How I Made $72,120 Trading in 1 Month So You Can Copy Me

Summary

TLDRIn this video, the speaker shares how they earned $72,120 in November through a simple yet effective trading strategy. They outline their approach, emphasizing the importance of avoiding risky practices like leverage, Forex, and automated trading. The core of their method involves identifying volatile stocks, selecting the best one, buying at a low price, and selling quickly for a profit. The speaker also highlights their daily process and offers a free trading bundle for beginners, with access to their watchlist and trade reviews, as well as an invitation to join their exclusive community.

Takeaways

- 😀 Avoid using leverage if you don't fully understand how it works—it can lead to major losses and even debt.

- 😀 Don’t fall for trading strategies based solely on indicators like those commonly promoted on platforms like TradingView.

- 😀 Automated trading bots are not reliable for long-term success. Stick to manual trading and make decisions based on market analysis.

- 😀 Focus on trading volatile stocks that have the potential for quick gains, rather than playing with risky instruments like Forex or options.

- 😀 Use a stock screener to identify 10 volatile stocks daily. Look for stocks that are gapping up due to news or earnings reports.

- 😀 When choosing a stock, prioritize those with high volume and strong price action. Avoid stocks with weak volume or inconsistent movement.

- 😀 Always buy stocks at a lower price, waiting for a pullback after the stock opens. Don’t jump in immediately.

- 😀 Set your exit strategy around pre-market highs or key resistance levels, ensuring you lock in profits when the stock reaches your target.

- 😀 Aim for consistency—making one good trade per week can turn a small initial investment into significant profits over time.

- 😀 Access to a trading community, where trades and strategies are shared daily, can provide valuable insights and support for both beginners and experienced traders.

- 😀 The speaker provides free resources like a beginner’s course, eBooks, and a trade tracker to help new traders start their journey and improve their skills.

Q & A

What is the primary strategy used to make $72,120 in November?

-The primary strategy involves finding 10 volatile stocks daily, analyzing them, choosing the best one, buying at a cheap price, holding for a short period (5–10 minutes), and selling for a profit. This process is repeated daily.

Why is using leverage considered risky in the script?

-Using leverage is risky because it amplifies both potential gains and losses. If you don’t fully understand how leverage works, you can end up in significant debt, which is why it’s advised to avoid using it unless you have experience.

What is the issue with relying on trading indicators?

-Relying on trading indicators, especially those that are just combinations of simple metrics, is ineffective. The speaker argues that indicators can’t consistently predict stock movement and suggests that successful trading comes from understanding price action and volume, not from following preset indicator signals.

What’s the speaker’s stance on using automated trading bots?

-The speaker believes that automated trading bots and scripts are ineffective long-term. They emphasize that if a person is capable of manual trading, they don’t need to rely on automation, which often leads to poor results.

How can a trader select the best stock to trade from a list of volatile stocks?

-To select the best stock, the trader should look for high volume and strong price action. The stock should show signs of bouncing back after a minor dip, indicating support at certain price levels. Consistent volume is a key indicator of potential success.

What is meant by 'pre-market high' in the strategy?

-The 'pre-market high' refers to the highest price a stock reached during pre-market trading. The strategy involves setting a goal to sell when the stock price reaches or approaches this pre-market high, as it's seen as a key resistance level.

How long should a trader hold a stock in this strategy?

-The stock is typically held for a short period, usually between 2 to 12 minutes. The goal is to capitalize on quick price movements and sell for a profit before the price reverses or levels out.

What is the importance of volume in the strategy?

-Volume is crucial because high trading volume often indicates that the stock is being actively traded and may continue its movement. In the script, high volume signals more confirmation to enter a trade, as it shows strong market interest.

What does 'drawdown' refer to in this trading strategy?

-Drawdown refers to the temporary decrease in stock price after it opens. The strategy suggests entering the trade only after the stock has dipped slightly (drawdown), as this presents a better entry point before the stock price starts to rise again.

How can a small initial investment grow using this strategy?

-By making just one successful trade per week, a small investment (e.g., $1,000) can grow substantially. The speaker provides an example where $1,000 could grow to $7,000 in a month if one profitable trade is made each week.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

My Simple One Candle Scalping Strategy (Backtested Results)

Fibonacci Trading - Complete Guide & Settings

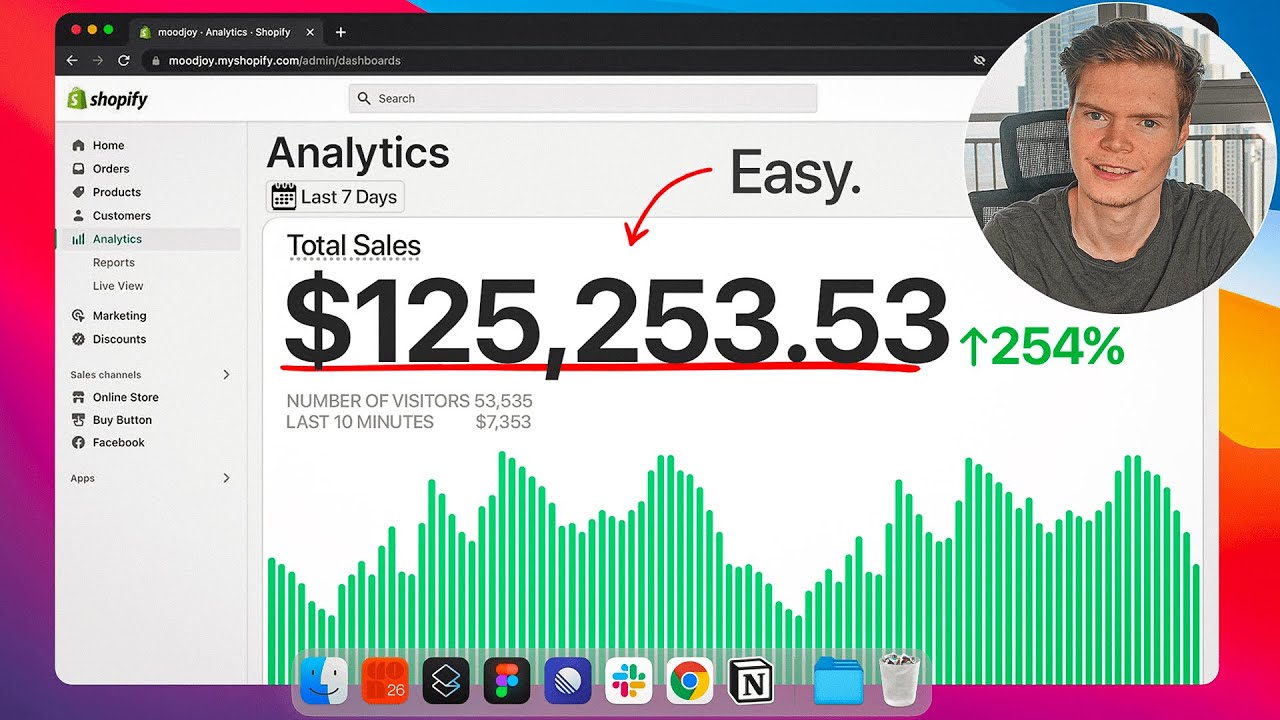

I Make $125K/Week with Dropshipping & It’s Easy.. (FULL EXPOSE)

Trading Strategy had 100% Win Rate in 2024 - What’s the Secret?

My Stupid Easy 2 Minute Scalping Strategy To Make $15K/Week

if ur legit totally lost in forex trading, start here lol

5.0 / 5 (0 votes)