Accounting Terminology for Corporation Accounting

Summary

TLDRThis video introduces foundational accounting concepts, focusing on key terms such as the journal, accounts, debits, credits, and the ledger. It explains how transactions are recorded chronologically in the journal and later transferred to accounts, which are classified into assets, liabilities, equity, revenues, and expenses. The video also covers the importance of double-entry accounting, where each transaction affects at least two accounts. Key examples clarify how balances are calculated and the roles of assets, liabilities, and equity in financial statements, offering a comprehensive yet digestible overview for beginners in accounting.

Takeaways

- 😀 The Journal (or General Journal) is where transactions are first entered chronologically in accounting records.

- 😀 An account is a summary device in accounting used to track transactions related to a particular item, such as cash.

- 😀 Accounts are categorized into five main types: assets, liabilities, equity, revenues, and expenses.

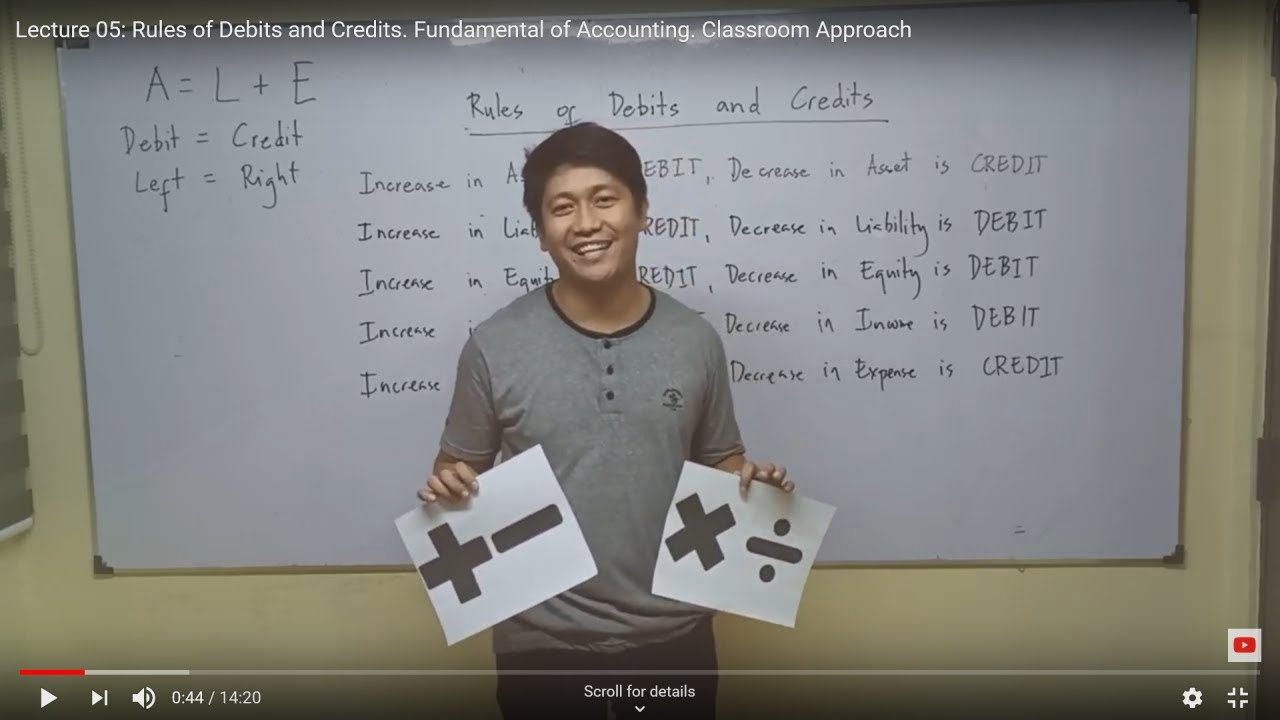

- 😀 Debits (DR) refer to the left side of an account, and credits (CR) refer to the right side, affecting accounts differently depending on the type.

- 😀 Double-entry accounting requires every transaction to impact at least two accounts, ensuring the accounting equation stays balanced.

- 😀 The accounting equation (Assets = Liabilities + Equity) must always be maintained through proper debits and credits.

- 😀 Accounts can have either debit or credit balances, with the balance being calculated by subtracting the smaller side from the larger.

- 😀 The Ledger (or General Ledger) is a compilation of all the company’s accounts, including assets, liabilities, equity, revenue, and expense accounts.

- 😀 Assets are resources owned by a business that provide future economic benefits, while liabilities represent claims from external parties.

- 😀 Equity represents the internal claim on assets, often referred to as net worth or net assets, and is calculated as assets minus liabilities.

- 😀 Revenues are inflows resulting from business operations, while expenses are outflows that reflect the cost of doing business.

