#2 Types of Islamic Finance - ACCA / CPA / SFM -By Saheb Academy

Summary

TLDRThis video from Saheb Academy dives into the principles and contracts of Islamic finance. It explores key concepts such as the prohibition of interest, involvement in prohibited businesses, and the need for risk-sharing in financial transactions. The video explains five major contracts in Islamic finance: Mudaraba, Musharaka, Sukuk, Ijara, and Murabaha, with detailed examples for each. The video highlights how Islamic finance structures transactions in compliance with Sharia law, offering alternatives to conventional finance methods by ensuring all contracts are asset-based and interest-free, focusing on fairness and transparency in financial dealings.

Takeaways

- 😀 Islamic finance strictly adheres to the principles of Sharia, which prohibit interest, speculation, and investment in prohibited businesses like gambling, alcohol, and pornography.

- 😀 Interest (Riba) is completely forbidden in Islamic finance, and financial transactions that involve charging or paying interest are not allowed.

- 😀 Islamic finance emphasizes risk-sharing; the lender and borrower must share the risks involved in financial transactions.

- 😀 Wealth in Islamic finance must be generated from legitimate trade or asset-based investments, where every transaction involves an underlying asset.

- 😀 Mudaraba is a partnership contract where one party provides capital and the other provides skills. If there’s a profit, it’s shared; if there’s a loss, the capital provider bears the full loss, unless fraud or negligence is involved.

- 😀 Musharaka is a joint enterprise contract where multiple partners contribute capital and skills. Profits are shared according to the pre-decided ratio, but losses are distributed according to the capital ratio of the partners.

- 😀 Sukuk (Islamic bonds) are structured to offer profit-sharing rather than interest. Investors gain returns based on ownership in tangible assets, which generate income and risk.

- 😀 Ijara is an Islamic lease contract where the lessor rents out an asset to the lessee for a pre-determined rental fee. The ownership remains with the lessor, and at the end of the lease period, the lessee may have the option to purchase the asset.

- 😀 Murabaha is a credit sale contract where an asset is sold to a buyer at a markup (profit margin) with deferred payment. The price and terms are agreed upon upfront.

- 😀 Islamic financial contracts are structured in a way to ensure transparency, fairness, and that they comply with Sharia principles, which prohibit activities like speculation and uncertainty in transactions.

Q & A

What is the fundamental principle of Islamic finance?

-The fundamental principle of Islamic finance is that it must comply with Islamic law, or Sharia. This includes prohibitions on interest (Riba), investing in prohibited activities, and excessive uncertainty or risk.

Why is interest (Riba) forbidden in Islamic finance?

-Interest is forbidden in Islamic finance because it is considered exploitative and unjust. Islam encourages profit-making through legitimate trade and asset-based transactions, not through charging interest on loans.

What are some activities that Islamic financial institutions cannot be involved in?

-Islamic financial institutions cannot be involved in businesses related to gambling, alcohol, pornography, prostitution, music, or anything that is considered haram (forbidden) under Islamic law.

What is the principle of risk-sharing in Islamic finance?

-The principle of risk-sharing in Islamic finance means that the risks and rewards of a business venture or financial contract should be shared between the parties involved. This avoids unfair exploitation and ensures that both parties are committed to the success of the venture.

What does the term 'Mudaraba' refer to in Islamic finance?

-Mudaraba is a contract in Islamic finance similar to a partnership, where one party provides the capital (Rab-al-Maal) and the other party provides expertise and management (Mudarib). Any profits are shared based on a pre-agreed ratio, while any losses are borne entirely by the capital provider, unless negligence or fraud is involved.

How is the loss handled in a Mudaraba contract?

-In a Mudaraba contract, if there is a loss, it is borne entirely by the capital provider (Rab-al-Maal). However, if the loss is caused by the negligence or fraud of the working partner (Mudarib), the loss will be shared or entirely borne by the negligent party.

What is the difference between Mudaraba and Musharaka contracts in Islamic finance?

-Mudaraba is a partnership where one party provides capital and the other provides expertise, and only the capital provider bears the risk of loss. Musharaka, on the other hand, involves multiple parties who contribute both capital and expertise, and losses are shared based on the ratio of capital contributed.

