Order Blocks Simplified - ICT Concepts

Summary

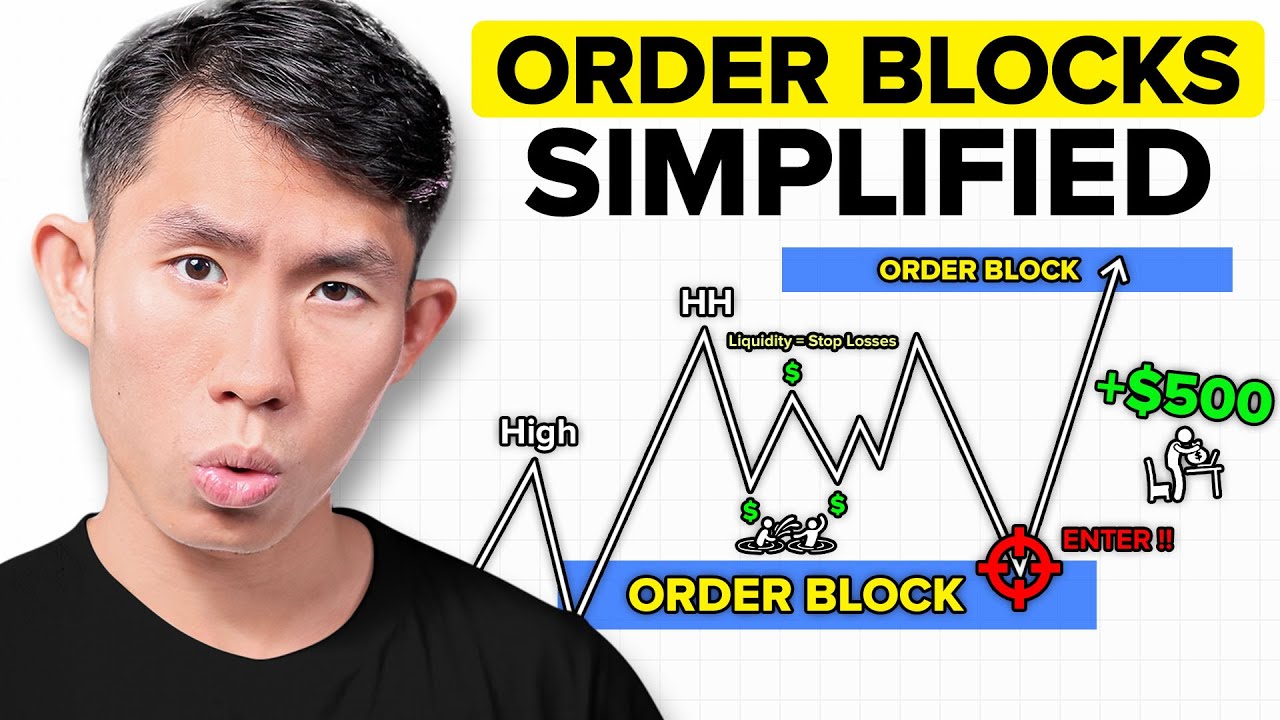

TLDRThis video delves into the concept of order blocks, focusing on their role in smart money reversals and how to identify them on both the buy and sell sides of the curve. The video covers how order blocks form around important levels, their validation, and when they can be used for entry points. It also introduces the mean threshold, explaining how it helps with risk-to-reward calculations. Examples are provided to demonstrate how to use order blocks in various market conditions, including stops, fair value gaps, and continuation trends. The video also discusses managing stop losses for these strategies.

Takeaways

- 😀 Order blocks are key to understanding smart money reversals, where price creates liquidity and then displaces in the opposite direction.

- 😀 An order block is validated when price displaces and closes below or above the opening price of a series of candles, depending on the direction of the trade.

- 😀 The importance of order blocks increases when they are off higher time frame levels, such as important price levels or fair value gaps (FVG).

- 😀 A sweep of liquidity often occurs before the closure of an order block, providing additional confirmation of the order block’s validity.

- 😀 The mean threshold of an order block, marked at 50% of the candle range, should not be violated for the order block to remain valid.

- 😀 If price fails to respect the 50% mean threshold, the order block may be invalidated, potentially leading to a stopped-out trade.

- 😀 Smart money reversals are marked by down-close candles into important levels, followed by displacement and closure above the down-close candles, signaling potential buy entries.

- 😀 A valid order block requires price to reach into an important level such as a fair value gap, and then displace and close above or below the series of candles.

- 😀 For entries, traders often use the opening price of the validated order block, with a stop loss set at the low or high, depending on the direction of the trade.

- 😀 Using the mean threshold for entries can increase the risk-to-reward ratio, but it comes with the risk of not getting filled if price does not reach the threshold.

Q & A

What is the primary focus of this video?

-The video primarily focuses on understanding order blocks in trading, including their validation, usage for buy and sell decisions, and how to manage risk with stop losses.

What is an order block, and how is it validated?

-An order block is a key price level where significant market orders are placed, leading to a price reversal. It is validated when the price closes below the opening price of a series of up-close candles, confirming it as a reversal zone.

What does the term 'sweep' refer to in the context of order blocks?

-A 'sweep' refers to the market reaching a liquidity level, such as buy or sell stops, and clearing these levels before reversing in the opposite direction, which can validate an order block.

How does the concept of the mean threshold of an order block work?

-The mean threshold is the 50% level of the order block. It is used as a reference point where price ideally should not close below, indicating that the order block is respected and the price is likely to continue in the expected direction.

What is the importance of higher time frame levels in identifying order blocks?

-Higher time frame levels are critical because order blocks formed near these levels have more significance. A pattern formed in isolation on a lower time frame without aligning with a higher time frame level may not represent a valid order block.

How should one manage stop losses when trading order blocks?

-Stop losses are typically placed at a swing high or low or at the other end of the order block. Placing a stop loss at the other end of the order block provides higher risk-to-reward ratios but also increases the risk of getting stopped out by price wicks.

What is the risk-to-reward ratio like when entering based on the mean threshold of an order block?

-Entering at the mean threshold (50% level) of an order block can provide a better risk-to-reward ratio. For example, it may increase the ratio from 1.3 to 2.6 compared to entering at the opening price of the order block.

What distinguishes a valid order block from an invalid one?

-A valid order block must meet certain criteria: it should occur at an important level (such as a higher time frame PD array), involve a sweep of liquidity, and show displacement in the price direction. An invalid order block often lacks these key characteristics.

How does the strategy for using order blocks differ when transitioning from a bearish to a bullish market?

-When transitioning from a bearish to a bullish market, the strategy focuses on finding a buy-side order block after a smart money reversal. This is done by looking for a down-close candle into an important level, such as a previous order block, fair value gap, or sweep.

What role do fair value gaps play in trading order blocks?

-Fair value gaps represent areas where price has moved too quickly, leaving behind inefficiencies. These gaps are important when identifying order blocks because they can act as key levels for price retracement, helping to validate an order block or an entry point.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

ICT Mentorship Core Content - Month 04 - Reclaimed ICT Orderblock

Mitigation Blocks Simplified - ICT Concepts

Master Order Blocks to Trade like Banks (no bs guide)

PO3 + MMXM + SMT + STDV | ICT Concepts | DexterLab

4HR PO3 | MMXM | Standard Deviations | ICT Concepts

Episode 8: Finding Market Makers Models (MMXM's) - ICT Concepts

5.0 / 5 (0 votes)