologies like ChatGPT, making it one of the primary winners in the current AI boom.

What is the 'data wall' and how could it affect AI progress?

-The 'data wall' refers to the point at which AI systems may run out of new, usable data to train on. Since AI has been learning from vast amounts of publicly available data, by 2027, much of that data will be exhausted. This could slow AI's progress, as it would need to find new sources or types of data to continue improving.

What is the speaker's advice for investing during a potential AI bubble?

-The speaker advises continuing to invest regularly, especially in low-cost index funds that track the overall stock market. By doing so, investors can benefit from long-term growth while weathering short-term market corrections. The key is to avoid panic during downturns and focus on diversification and increasing income through promotions or side hustles.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Why Everyone Is Wrong About the AI Bubble

How to Survive an AI Market Crash: Lessons from the Dot-Com Bubble

A.I. arms race heats up: Tech giants compete for leadership

Are we in an AI Bubble? (These 5 Warning Signs Will Tell You)

المُخبر الاقتصادي+ | لماذا قد تنهار إنفيديا وتتسبب في أزمة مالية عالمية أسوأ من 2008؟

AI Looks EXACTLY Like the Dot-Com Bubble

5.0 / 5 (0 votes)