Hands on with R for CAPM

Summary

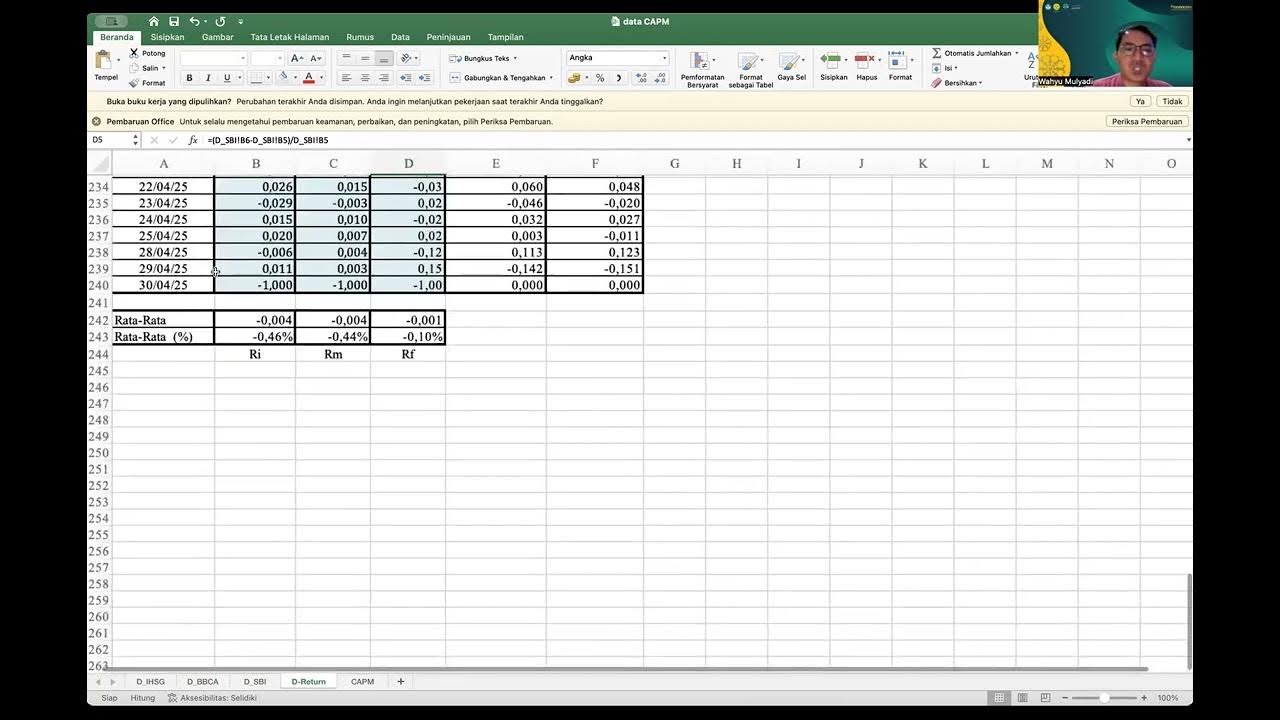

TLDRIn this educational video, the instructor guides viewers through using R for financial analysis, focusing on the Capital Asset Pricing Model (CAPM). The process involves downloading stock data via the TSeries package, calculating returns, and adjusting for risk. The lecturer demonstrates how to assess risk premiums, run CAPM analysis, and test key assumptions such as randomness, homoscedasticity, and normality. Issues with normality are identified, leading to the suggestion of using bootstrap regression for more reliable results. The video serves as an informative tutorial for applying financial models in R, with an emphasis on troubleshooting and improving analysis.

Takeaways

- 😀 The T-Series package in R is essential for downloading historical financial data, such as stock prices for analysis.

- 😀 If the T-Series package isn't installed, it can be installed using the `install.packages('TSeries')` function in R.

- 😀 Users can set custom date ranges for financial data, like 90 days before the system's current date, for analysis.

