The only 15 min London killzone trading strategy you need to watch

Summary

TLDRIn this video, traders learn about the London Kill Zone, a prime period for trading that injects high liquidity into the market, offering optimal opportunities. The focus is on using advanced strategies such as identifying liquidity sweeps, fake-outs, and change of character to capitalize on price movements. The video explains how to mark the London session on charts, spot key liquidity zones, and apply smart money concepts for high probability trades. Through real chart examples, viewers are shown how to effectively navigate the London Kill Zone, emphasizing discipline, patience, and the importance of backtesting to refine trading strategies.

Takeaways

- 😀 The timing of trades is crucial for success; executing trades randomly without understanding market sessions can lead to missed opportunities.

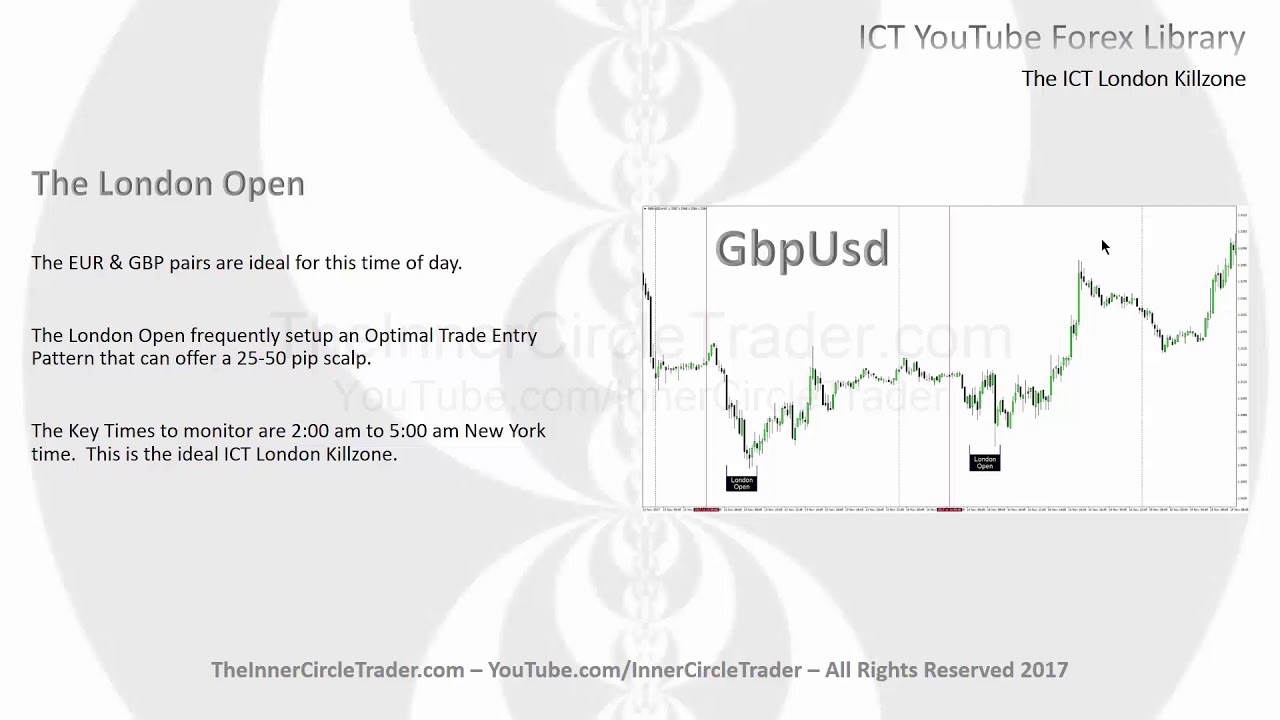

- 😀 The London Kill Zone refers to a critical period of the trading day when high liquidity is injected into the market, offering optimal trading opportunities.

- 😀 To identify the London Kill Zone, use the TradingView platform with the 'Market Sessions' indicator by Leviathan and adjust the session settings to focus on London.

- 😀 The London session is unique due to significant liquidity influx, new market participants, and the formation of key levels that provide valuable insights for traders.

- 😀 Key currency pairs like Euro, Pound, Franc, and Gold are actively traded during the London session, influencing market movements.

- 😀 The London session often sets the high and low for the day, which are critical levels for identifying trends and potential trades.

- 😀 Liquidity zones and key support or resistance areas, created during the Asian session, are important for predicting price movements when the London session begins.

- 😀 Fake outs (failed breakouts) and changes of character are essential indicators that signal liquidity grabs and potential shifts in market direction.

- 😀 To apply this knowledge, traders should combine higher time frame analysis with lower time frame confirmation for optimal trade entry points.

- 😀 A disciplined approach to trading is necessary, including thorough backtesting (at least 100 times) to gain confidence in a trading plan before live trading.

Q & A

What are Kill Zones in trading?

-Kill Zones are specific times during the trading day when liquidity is injected into the market, creating prime trading opportunities. These times typically correspond to major trading sessions, such as the London Kill Zone, when market movements are more pronounced.

Why is the London Kill Zone important for traders?

-The London Kill Zone is important because it sees a high influx of liquidity as many major currencies and commodities are actively traded. This liquidity leads to larger price movements, offering opportunities for high probability trades.

How do you identify the London Kill Zone on a chart?

-To identify the London Kill Zone on a chart, you need to use a Market Sessions indicator in TradingView. Adjust the settings to highlight only the London session and set the session close time to 13:00. This will mark the start and end of the London Kill Zone.

What should you do if the London session doesn't align with your trading plan?

-If the London session doesn’t align with your trading plan, it’s crucial to avoid entering trades. Patience is key, as trading when conditions aren’t favorable can lead to unnecessary risks and losses.

What is a fake out, and how does it affect trading decisions?

-A fake out occurs when the price breaks through a significant structure level but quickly returns within the previous range. This indicates a potential reversal or change in market direction, signaling that the breakout was simply a liquidity grab.

How can you confirm a trend reversal during the London Kill Zone?

-To confirm a trend reversal, look for a **Change of Character (CHoCH)**, which occurs when the price breaks below the last swing low, indicating a shift in market structure. This confirms that the earlier move was likely a fake out and signals a potential trend change.

How does liquidity accumulation during the Asian session impact the London session?

-During the Asian session, liquidity tends to accumulate around specific price levels. When the London session opens, the market often sweeps these levels to grab the accumulated liquidity, leading to price movements that can be used for entering trades in the direction of the dominant trend.

Why are the high and low of the day important during the London session?

-The high and low of the day are often formed during the London session, making them key reference points for traders. These levels tend to hold more significance, as they represent areas where liquidity has gathered, which can influence future price movements.

How do smart money concepts, such as order blocks, help in trading the London Kill Zone?

-Smart money concepts like order blocks, fair value gaps, and break of structure help identify areas where institutional players have entered the market. By recognizing these patterns during the London Kill Zone, traders can align their trades with institutional movements, improving the probability of success.

What are the advantages of using a more conservative approach when trading the London Kill Zone?

-A more conservative approach, such as waiting for a confirmation of trend reversal (Change of Character), reduces the risk of false signals and fake outs. While it might result in missed opportunities, it provides a more controlled and less risky way to trade, which is often more comfortable for traders.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)