Notions de base du régime de change - Episode 1

Summary

TLDRThis video explains the concept of currency exchange and the fixed exchange rate system in Morocco. It highlights how individuals and businesses obtain foreign currencies for international transactions, the role of Bank Al Maghrib in setting exchange rates, and how the Dirham is tied to a basket of currencies (Euro and Dollar). The video also discusses the limitations of a fixed exchange rate, particularly in the context of global economic shifts, and introduces Morocco's planned reform towards a more flexible exchange rate system to better manage external shocks and maintain economic stability.

Takeaways

- 😀 The exchange rate is the price of a country's currency in relation to another currency, such as the dirham against the euro or dollar.

- 😀 A fixed exchange rate system means a country's currency is tied to one or more foreign currencies, like the dirham being anchored to a basket of euros and dollars.

- 😀 The Moroccan dirham is currently tied to a basket consisting of 60% euros and 40% US dollars, reflecting Morocco's main international trade partners.

- 😀 The central bank, Bank Al Maghrib, determines the maximum and minimum exchange rates for currency transactions in Morocco and provides this information through various platforms.

- 😀 Exchange rates are crucial for international trade, affecting both businesses importing goods and individuals traveling or studying abroad.

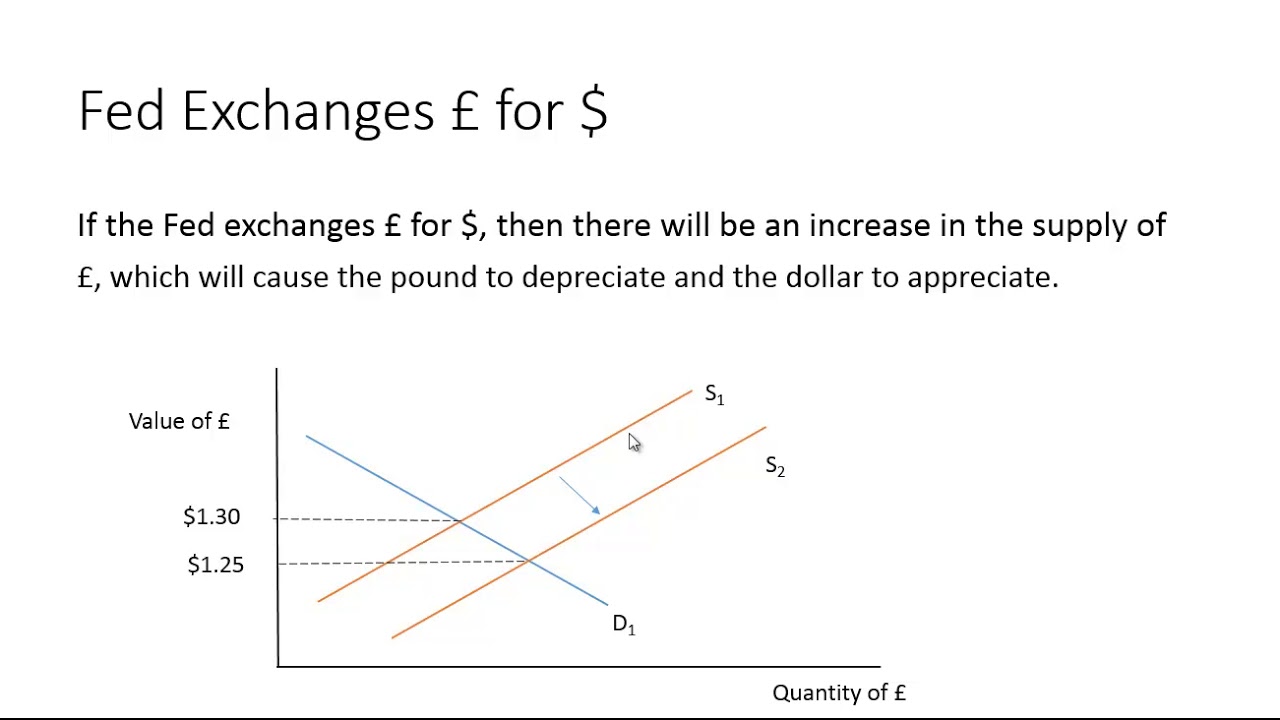

- 😀 The exchange rate is influenced by factors like the value of foreign currencies (e.g., euro and dollar) on international markets, causing fluctuations in the value of the dirham.