- 😀 Historical stock data, such as Reliance Industries, can be downloaded using the `get.hist.quote` function, and other stocks like TCS can also be analyzed by adjusting the stock symbol.

- 😀 Logarithmic returns are calculated for stocks like Reliance and Nifty 50, with risk-free rates incorporated to calculate risk premiums.

- 😀 The Capital Asset Pricing Model (CAPM) regression model is used to determine the relationship between market returns (Nifty) and stock returns (Reliance).

- 😀 Regression analysis output includes Alpha and Beta values; Alpha for Reliance is near zero with a non-significant p-value, implying fair pricing of the stock.

- 😀 Diagnostic checks are performed, including residual plots, QQ plots for normality, and the Breusch-Pagan test for homoscedasticity.

- 😀 The normality assumption for residuals is violated, rendering the T-test based analysis invalid.

- 😀 To address assumption violations, the lecture suggests using bootstrap regression, a non-parametric method that doesn't rely on normality assumptions.

- 😀 The next video will cover how bootstrap regression can be applied to solve the issues identified with the traditional CAPM analysis.

Q & A

What is the first step in the analysis process described in the video?

-The first step is installing the T-Series package in R, which is necessary to download and analyze financial data.

How can you install the T-Series package if it's not already installed in your R environment?

-You can install the T-Series package by going to the 'Packages' tab in RStudio, clicking 'Install', typing 'T-Series', and ensuring that 'Install dependencies' is checked before clicking 'Install'.

What is the purpose of using the 'get.hist.quote' function in the T-Series package?

-The 'get.hist.quote' function is used to download historical financial data for a given stock or instrument, like Reliance or TCS, from sources like Yahoo Finance.

How do you specify the stock you want to download using the 'get.hist.quote' function?

-You specify the stock by its instrument name, such as 'reliance.ns' for Reliance or 'tcs.ns' for Tata Consultancy Services, which can be found on Yahoo Finance.

What does the 'head' function do when applied to a financial data object in R?

-The 'head' function displays the first few rows of the financial data, showing the most recent adjusted close prices for the stock.

What is the significance of calculating log returns in financial analysis?

-Log returns are used to measure the relative change in stock prices over time, providing a normalized way to compare returns across different time periods and instruments.

Why is a risk-free rate of 6% used in the analysis, and how is it applied?

-A risk-free rate of 6% is assumed for the analysis, representing a safe return (like from government bonds). It is used to calculate the risk premium by subtracting the risk-free rate from the stock's return.

What is the purpose of plotting the risk premiums of Nifty and Reliance?

-Plotting the risk premiums of Nifty and Reliance helps visualize the relationship between the stock's returns and the market's returns, illustrating how each behaves relative to one another.

What is the significance of the alpha and beta values obtained from the CAPM analysis?

-In the CAPM analysis, the alpha value indicates how much the stock's return deviates from what is predicted by the market (Nifty index), while the beta value measures the stock's volatility relative to the market. A beta above 1 suggests higher volatility than the market.

Why does the assumption of normality fail in this analysis, and what are the consequences?

-The normality assumption fails because the residuals (differences between actual and predicted returns) do not follow a normal distribution. This invalidates the use of standard statistical tests based on the assumption of normality, making the CAPM results unreliable.

What is the solution proposed for dealing with the violation of the normality assumption?

-The proposed solution is to use bootstrap regression, specifically non-parametric bootstrap regression, which does not rely on the assumption of normality and can provide more accurate results in such situations.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

CAPM - What is the Capital Asset Pricing Model

Risk and Return: Capital Asset Pricing Model (CAPM) 【Dr. Deric】

Teori Portofolio dan Analisis Investasi sesi 12 ( Menghitung Capital Aset Pricing Model)

Penjelasan Tentang Capital Asset Pricing Model

Capital Market Line (CML) vs Security Market Line (SML)

BIAYA MODAL PART 2 - FARFIN CLASS

5.0 / 5 (0 votes)