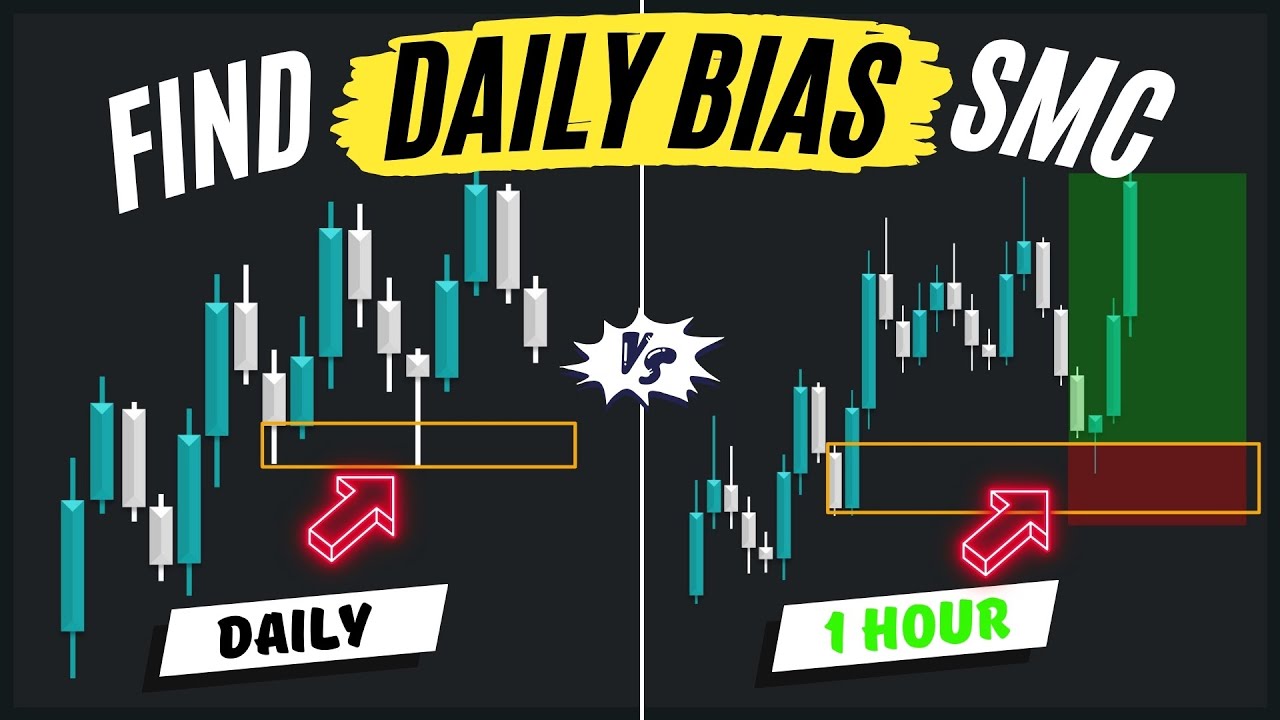

Intraday Bias - ICT Concepts

Summary

TLDRIn this video, the speaker explains how to use intraday charts (such as the 4-hour and 1-hour time frames) to determine trading bias. They focus on three key elements: displacement, structure, and imbalances, demonstrating how to spot potential entry points and target liquidity. The speaker also discusses how to incorporate price action from London and Asia sessions, as well as the importance of identifying trendline liquidity and fair value gaps for making informed trades. Overall, the video provides insights into refining intraday trading strategies.

Takeaways

- 😀 Displacement, structure, and imbalances are the three key factors when determining intraday bias.

- 😀 A strong move in one direction (displacement) followed by structural patterns like equal lows can indicate where price wants to go next.

- 😀 After identifying the general trend, you can use lower time frames like the one-hour and four-hour charts to find specific entries for trades.

- 😀 An example of a short setup is when price reaches an optimal trade entry (OTE) and targets lower liquidity levels.

- 😀 Old lows being run is a sign that displacement has occurred, which can lead to finding long opportunities after the move is confirmed.

- 😀 Liquidity runs, such as breaking previous highs or lows, are crucial to understanding price direction and potential targets.

- 😀 After displacement in the market, one should look for entries that align with the identified bias, whether bullish or bearish.

- 😀 The London and Asia sessions' price action often sets the stage for potential trades in the New York session.

- 😀 Fair value gaps (FVG) act as areas of interest, often indicating where price will head after running highs or lows.

- 😀 A bearish trend is expected when a high is formed and liquidity is resting below, creating the potential for price to run those lows.

- 😀 Using market structure, liquidity runs, and imbalances allows traders to create a solid intraday bias for their positions.

Q & A

What are the three key elements to determine intraday bias according to the speaker?

-The three key elements are displacement, structure, and imbalances.

What does the speaker mean by 'displacement' in the context of intraday trading?

-Displacement refers to an aggressive move in the market, such as a sharp price move in one direction.

How does the speaker define 'structure' in the trading context?

-Structure refers to price action formations, like relative equal lows, which can help define the market’s direction and sentiment.

What is an 'imbalance' in the context of intraday trading?

-An imbalance occurs when there is a gap in price action, typically marked by areas where price has moved quickly, leaving little to no retracement.

How does the speaker suggest using lower time frames for trade entries?

-The speaker suggests that once you determine where price is headed based on the four-hour or one-hour chart, you can use lower time frames to find more precise entry points.

What is the significance of running liquidity in intraday trading?

-Running liquidity refers to the action of targeting areas where previous lows or highs have been established, and then seeing price move to clear these levels for potential reversal or continuation.

What does 'OTE' mean in the trading context?

-OTE stands for Optimal Trade Entry, which refers to a price point where a trader expects to enter a trade, typically after a retracement to a favorable level like a discount or a fair value gap.

How does the speaker incorporate London and Asia's price action into their bias formation?

-The speaker looks at the price action from the London and Asia sessions, using this to gauge how price might react during the New York session, especially in relation to liquidity and fair value gaps.

What is the role of 'trendline liquidity' in forming the intraday bias?

-Trendline liquidity refers to areas where price has previously respected a trendline or levels of support and resistance, often indicating where liquidity is resting and could be targeted in the market.

How does the speaker suggest managing risk in a short position?

-In a short position, the speaker suggests risking the high point of the move (where displacement occurred) and targeting the lows, which is considered the logical price objective for a downward move.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тариф5.0 / 5 (0 votes)