Best Order Block Trading Strategy of All Time!

Summary

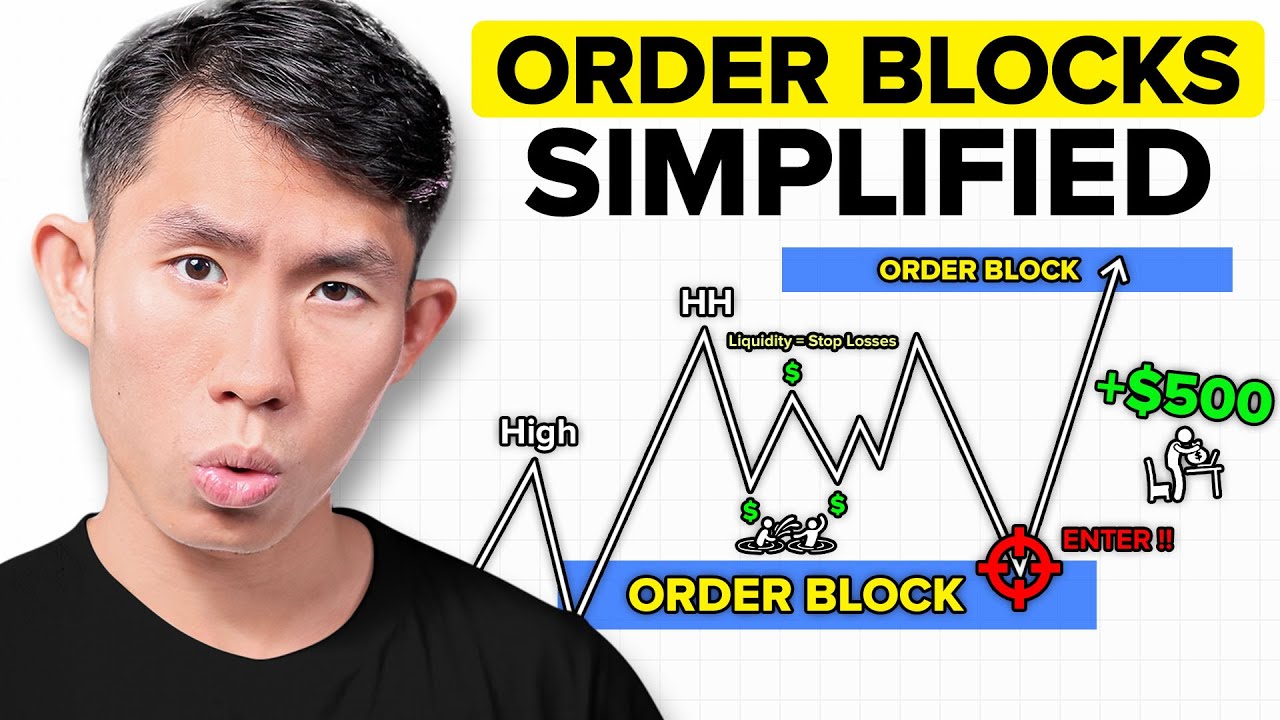

TLDRIn this video, viewers are introduced to an advanced trading strategy based on smart money concepts, order blocks, and price action. The strategy involves a step-by-step approach, starting with identifying key levels on higher time frames, then confirming reversals on lower time frames, and executing trades based on order block formations. Key concepts like liquidity levels, fair value gaps, and market structure are explored to ensure high-quality entries and risk management. The video emphasizes the importance of backtesting, understanding the strategy thoroughly, and adhering to discipline and proper risk management for consistent success in trading.

Takeaways

- 😀 The strategy focuses on using Smart Money Concepts, order blocks, and price action to develop a trading plan.

- 😀 The trading setup consists of three major time frames: daily, 1-hour, and 5-minute charts.

- 😀 Higher time frame analysis helps identify key levels and market structure before moving to lower time frames.

- 😀 Key levels include opposite colored candles, fair value gaps, and major market structure zones that indicate strong support or resistance.

- 😀 The safest trading opportunities occur in 'empty spaces' between significant key levels, avoiding manipulations that often occur around those levels.

- 😀 On the 1-hour chart, traders apply Smart Money Concepts, including identifying market direction, liquidity levels, and order blocks as optimal trading zones.

- 😀 Identifying liquidity areas helps confirm price movements, as the market often moves toward levels containing liquidity.

- 😀 Fair value gaps and order blocks signal imbalances, where the market often returns to fill gaps, offering high-quality trading setups.

- 😀 Reversal confirmations on lower time frames (5-minute chart) indicate when a short-term downtrend ends and an uptrend begins.

- 😀 The strategy allows for multiple trades along the way if order blocks continue forming, with reduced risk per trade and strict risk management rules.

- 😀 The key to success is disciplined backtesting, adhering to the strategy, and focusing on risk management, even if losing trades occur.

Q & A

What is the main focus of this video?

-The video focuses on an advanced entry strategy for trading, using smart money techniques, order blocks, and how to apply these strategies step by step on any chart.

What are the three major time frames used in this trading strategy?

-The three major time frames are the daily time frame for general analysis, the 1-hour chart for applying smart money concepts, and the 5-minute chart for confirming entries and executing trades.

Why is it important to identify key levels on the higher time frame?

-Identifying key levels on higher time frames helps to understand the bigger market picture and avoid trading blindly on lower time frames. It also allows traders to determine how much space is available before reaching the next key level.

What are the key criteria for identifying important levels on higher time frames?

-The key criteria include opposite-colored candles (acting as support or resistance), fair value gaps (indicating institutional activity), multiple rejections (indicating stronger levels), and major levels of market structure (where the price has been rejected multiple times).

What role do fair value gaps play in this strategy?

-Fair value gaps indicate areas where big players have moved the price significantly. These areas often act as zones where the market returns to fill leftover orders, providing high-probability setups for trades.

What is meant by 'trading in the empty spaces' on higher time frames?

-Trading in the empty spaces refers to entering trades when there are no significant levels of support or resistance ahead of the current price, thus reducing the likelihood of price manipulation and fake-outs.

How do liquidity levels impact the strategy?

-Liquidity levels are important because the market tends to move toward areas containing liquidity. Identifying liquidity zones helps traders anticipate potential price movements and avoid traps at areas where liquidity has been swept.

What is an order block, and why is it important in this strategy?

-An order block is a price zone where a significant institutional buy or sell decision occurred. It represents an imbalance in buying or selling pressure and is a key trading zone for entering high-probability trades.

What are the steps for executing the trade after identifying an order block?

-After identifying an order block, traders wait for the price to enter the zone, then zoom into lower time frames to confirm a reversal. Once confirmed, they enter the trade with a buy limit at the start of the order block zone, setting a stop below it.

How should a trader handle different scenarios with order block size?

-If an order block is small, traders should consider using a larger zone for the stop loss. If the order block is large, they can either use a smaller stop loss zone within the block or set the order in the middle of the block to improve the risk-to-reward ratio.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тариф5.0 / 5 (0 votes)