The Economists: Risk Versus Uncertainty

Summary

TLDRThis video explores the key distinction between risk and uncertainty in finance. Risk is quantifiable, often through models like implied volatility, whereas uncertainty arises from unpredictable factors that cannot be easily measured. Using the Federal Reserve's policy changes in 2022 as an example, the video highlights how uncertainty can overshadow risk, creating volatility in financial markets. The analogy of water boiling, transitioning from liquid to gas, is used to explain how sudden shifts in economic conditions can increase uncertainty. Ultimately, the video underscores the challenge of managing risk in an uncertain environment and the complexity of forecasting market outcomes.

Takeaways

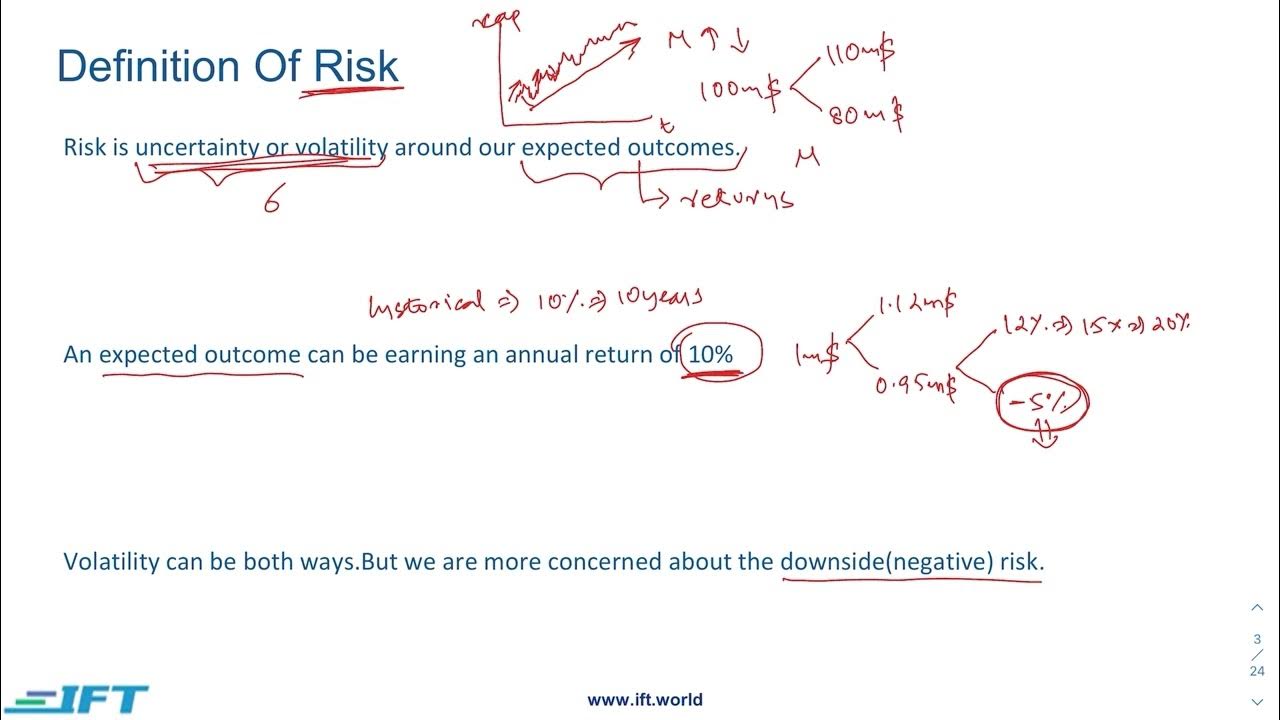

- 😀 **Risk vs. Uncertainty**: Risk can be quantified and measured, while uncertainty is much harder to quantify and often driven by unpredictable factors.

- 😀 **Quantifying Risk**: In financial markets, risk often relates to things like volatility or potential asset price declines, which can be numerically calculated (e.g., options pricing).

- 😀 **Uncertainty in Financial Markets**: Uncertainty arises from unpredictable shifts, such as sudden policy changes or unobserved economic environments, making future outcomes difficult to forecast.

- 😀 **Federal Reserve Policy Shift**: The Federal Reserve's transition from quantitative easing (buying securities) to quantitative tightening (reducing its balance sheet) increased market uncertainty.

- 😀 **Impact of Interest Rate Hikes**: Along with quantitative tightening, the Fed's aggressive interest rate hikes in 2022 and 2023 created significant market volatility and uncertainty.

