What is the Adjusted Trial Balance and How is it Created?

Summary

TLDRThis video explains the purpose and preparation of an adjusted trial balance, a crucial tool used by accountants at the end of an accounting period. It highlights how adjustments are calculated and entered into a worksheet to ensure that debits and credits balance. The adjusted trial balance verifies the accuracy of balance sheet and income statement items, reflecting updates like expenses, depreciation, and interest. The video also clarifies common mistakes students make when summing adjustments, emphasizing the importance of correctly handling credits that reduce account balances. Understanding this process ensures accurate financial reporting.

Takeaways

- 😀 The adjusted trial balance is a tool accountants use to help organize and verify adjustments made at the end of an accounting period.

- 😀 The unadjusted trial balance shows the balances of the accounts before adjustments are made.

- 😀 Adjustments are entered in specific columns, helping to summarize and calculate necessary changes before updating account balances.

- 😀 The adjusted trial balance reflects the balances after adjustments, ensuring that debits and credits are equal.

- 😀 The adjusted trial balance is used to ensure the financial statements are accurate and that the balance sheet and income statement accounts are correctly updated.

- 😀 The worksheet, which contains the unadjusted trial balance, adjustment columns, and adjusted trial balance, is a crucial tool in the adjustment process.

- 😀 A set of typical adjustments may include changes in supplies expense, depreciation, and interest expense.

- 😀 Each adjustment, like debiting supplies expense and crediting supplies, reflects the usage of supplies during the accounting period.

- 😀 Depreciation adjustments reflect the wear and tear of assets over time, recorded as an increase in depreciation expense and accumulated depreciation.

- 😀 Interest payable adjustments are used to record amounts owed for interest that have not yet been paid, showing an increase in both interest expense and interest payable.

- 😀 After completing the adjustment columns, accountants check the debits and credits to ensure they match, then update the adjusted trial balance to reflect accurate final balances.

Q & A

What is the purpose of preparing an adjusted trial balance?

-The adjusted trial balance ensures that the debits equal the credits after all adjusting entries have been made. It is used to verify that the balance sheet and income statement accounts are properly valued and updated before preparing financial statements.

What are the columns in a worksheet used for during the accounting period?

-The worksheet contains columns for the unadjusted trial balance, adjustments, and adjusted trial balance. The unadjusted trial balance shows account balances before adjustments, the adjustments columns are for recording the necessary adjustments, and the adjusted trial balance shows the account balances after the adjustments are made.

How are the debits and credits calculated in the adjusted trial balance?

-The debits and credits are calculated by first making adjustments in the adjustment columns, then updating the balances in the adjusted trial balance columns. The debits and credits should equal after adjustments, ensuring the books are balanced.

What role does the worksheet play in the adjustment process?

-The worksheet helps accountants summarize and calculate adjustments before entering them directly into the journal. It organizes the data to ensure accuracy and completeness before preparing the financial statements.

What does a credit to an asset account mean in the context of an adjustment?

-A credit to an asset account indicates a decrease in that account. For example, when supplies are used, a credit is made to the supplies account to reflect that the amount of supplies has decreased.

What is the purpose of depreciation adjustment in the worksheet?

-The depreciation adjustment records the depreciation expense for the period and adjusts the accumulated depreciation. This ensures that the equipment's value is accurately reflected in the financial statements.

Why is interest payable adjusted in the worksheet?

-Interest payable is adjusted to reflect any interest that is owed but not yet paid at the end of the accounting period. This ensures that the company's liabilities are accurately reported.

How do you handle a scenario where an asset account has a debit and a credit adjustment?

-In such a scenario, the debits and credits are combined to update the account balance. For instance, if supplies had a debit of 700 and an adjustment credit of 500, the new balance would be 200, reflecting the usage of supplies during the period.

What should accountants do after completing the adjustments in the worksheet?

-After completing the adjustments, accountants verify that the debits and credits match, then update the adjusted trial balance columns. Once the adjustments are made, they enter the data into the journal and prepare the financial statements.

