Why Resource Rich Countries Grow Slowly?

Summary

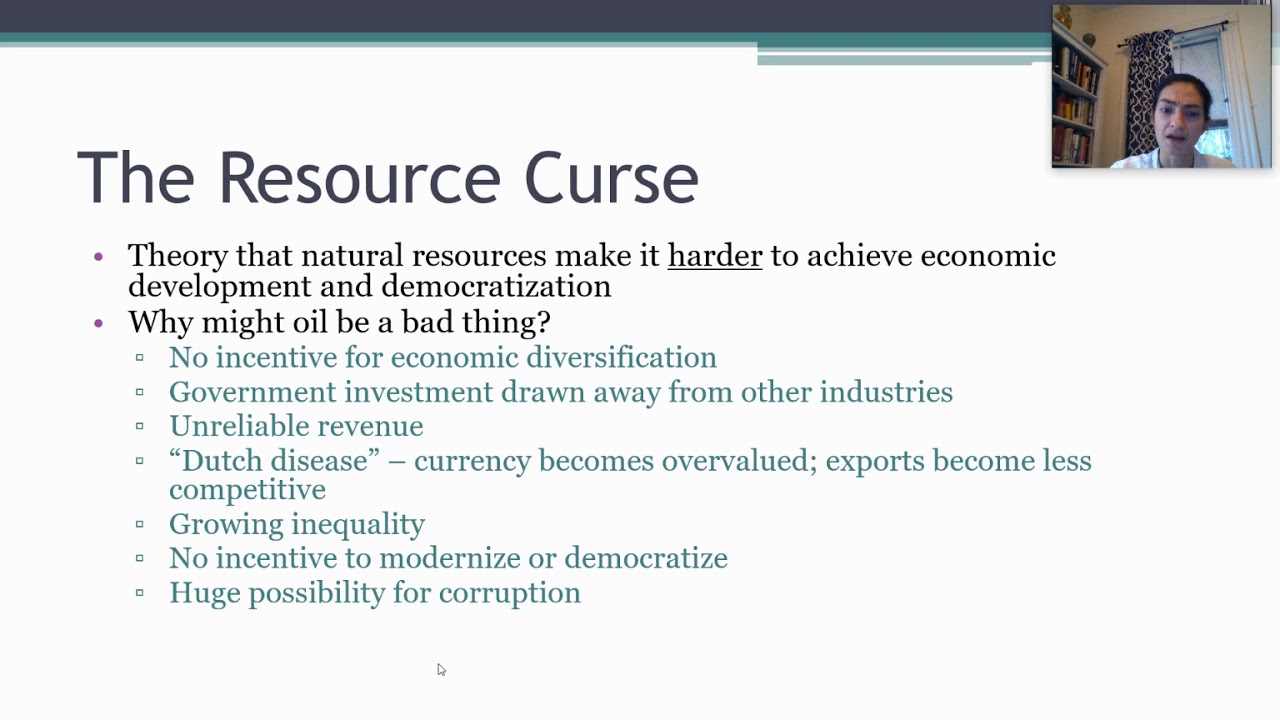

TLDRDespite having vast natural resources, many countries like Nigeria, Venezuela, and Trinidad and Tobago suffer from economic struggles due to reliance on a single resource. While resource-rich nations often face issues such as inflation, lack of innovation, and economic vulnerability, countries like Japan, Norway, and Malaysia have thrived by diversifying industries and investing in sustainable practices. The phenomenon of the 'resource curse' shows that, without proper management and strategy, natural resources can sometimes hinder rather than help economic growth.

Takeaways

- 😀 Natural resource-rich countries like Nigeria and the Democratic Republic of Congo struggle with low economic growth compared to resource-poor nations.

- 😀 Surprisingly, countries such as South Korea, Taiwan, Singapore, and Hong Kong, with limited resources, have become economic powerhouses.

- 😀 The 'resource curse' phenomenon shows that having more natural resources can sometimes result in slower economic growth, contrary to expectations.

- 😀 In the 18th century, nations like Germany, Britain, and the United States benefited from their natural resources due to high transport costs, giving them an edge in development.

- 😀 Modern global transport and energy revolutions have made it easier for countries to import resources, reducing the advantage of having abundant domestic resources.