- 😀 **Difficulty of Forecasting in Uncertainty**: Heightened uncertainty makes it challenging to quantify risk, as multiple competing outcomes must be accounted for in market predictions.

- 😀 **Market Complexity and Chaos**: The example of water transitioning from liquid to gas illustrates how financial markets can experience chaotic and unpredictable shifts during times of high uncertainty.

- 😀 **Managing Uncertainty in Financial Markets**: As uncertainty rises, investors must refine their methods for managing risk exposure, which becomes more complex when competing possibilities are present.

- 😀 **Event Risk in Options Trading**: Options are well-suited to manage event risk, particularly when there is a high probability of sudden price movements, as opposed to futures contracts, which are more suited to directional risk.

- 😀 **Final Outcome Dominance**: In uncertain times, one possible outcome will eventually dominate, and market prices will adjust rapidly once it becomes clear which outcome is most likely.

Q & A

What is the difference between 'risk' and 'uncertainty' in financial markets?

-Risk refers to measurable factors, such as volatility or the likelihood of asset price changes, which can be quantified using statistical models. Uncertainty, on the other hand, pertains to unpredictable factors that are difficult to measure, such as sudden shifts in economic policies or geopolitical events.

How does the Federal Reserve’s policy shift impact financial markets?

-The Federal Reserve's shift from quantitative easing (buying bonds to increase market liquidity) to quantitative tightening (reducing its balance sheet by selling bonds) and raising interest rates has created market instability. These actions can lead to sharp declines in both the stock and bond markets, increasing uncertainty among investors.

Why is uncertainty in the market more challenging than risk?

-Uncertainty is difficult to manage because it involves unknown future events or conditions that cannot be easily predicted or measured. Unlike risk, which can be quantified and mitigated using tools like financial models, uncertainty lacks clear parameters, making it harder for market participants to make informed decisions.

Can you explain the analogy between financial uncertainty and the boiling of water?

-The analogy compares the transition from liquid to gas when water boils to how small changes in an environment (like shifts in monetary policy) can lead to unpredictable and chaotic outcomes in markets. Just as water's state can change rapidly when heated, markets can experience sudden, drastic changes due to unforeseen events.

How did the Federal Reserve’s actions in 2022 affect market participants?

-The Federal Reserve’s shift in 2022—from continuing quantitative easing to initiating quantitative tightening and raising interest rates—led to a significant drop in both the stock and bond markets. This created heightened uncertainty among market participants, who struggled to predict the effects on the economy, consumer behavior, corporate profits, and employment.

What role does 'event risk' play in market uncertainty?

-Event risk refers to the risk of sudden, unexpected events that can drastically affect financial markets. These events, such as policy changes or geopolitical crises, increase market uncertainty by creating unpredictable fluctuations in asset prices.

Why is risk management becoming more complicated in today’s financial environment?

-With increasing uncertainty, traditional methods of risk management, which focus on quantifiable risks, are becoming less effective. The complexity arises from the fact that multiple unpredictable events are happening simultaneously, and market participants need to account for both known risks and unknown uncertainties.

What are 'options' and why are they useful in managing market uncertainty?

-Options are financial derivatives that allow investors to hedge against price movements by offering the right (but not the obligation) to buy or sell an asset at a set price within a specified time. They are useful in managing uncertainty because they allow market participants to protect themselves against sudden, unpredictable price changes, which are more challenging to handle with other financial instruments like futures.

How did the Fed's actions from January 2022 to 2023 affect inflation and the stock market?

-The Fed’s shift to tighten monetary policy by reducing its balance sheet and raising interest rates helped curb inflation but also triggered a sharp drop in the stock market. This sudden change in policy, from inflation-supportive measures to inflation-fighting measures, heightened market volatility and uncertainty about future economic conditions.

Why is it difficult to predict long-term impacts of the Fed’s policy changes?

-The long-term impacts of the Fed’s policy changes are difficult to predict due to the complexity and unpredictability of economic systems. Changes like interest rate hikes and balance sheet reductions can have ripple effects throughout the economy, affecting everything from consumer spending to global trade, which makes forecasting their precise impact challenging.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

What is Entrepreneurial Finance and how does it Relate to Effectuation?

Project risk and uncertainty in pmbok 7th edition

Acting on Innovation S01E02 — Innovation vs. Core Business

FRM Part 1 Book 1 Chapter 1 – Lecture 1

Perbedaan Bank Syariah dan Bank Konvensional | BANK SYARIAH VS BANK KONVENSIONAL

Stocks vs Bonds Full Explanation (For Beginners)

5.0 / 5 (0 votes)