Apa itu Balance Sheet? Ini Komponen yang Harus Kamu Ketahui | feat. Brenda Andrina

Summary

TLDRIn this video, Brenda explains the financial position report, detailing its three key components: assets, liabilities, and equity. Using the example of a fictional food and beverage company, Stok Becik, she illustrates how assets are the sum of liabilities and equity, emphasizing their role in business operations. The video covers types of assets, such as current and non-current, and explains liabilities, including short-term and long-term debts. Brenda also discusses equity contributions and the principles of recording financial statements, highlighting the importance of these elements in assessing a company's financial health.

Takeaways

- 😀 Financial statements consist of three main components: assets, liabilities, and equity.

- 😀 The equation for assets is: Assets = Liabilities + Equity.

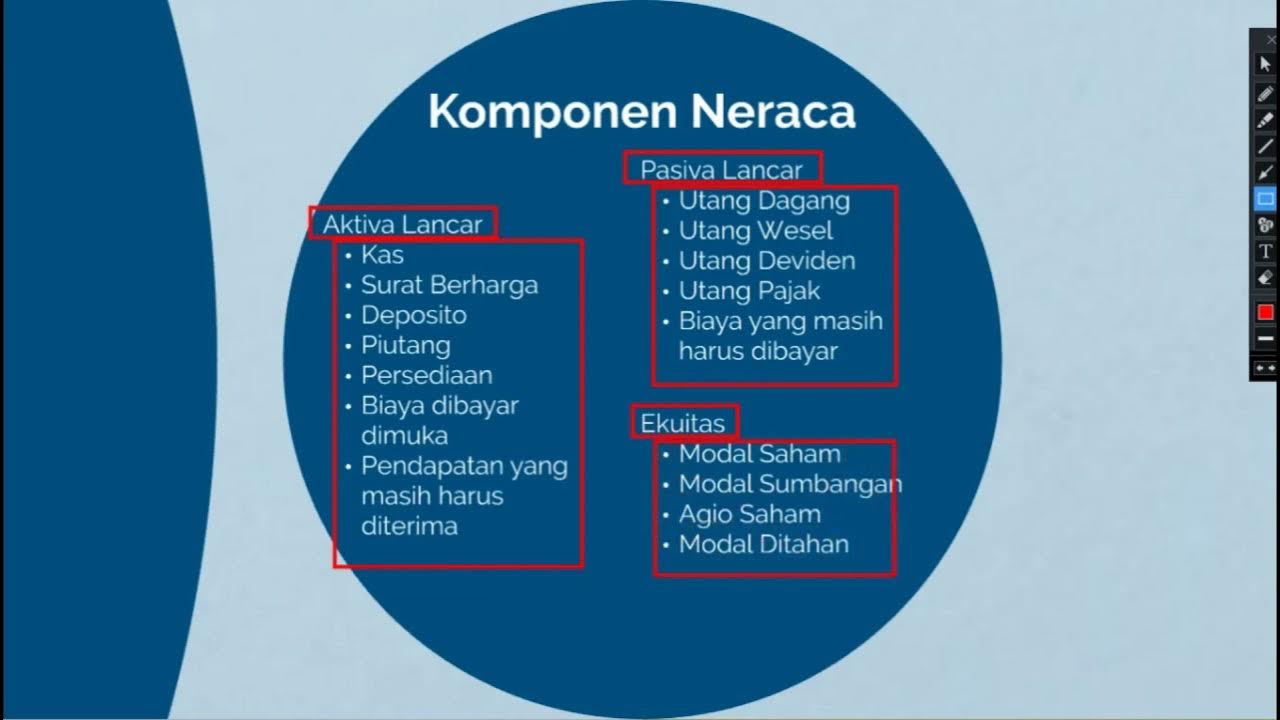

- 😀 Assets are classified into current (convertible to cash within a year) and non-current (longer than a year).

- 😀 Current assets include cash, inventory, accounts receivable, and prepaid expenses.

- 😀 Non-current assets include fixed assets, intangible assets, and long-term investments.

- 😀 Liabilities are obligations owed to others and are classified as short-term (due within a year) or long-term.

- 😀 Short-term liabilities include accounts payable and short-term loans, while long-term liabilities involve debts due after one year.

- 😀 Equity represents the owner's contributions to the company, including issued capital and retained earnings.

- 😀 Retained earnings are profits not distributed as dividends and can be reinvested in the business.

- 😀 Financial reporting principles include historical cost and fair value, influencing how assets and liabilities are recorded.

Q & A

What are the three main components of a balance sheet?

-The three main components of a balance sheet are assets, liabilities, and equity.

How are assets defined in the context of a balance sheet?

-Assets are defined as the sum of liabilities and equity owned by the company.

What is the difference between current assets and non-current assets?

-Current assets are resources that can be converted into cash within one year, while non-current assets are more difficult to convert to cash and have a lifespan of more than one year.

Can you provide examples of current assets?

-Examples of current assets include cash and cash equivalents, inventory, accounts receivable, and prepaid expenses.

What are non-current assets and can you give examples?

-Non-current assets include fixed assets like kitchen equipment, intangible assets like goodwill, and long-term investments.

What is the formula for calculating total assets?

-The formula for calculating total assets is liabilities plus equity.

What are liabilities, and how are they categorized?

-Liabilities are obligations the company owes to external parties, categorized into short-term liabilities (due within one year) and long-term liabilities (due after more than one year).

What types of liabilities are considered short-term?

-Short-term liabilities include accounts payable, wages payable, and short-term bank loans.

What is equity in the context of a balance sheet?

-Equity represents the owner's contributions to the business, including paid-in capital and retained earnings.

How does the principle of historical cost differ from fair value in financial reporting?

-The historical cost principle records assets at their original purchase price, while the fair value principle adjusts the value based on current market conditions.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тариф5.0 / 5 (0 votes)