Why can't you just add the adjustments directly to the trial balance to calculate the adjusted total?

-You can't simply add the adjustments to the trial balance because not all adjustments increase the account balance. Some, like the credit to supplies, decrease the balance. Each adjustment must be applied correctly to reflect the accurate ending balance.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

The TRIAL BALANCE Explained (Full Example!)

Neng Ida Soniawati–Ekonomi XII-SMAN 1 Babakan Madang-Jurnal Penutup & Pembalik – Nov2022#pgtkjabar

TRIAL BALANCE CHAPTER -14 T.S.Grewal Solution question number -2 Class-11 accounts session (2022)

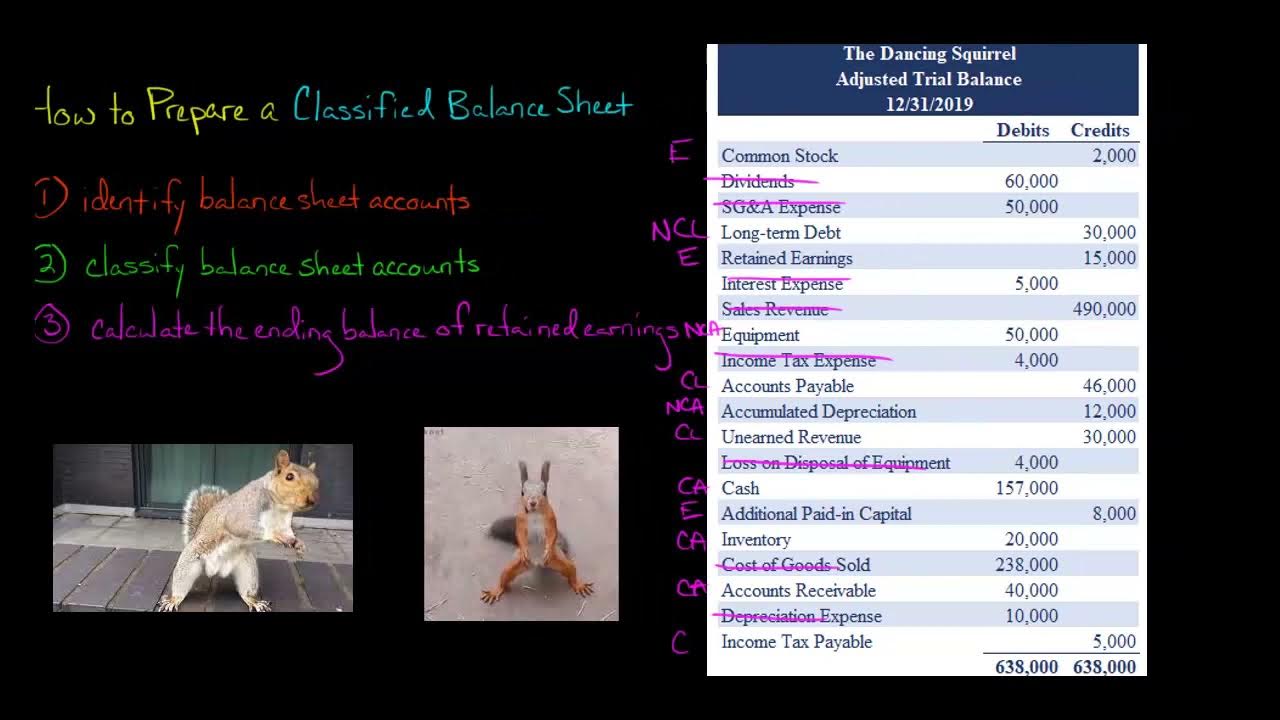

How to Prepare a Classified Balance Sheet

FA15 - Adjusting Journal Entries - MORE EXAMPLES

Jurnal Penutup & Jurnal Pembalik | Pengantar Akuntansi

5.0 / 5 (0 votes)