Fractional Reserve Banking Explained in One Minute

Summary

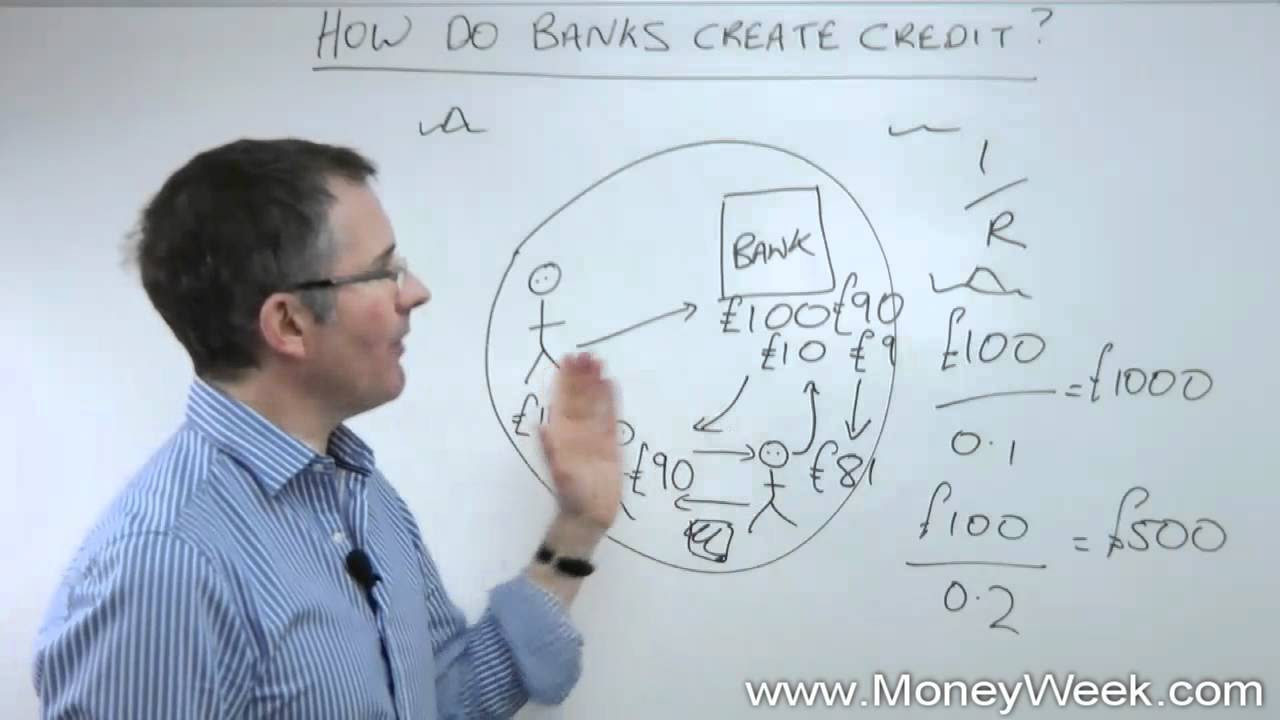

TLDRThis video explains the concept of fractional reserve banking, where banks lend out most of the money deposited by customers while keeping only a small percentage in reserve. Through an example, it shows how a $1,000 deposit can eventually grow into $10,000 as the money is lent out, spent, and redeposited across multiple banks. The video emphasizes that commercial banks play a larger role in creating money than central banks, offering a unique perspective on the money supply and the banking system's function in the economy.

Takeaways

- 😀 Banks create money through fractional reserve banking, where they lend out more than they hold in deposits.

- 😀 A certain percentage of a deposit is kept in reserve, and the rest is loaned out, stimulating the economy.

- 😀 With a 10% reserve requirement, a $1,000 deposit can eventually create up to $10,000 in the economy.

- 😀 For every deposit made, banks only need to keep a fraction, such as 10%, and lend out the rest.

- 😀 This process creates a ripple effect, where money keeps circulating through the system and creating more loans.

- 😀 John deposits $1,000 in the bank, and the bank lends out $900, increasing the total money supply to $1,900.

- 😀 When Mike buys something with the loaned money and Karen deposits it in another bank, more money is created.

- 😀 Karen's deposit leads to another loan being made, further increasing the amount of money in circulation.

- 😀 Through multiple cycles, the initial deposit grows exponentially, with the system generating more money than originally deposited.

- 😀 Commercial banks, through fractional reserve banking, actually create more money than central banks do, showcasing their significant influence in the economy.

Q & A

What is fractional reserve banking?

-Fractional reserve banking is a system where banks are required to keep only a fraction of their deposits in reserve, and they are allowed to lend out the rest of the money to borrowers.

How does fractional reserve banking create money?

-Fractional reserve banking creates money by allowing banks to lend out a large portion of the deposits they receive. When a bank lends out money, that loan becomes new money in the system, as it can be deposited in other banks and lent out again.

What is the reserve requirement in fractional reserve banking?

-The reserve requirement is the percentage of deposits that a bank must hold in reserve and not lend out. In the example provided, the reserve requirement is 10%, meaning the bank must keep 10% of the deposit and can lend out the remaining 90%.

How does the example with John and his $1,000 deposit work?

-John deposits $1,000 into his bank. The bank keeps 10% of this amount ($100) as required by the reserve rule, and lends out the remaining $900. This $900 is then spent and deposited elsewhere, continuing the cycle of money creation.

What happens after Mike spends his $900 loan on a laptop?

-When Mike spends his $900 loan on a laptop, Karen receives the payment and deposits the $900 into another bank. That bank keeps 10% of the deposit ($90) and lends out the remaining $810, continuing the process of money creation.

How does money multiply in the system?

-Money multiplies in the system because each deposit creates new loans. With each successive loan, more money is added to the financial system. In the example, John's initial $1,000 deposit eventually creates around $10,000 in the system.

Why do commercial banks create more money than central banks?

-Commercial banks create more money than central banks because, through fractional reserve banking, they can lend out most of the deposits they receive. Central banks primarily issue currency, but commercial banks effectively expand the money supply through lending.

What is the role of the reserve requirement in controlling money creation?

-The reserve requirement helps control how much money banks can lend and thus how much money can be created. A higher reserve requirement means less money is created, while a lower reserve requirement allows more money to be created.

What is the total amount of money created in the system after John's initial deposit?

-After John's initial $1,000 deposit, the total amount of money created in the system is approximately $10,000, as each loan becomes a new deposit that continues the cycle of lending and money creation.

What are the implications of fractional reserve banking on the economy?

-Fractional reserve banking can stimulate economic growth by increasing the money supply, which in turn fuels lending, investment, and spending. However, it can also contribute to financial instability if not properly regulated, as banks may not have enough reserves to meet withdrawal demands in times of crisis.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тариф5.0 / 5 (0 votes)