What is Sukuk, and how does it differ from conventional bonds?

-Sukuk are Islamic bonds that are structured to avoid interest. Instead of paying interest, Sukuk holders receive returns from ownership of tangible assets. This differs from conventional bonds, where bondholders receive fixed interest payments.

How do Sukuk investors earn returns?

-Sukuk investors earn returns by holding ownership in the underlying asset purchased by the company issuing the Sukuk. The income generated from that asset is shared among the Sukuk holders, rather than receiving interest.

What is the concept of 'Ijara' in Islamic finance?

-Ijara is the Islamic equivalent of a lease contract, where one party (the lessor) allows another party (the lessee) to use an asset in exchange for rental payments. The rental fee is predetermined and does not include interest. At the end of the lease, the lessee may have the option to purchase the asset.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

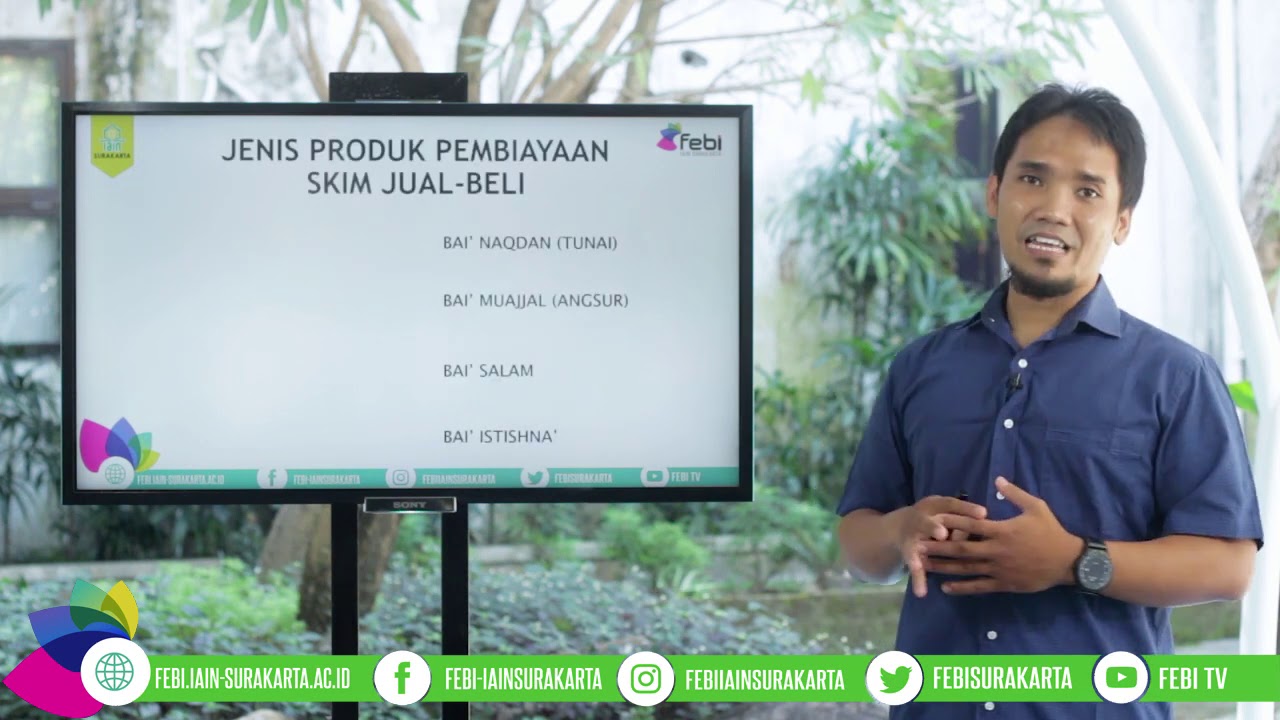

Akad-akad dalam Bank Syariah • Perbankan Syariah #5

FAQ EKONOMI SYARIAH #4: Bunga Kredit & Deposito di Bank Syariah

Prinsip-prinsip Dasar Bank Syariah • Perbankan Syariah #4

Desain Kontrak Syariah_Manajemen Perbankan dan Keuangan SYariah

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

Pengertian Leasing Syariah

5.0 / 5 (0 votes)