Matemática em toda parte - Matemática nas finanças

Summary

TLDRThis video script explores the importance of mathematical concepts in finance, particularly focusing on practical applications such as simple and compound interest, inflation, and budgeting. The script emphasizes how foundational math, like percentages and calculations, is essential in everyday financial decisions, from purchases to debt management. It also discusses the role of technology, such as calculators and spreadsheets, in making calculations easier. The video encourages using real-world math to enhance decision-making skills and highlights the significance of financial literacy in both personal and professional contexts.

Takeaways

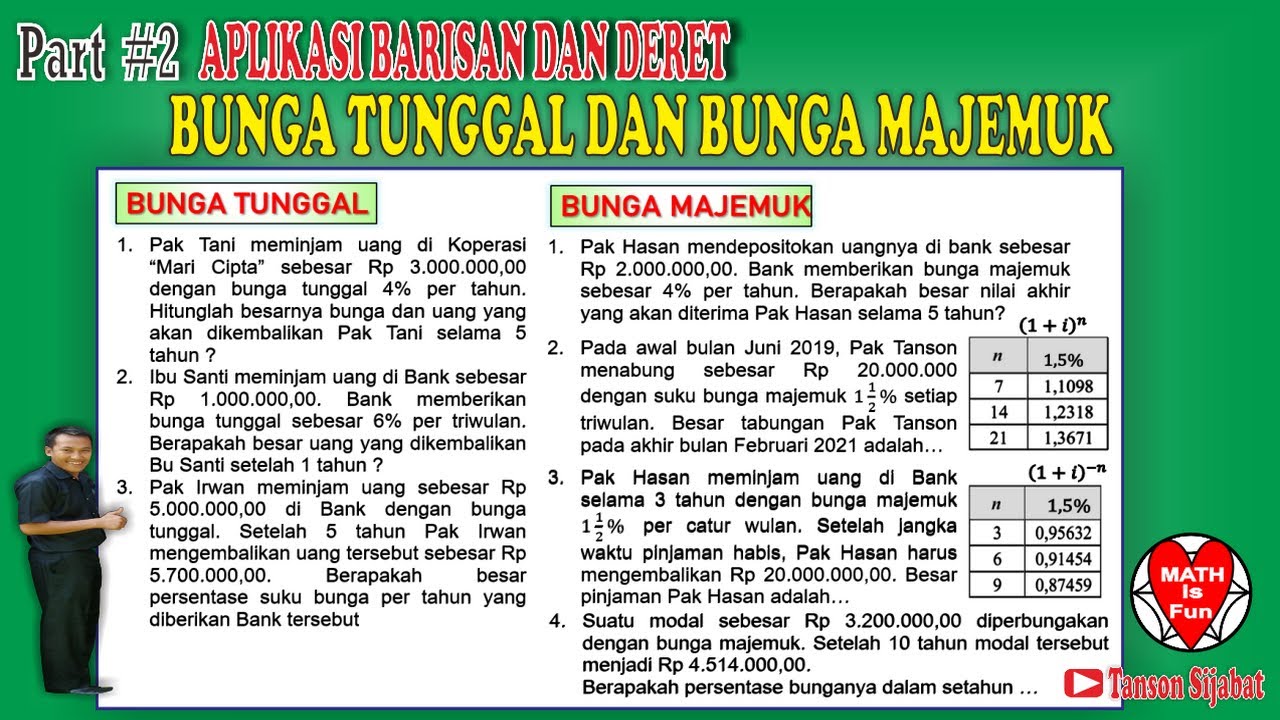

- 😀 The importance of realistic mathematics in understanding financial concepts like interest, loans, and savings is emphasized.

- 😀 Basic concepts of simple and compound interest are explained, highlighting how compound interest can lead to rapidly increasing debt.

- 😀 Inflation is discussed as a force that erodes purchasing power over time, similar to how compound interest works on debt.

- 😀 Consumers should be cautious of inflated prices in installment purchases, which often include hidden interest rates.

- 😀 When purchasing items on credit, it is important to compare installment prices to the cash price to avoid paying significantly more due to hidden interest.

- 😀 Financial literacy is essential, and tools like calculators and spreadsheets are crucial for accurate calculations in real-world financial decisions.

- 😀 The history of calculation tools, from basic hand counting to mechanical calculators, is explored to show how humans have always used tools to solve mathematical problems.

- 😀 The use of mental math for estimating percentages, like 10%, 20%, or 50%, is encouraged as a skill for everyday financial decisions.

- 😀 The concept of prime numbers is linked to the security of financial transactions, such as passwords for credit cards.

- 😀 Technology, like computers and calculators, should be used alongside mental math to enhance problem-solving and decision-making, not replace cognitive skills.

Q & A

What is the main focus of the script?

-The script primarily discusses the importance of mathematics in financial decision-making, with a focus on practical concepts like simple and compound interest, inflation, and the application of mathematical tools in real-life financial situations.

How does simple interest differ from compound interest in financial transactions?

-Simple interest is calculated only on the principal amount, meaning the interest is constant each period. In contrast, compound interest is calculated on both the principal and the accumulated interest, causing the amount owed to increase at an accelerating rate.

What are some examples of financial situations discussed in the script?

-Examples include a loan between friends with simple interest, a bank loan with compound interest, and the calculation of the cost of an item when bought in installments, comparing the price paid upfront versus the total price with interest.

Why is understanding inflation important in financial planning?

-Inflation reduces the purchasing power of money over time. Without understanding inflation, individuals may make financial decisions that do not account for the decrease in value of money, leading to poor financial outcomes.

What is the significance of the 50% and 25% mental math examples provided in the script?

-The script illustrates how mental math can be used to quickly calculate percentages, with examples of 50% (half of a number) and 25% (a quarter of a number). These calculations are easy to do and help in quickly assessing financial situations.

What does the script say about the role of calculators and technology in learning mathematics?

-The script emphasizes the importance of balancing mental math, estimation, and the use of calculators. Technology like calculators and spreadsheets should be used for more complex calculations, but mental math and estimation skills should also be developed.

How does the script explain the impact of interest on debt in the context of simple versus compound interest?

-It explains that with compound interest, the debt increases more rapidly than with simple interest, as interest is applied to the previous interest as well as the principal. This leads to a faster accumulation of debt over time.

What practical example of pricing and financing is provided in the script?

-The script describes a situation where a refrigerator is priced at R$ 999 if paid upfront or R$ 1,331.28 if paid in 12 installments. It shows how to calculate the additional cost incurred due to the interest applied to the installments.

What is the 'golden ratio' discussed in relation to credit card dimensions?

-The script mentions that the ratio of the dimensions of a credit card (86mm by 54mm) approximates the golden ratio, which is approximately 1.618. This ratio is significant in various natural and human-made structures.

What is the role of prime numbers in credit card security, according to the script?

-Prime numbers are used in the generation of secure credit card numbers. These numbers are part of an encryption system that ensures data security, making it difficult to decipher or duplicate the information without the proper key.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тариф5.0 / 5 (0 votes)