- 😀 Countries like Japan and Korea are major steel producers despite lacking iron ore, showcasing the potential to thrive without significant natural resources.

- 😀 High wages in resource sectors, such as oil, lead to an over-reliance on those sectors, diminishing innovation and discouraging entrepreneurship in other industries.

- 😀 Trinidad and Tobago, with its oil boom, faces an over-reliance on oil, which has led to the neglect of agriculture, despite the country spending billions importing food.

- 😀 Venezuela's over-dependence on oil exports made it vulnerable to price fluctuations, causing a massive economic crisis fueled by corruption and poor economic policies.

- 😀 Nauru's once-booming phosphate industry left the country with staggering unemployment after its reserves ran out, highlighting the dangers of relying too heavily on a single resource.

- 😀 Some countries, like Norway, have successfully avoided the resource curse by establishing sovereign wealth funds, which help buffer the economy during downturns in resource prices.

- 😀 Saudi Arabia and Malaysia are working to diversify their economies, reducing dependence on oil through open trade policies and strategic long-term planning.

- 😀 Iran's manufacturing sector has flourished despite abundant natural resources, thanks to strategic policies that make energy affordable for manufacturers and support exports.

- 😀 To avoid disaster, resource-rich countries need strong economic policies, diversification strategies, and innovation to ensure sustainable growth and development.

Q & A

Why do some countries with abundant natural resources suffer economically?

-Countries rich in natural resources can face economic challenges due to overdependence on a single commodity, such as oil. This vulnerability to fluctuating global prices, coupled with issues like corruption, poor policy decisions, and lack of diversification in other sectors, can lead to economic instability.

How did resource-poor countries like Korea, Taiwan, and Singapore become global economic powerhouses?

-Despite having few or no natural resources, these countries thrived due to strategic policies, strong manufacturing sectors, innovation, and investment in education and infrastructure, which enabled them to become world-class producers in industries such as technology and manufacturing.

What impact did the Industrial Revolution have on the use of natural resources in countries like Germany, Britain, and the U.S.?

-During the Industrial Revolution, countries like Germany, Britain, and the U.S. experienced significant economic growth by utilizing their natural resources, such as coal and iron, to fuel industrial production. The high transportation costs of the time meant that having local resources provided a competitive edge.

How have advances in global transport and energy affected the economic advantages of natural resource-rich countries?

-Advances in global transport and energy technologies have diminished the need for countries to rely on local resources. Nations can now easily import raw materials, which means resource-rich countries no longer have the same economic advantage they once did.

Why does Trinidad and Tobago's oil wealth not translate into overall economic prosperity?

-While oil wealth has boosted wages in the oil sector, it has led to a decline in industries like agriculture and manufacturing. The country also faces a significant dependence on oil, making it vulnerable to fluctuations in global oil prices, which affects its overall economic stability.

What happened to Venezuela's economy after it became heavily dependent on oil exports?

-Venezuela's economy became heavily reliant on oil, with 96% of export earnings coming from the sector. This made the country vulnerable to oil price changes, and combined with bad economic policies and corruption, it led to a severe economic, social, and political crisis.

How does the lack of entrepreneurship impact resource-rich nations?

-High wages in resource sectors discourage people from starting their own businesses, leading to a lack of innovation. This stifles overall economic growth and development as countries become too reliant on resource extraction rather than diversifying into other industries.

What happened to the economy of Nauru after its phosphate reserves were depleted?

-In the 1970s, Nauru was one of the wealthiest nations due to its phosphate reserves. However, the depletion of these reserves led to widespread unemployment, with the current unemployment rate exceeding 90%, highlighting the dangers of over-reliance on a single resource.

What strategies did Norway implement to avoid the 'resource curse'?

-Norway established a wealth fund in 1990 to manage its oil revenues. This fund, now worth $900 billion, helps cushion the economy during periods of low oil prices and supports long-term economic stability by diversifying away from oil dependence.

How have countries like Saudi Arabia and Malaysia managed to avoid the resource curse despite their oil wealth?

-Saudi Arabia and Malaysia have managed to offset the resource curse through open trade policies, economic diversification, and long-term planning. For instance, Saudi Arabia has committed to gradually reducing its dependence on oil by focusing on the growth of other industries.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)