if ur legit totally lost in forex trading, start here lol

Summary

TLDRIn this insightful video, a seasoned trader shares a straightforward trading strategy emphasizing the use of daily charts and major support and resistance zones, without the need for complex indicators or time frames. Highlighting a simple yet effective approach, the speaker advises setting alerts at these key zones and acting on these signals for potential trades. The narrative showcases a successful example where this strategy led to a significant profit, debunking the notion that complicated techniques are necessary for trading success. The speaker advocates for a minimalist, risk-managed approach, ensuring sustainability and consistency in trading, making it accessible for both novices and experienced traders seeking simplicity and efficiency.

Takeaways

- 😀 You only need the daily chart and alerts at major support/resistance zones to keep trading simple

- 👍 Draw obvious, clear support/resistance levels, avoid unclear or questionable ones

- 🔔 Set alerts at major zones so you don't need to watch the charts all day

- 💡 Sell at resistance when price gets there, buy at support when price gets there

- 📈 Use smaller timeframes like 1 minute to fine tune entries at key levels

- 🎯 Identify risk levels below/above zones to define your risk vs reward

- 💰 Simple support/resistance trading works long term if you control risk

- 🤝 Get experience identifying best trading opportunities and avoiding bad ones

- 😎 You don't need crazy risk/reward ratios, make a bit more than you lose

- 💡 Keep it simple - draw major zones and trade the bounces

Q & A

What is the core trading strategy being recommended in the video?

-The core strategy is to identify major support and resistance levels on the daily chart, set alerts at those levels, and take trades when price reaches those levels. No complex indicators are used, just basic technical analysis.

What time frame does the speaker recommend using?

-The speaker recommends primarily using the daily chart to identify major support and resistance zones. The 1 minute or 1 hour chart can also be used to refine entry and exit timing.

How does the speaker control risk in trades?

-The speaker controls risk by setting a 1:1 or less risk/reward ratio per trade. Average losses are kept smaller than average wins through sound risk management.

What was the example trade that the speaker took and what was the rationale?

-The example trade was a short trade taken at a key daily resistance level on Friday. The rationale was that it was unlikely for price to break above the resistance level and recent highs, providing a good risk/reward scenario.

What recommendations does the speaker make regarding avoiding trades sometimes?

-The speaker recommends avoiding trades right before major news events to avoid getting wicked out. Also avoiding trades into key levels when there is huge opposing momentum and breakout potential.

How long has the speaker been using this trading approach?

-The speaker mentions running a free telegram channel for 5 years using the same simple support/resistance approach.

What does the speaker say about more complex trading strategies?

-The speaker questions the need for very complex strategies involving order flow, bank manipulation etc. when a simple support/resistance system has worked well consistently.

What education platform is mentioned in the video?

-Mission FX is mentioned as an educational platform that the speaker will be doing a live session for.

What future plans are mentioned regarding trading?

-The speaker mentions setting up a new office to allow getting analysis done and trading as the US stock market opens.

What is the key takeaway or piece of advice from the video?

-The key takeaway is to keep your trading strategy simple, control your risk, and consistently follow your plan over time to achieve sustainability.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How to Backtest in Forex So Live Trading Becomes Easier (Step By Step Guide)

How to Start Forex Trading as a BEGINNER in 2025 (Full Guide)

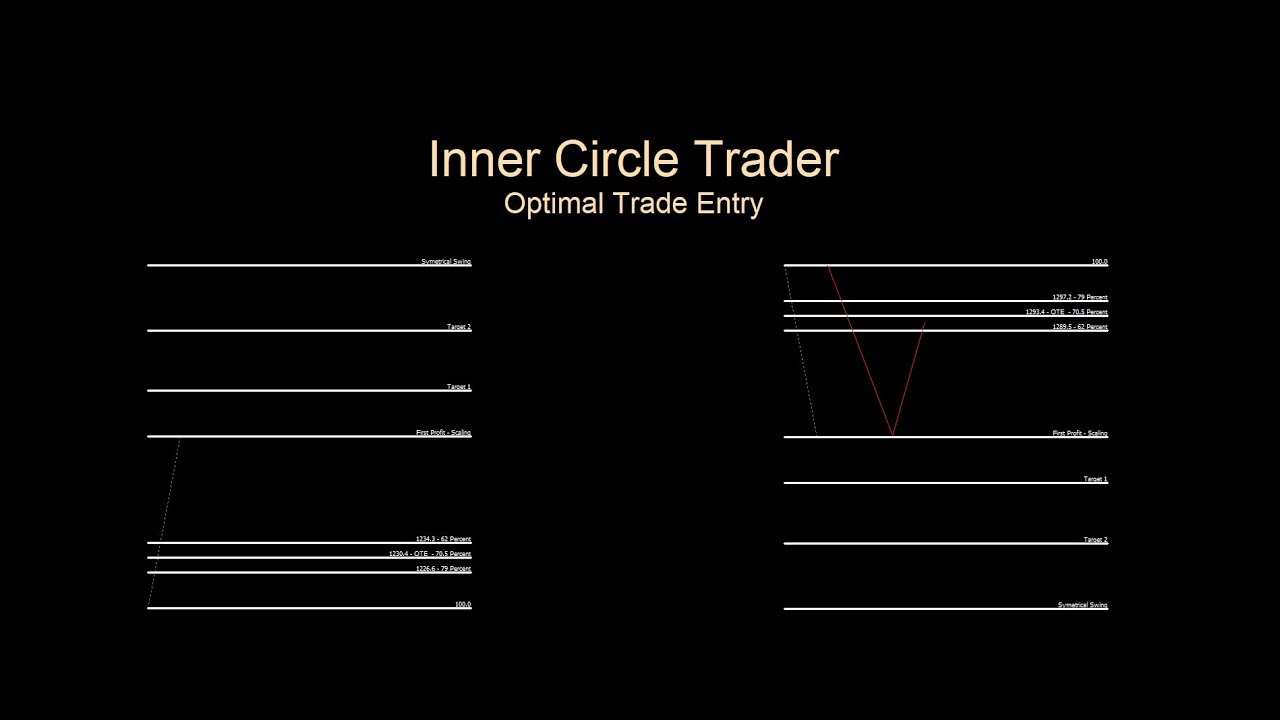

OTE Primer - Intro To ICT Optimal Trade Entry

95% WINRATE MULTITIMEFRAME CONFRIMATION ( GUARANTEED )

ICT Mentorship - Core Content - Month 02 - Framing Low Risk Trade Setups

Aligning Time Frames Is What You Are MISSING

5.0 / 5 (0 votes)