Team 9. Moneter Islam: Kebijakan Syariah, Tanpa Riba dan Pelajaran dari Krisis Venezuela

Summary

TLDRThis video explores the concept of money in Islamic economics, emphasizing its role as a medium of exchange rather than a commodity. It critiques conventional interest-based systems that cause wealth inequality, highlighting the benefits of Islamic finance methods like profit-sharing partnerships. The script further discusses Venezuela's economic crisis, caused by over-reliance on oil, political instability, and poor policies. It suggests that applying Islamic economic principles—such as diversification, equitable wealth distribution, and monetary stability—could help Venezuela recover and build a fairer, more sustainable economy.

Takeaways

- 😀 Money in Islam functions as a medium of exchange, not a commodity, and should not be traded itself.

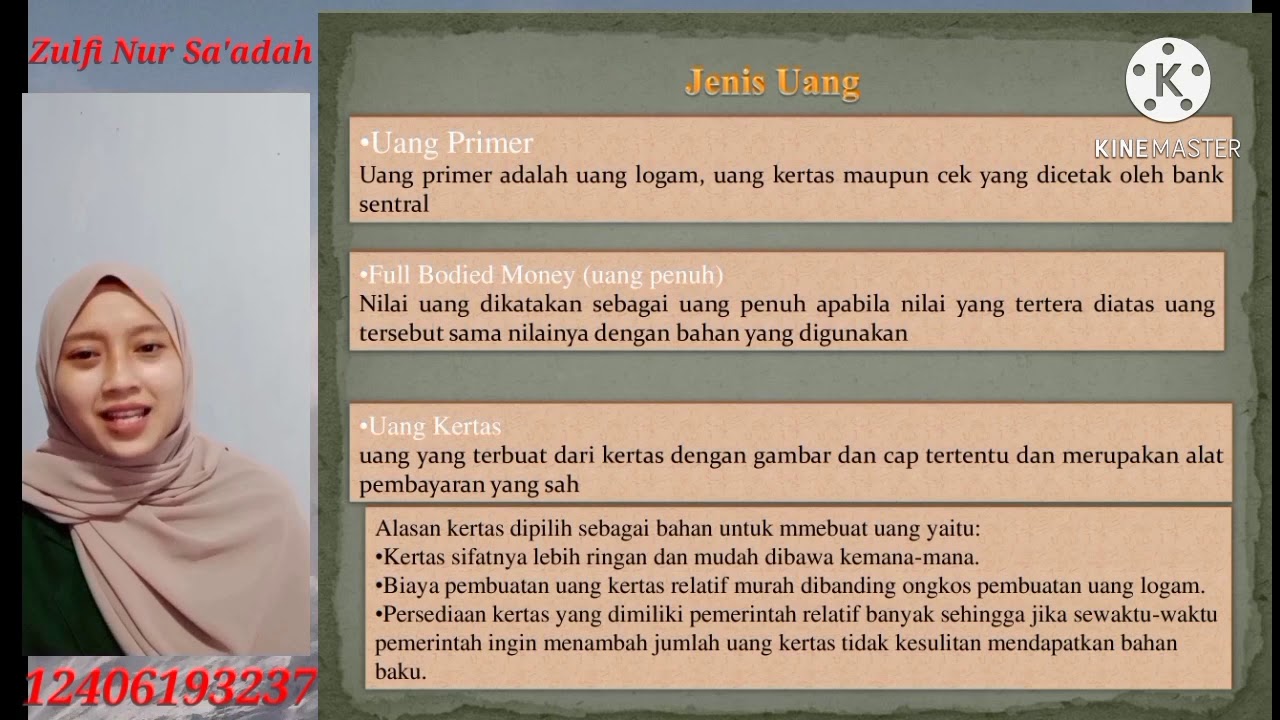

- 😀 The barter system was once the main method of transaction, but as human needs grew, money was created to facilitate easier trade.

- 😀 Islamic economics emphasizes social justice, wealth distribution, and virtue in money usage, encouraging productive and halal financial activities.

- 😀 Usury (riba) is strictly forbidden in Islam, as it leads to the exploitation of the less fortunate and exacerbates economic inequality.

- 😀 In Islamic economics, financing should focus on profit-sharing partnerships like mudarabah and musyarakah, rather than interest-based systems.

- 😀 The conventional interest-based monetary system leads to an unfair concentration of wealth and social division, worsening economic disparity.

- 😀 Islamic monetary policy promotes justice and balance, utilizing instruments like zakat, waqf, and profit-sharing to replace the interest system.

- 😀 The Islamic financial system aims to stabilize money value and create sustainable economic stability through fair distribution of wealth.

- 😀 Venezuela’s economic crisis is largely due to its heavy reliance on oil revenues, leading to a contraction of the economy and social instability.

- 😀 Applying Islamic economic principles, such as economic diversification, wealth redistribution, and value-based monetary systems, could help Venezuela recover and achieve social justice.

Q & A

What is the role of money in Islamic economics?

-In Islamic economics, money functions as a medium of exchange, not a commodity. It is not meant to be traded for profit but to facilitate transactions and contribute to social justice and common welfare.

Why was the barter system no longer effective?

-The barter system became ineffective due to the increasing complexity of human living standards and needs, which made it difficult to exchange goods directly. This led to the need for a more practical medium of exchange, which is money.

What is the Islamic view on trading money?

-According to Islamic teachings, trading money is prohibited because money should function as a medium of exchange, not as an item to be bought and sold for profit. This would distort its role and lead to unethical practices.

How does Islamic economics address social justice?

-Islamic economics emphasizes the use of money for halal (permissible) and productive purposes, promoting fair wealth distribution through zakat (charity), alms, and avoiding harmful practices such as usury and fraud.

What are the negative impacts of an interest-based monetary system?

-An interest-based system tends to enrich a small group of individuals or institutions with large capital while burdening the less fortunate with debt. It leads to unfair wealth distribution and social conflict, exacerbating economic inequalities.

What alternative financial systems does Islamic economics propose?

-Islamic economics advocates for profit-sharing systems such as mudarabah (profit-sharing) and musyarakah (joint partnership). These systems encourage partnerships and focus on productive activities rather than debt-based financing.

How does Islamic monetary policy differ from conventional policy?

-Islamic monetary policy differs by emphasizing justice, balance, and the use of sharia-compliant instruments like zakat, waqf (endowment), and profit-sharing systems. It aims for economic stability without the negative impacts of interest-based systems.

What is the role of zakat in Islamic economics?

-Zakat plays a critical role in Islamic economics by ensuring the fair distribution of wealth. It is a mandatory form of charity that helps reduce wealth inequality and supports the welfare of society.

How did Venezuela's oil dependence contribute to its economic crisis?

-Venezuela's economy heavily relied on oil exports, accounting for over 90% of its state revenue. When global oil prices dropped, the country faced a severe economic contraction, leading to a decline in GDP, high unemployment, and a devaluation of the bolivar.

What are some potential solutions to Venezuela's economic crisis based on Islamic economics?

-To address Venezuela's crisis, Islamic economics suggests diversifying the economy away from oil dependency, using profit-sharing systems like mudarabah and musyarakah, promoting social justice, and ensuring equitable wealth distribution through zakat and other ethical financial practices.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)