Q & A

What is the Journal in accounting?

-The Journal, also known as the Book of Original Entry or the General Journal, is where transactions are first recorded in accounting. It is a chronological list of the company's transactions.

What are accounts in accounting?

-An account is a basic summary device used in accounting. It records all transactions related to a specific item, such as the cash account, which records all transactions affecting cash.

What are the five broad categories of accounts?

-The five broad categories of accounts are assets, liabilities, equity, revenues, and expenses.

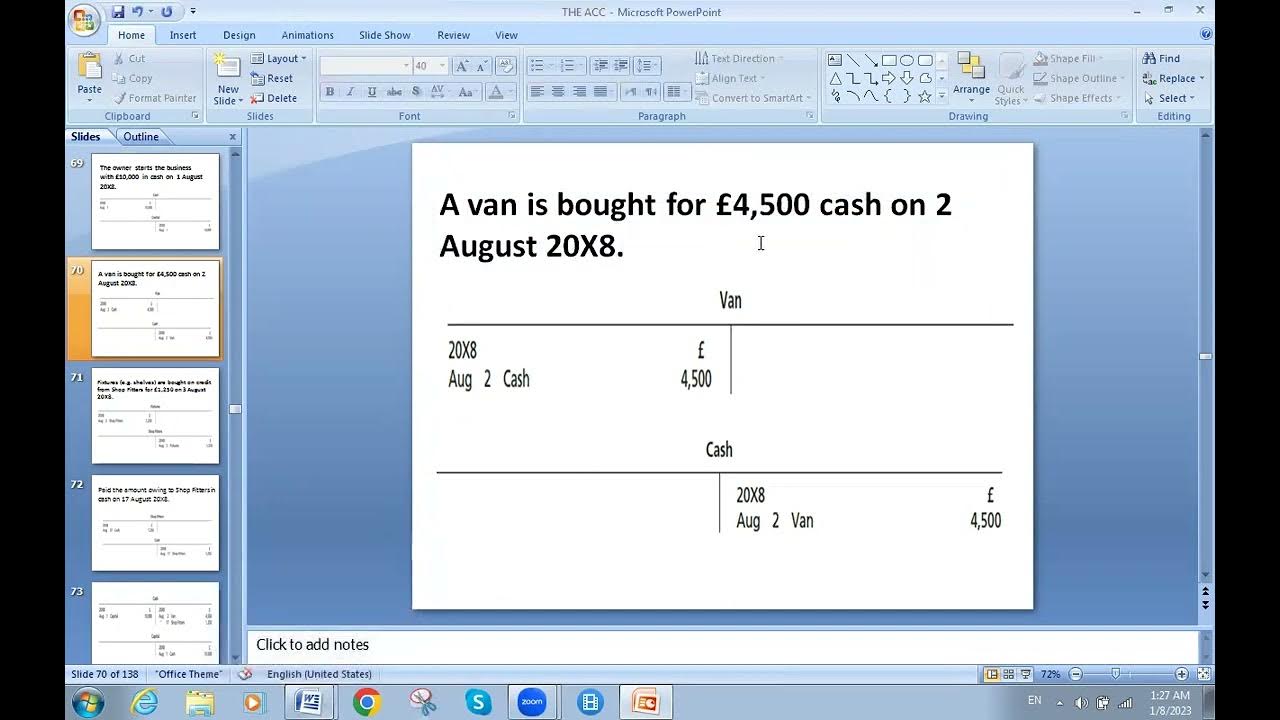

What is a T-Account in accounting?

-A T-Account is a representation of an account used in accounting, typically in an academic setting, showing debits on the left and credits on the right.

What do debit and credit mean in accounting?

-In accounting, debit (abbreviated as DR) refers to the left side of an account, and credit (abbreviated as CR) refers to the right side. They are used to record increases or decreases in various accounts, but the effect depends on the type of account.

What is double-entry accounting?

-Double-entry accounting is a method where each transaction affects at least two accounts, ensuring that debits always equal credits, maintaining the balance of the accounting equation.

What is the difference between a debit balance and a credit balance?

-A debit balance occurs when the total of debits in an account exceeds the total of credits, and a credit balance occurs when the total of credits exceeds the total of debits.

What is the general ledger in accounting?

-The general ledger is a collection of all the company's accounts, including asset, liability, equity, revenue, and expense accounts. It is the central record of all financial transactions.

What is the definition of assets in accounting?

-Assets are economic resources owned or controlled by a business that provide future benefits. Examples include supplies, accounts receivable, and prepaid expenses.

What is the accounting equation, and how is it manipulated?

-The accounting equation is Assets = Liabilities + Equity. It can be manipulated to show that Assets - Liabilities = Equity, which represents the value of the business after liabilities are settled.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тариф5.0 / 5 (0 votes)