- 😀 To obtain foreign currencies, individuals and businesses can exchange Moroccan dirhams through banks or currency exchange offices.

- 😀 Foreign currency reserves in Morocco are primarily sourced from exports, remittances from Moroccans abroad, tourism revenues, foreign investment, and loans from foreign countries.

- 😀 A fixed exchange rate system helps maintain economic stability but may become less effective as a country faces more external economic shocks and greater international exposure.

- 😀 The Moroccan government is planning to transition from a fixed exchange rate system to a more flexible system to better respond to economic challenges and maintain reserve stability.

Q & A

What is the exchange rate, and why is it important?

-The exchange rate is the price of a country's currency relative to other foreign currencies. It is important because it determines how much local currency is needed to purchase foreign currencies, which affects international trade, travel, and investments.

How do individuals or businesses obtain foreign currencies in Morocco?

-Individuals or businesses in Morocco can obtain foreign currencies by purchasing them through banks or exchange offices. This is done by exchanging Moroccan dirhams for the required foreign currency.

What is the 'fixed exchange rate regime'?

-A fixed exchange rate regime is when a country's currency is pegged to the value of one or more foreign currencies, or a basket of currencies, and its value does not fluctuate freely with the market. Morocco's dirham is pegged to a basket consisting of the euro and the US dollar.

How does the Moroccan dirham's value relate to other currencies under the fixed exchange rate system?

-Under the fixed exchange rate system, the value of the Moroccan dirham is linked to a basket of currencies, primarily the euro (60%) and the US dollar (40%). The value of the dirham may fluctuate against other currencies depending on the changes in the value of the euro and dollar on international markets.

What are the sources of foreign currency in Morocco?

-Foreign currency in Morocco comes from various sources, including tourist receipts, export revenues, remittances from Moroccans abroad, foreign investments, and loans or financial aid from international sources.

What is the role of Bank Al-Maghrib in Morocco's exchange rate system?

-Bank Al-Maghrib, the central bank of Morocco, plays a key role in setting the daily exchange rates for buying and selling foreign currencies. It also manages the country’s foreign currency reserves and ensures the stability of the currency market.

What is the potential risk of Morocco’s fixed exchange rate system?

-The fixed exchange rate system poses a risk of depleting foreign currency reserves if the demand for foreign currencies exceeds the available reserves. This could lead to economic instability, especially in times of external shocks or increased demand for foreign currency.

Why is Morocco transitioning from a fixed exchange rate system to a more flexible one?

-Morocco is transitioning to a more flexible exchange rate system because the fixed system is becoming less suited to an increasingly globalized economy. A flexible system will allow the currency to better respond to global economic fluctuations and reduce the risk of draining the country's foreign currency reserves.

How does Morocco's foreign exchange system impact businesses?

-Businesses in Morocco are directly affected by the exchange rate as it determines the cost of importing goods and services. A strong or weak dirham can either increase or decrease the cost of goods imported from abroad, impacting the profitability of companies involved in international trade.

What will happen in the next episode of the series 'Explain to Me'?

-In the next episode of the series, the focus will be on the transition from Morocco’s fixed exchange rate system to a more flexible system. The episode will explore the goals, challenges, and detailed process of this gradual shift.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Sistem Moneter Internasional dalam Mata Kuliah Bisnis Internasional

Mundell Fleming Model (3) : Nilai Tukar Tetap Fixed

Group 5: Global Monetary System Explained

Exchange Rate Systems Explained | A Level & IB Economics

VALUTA ASING DAN DEVISA - EKONOMI - MATERI UTBK SBMPTN DAN SIMAK UI

Foreign Exchange Government Intervention

5.0 / 5 (0 votes)