Docuvlog : Ketika ekonomi USA hancur Karena KPR

Summary

TLDRThe video explores the U.S. economic crisis of 2007-2008, tracing its roots to a housing bubble fueled by low interest rates and aggressive lending by banks like Lehman Brothers. Michael Burry, an investor, foresaw the impending collapse and bet against the market through credit default swaps. As property values plummeted and defaults surged, the crisis reverberated globally, affecting economies worldwide, including Indonesia. The film 'The Big Short' illustrates these events, providing insight into the complexities of the financial meltdown and its far-reaching consequences, prompting viewers to consider the potential for similar situations in other economies.

Takeaways

- 😀 No country is immune to economic crises, as exemplified by the 2007-2008 U.S. financial meltdown.

- 🎬 'The Big Short' is a film that illustrates the events leading up to the economic crisis, featuring key characters and their actions.

- 📉 The 2007-2008 crisis was rooted in a series of economic decisions, beginning with the Federal Reserve's decision to lower interest rates in 2001.

- 🏠 The lowered interest rates encouraged a housing market boom, with banks promoting subprime mortgages to low-income borrowers.

- 💰 Many financial institutions, including Lehman Brothers, became heavily invested in these risky mortgage-backed securities.

- 🔍 Michael Burry recognized the housing market's vulnerabilities and invested in credit default swaps, betting against the market.

- 🚨 The eventual surge in mortgage defaults led to a cascade of foreclosures and a collapse of housing prices.

- 🌍 The crisis resulted in Lehman Brothers' bankruptcy, significantly impacting the global economy and leading to widespread financial instability.

- 📊 The Dow Jones Industrial Average fell drastically, and unemployment rates surged, demonstrating the crisis's severe economic implications.

- 🤔 The speaker raises concerns about the potential for similar economic crises in other countries, including Indonesia, indicating the global interconnectedness of economies.

Q & A

What was the primary focus of the film 'The Big Short'?

-The film 'The Big Short' focuses on the events leading up to the 2007-2008 financial crisis, highlighting the actions of various individuals who anticipated the collapse of the housing market and took steps to profit from it.

What economic event triggered the financial crisis discussed in the transcript?

-The financial crisis was triggered by the subprime mortgage crisis in the United States, which began when many homeowners could not meet their mortgage obligations, leading to widespread defaults and foreclosures.

How did the Federal Reserve's policy in 2001 contribute to the financial crisis?

-In 2001, the Federal Reserve lowered interest rates to stimulate the economy. This made borrowing cheaper, encouraging more people to take out mortgages, including those who were less financially stable, thus contributing to the subprime mortgage market.

What role did Lehman Brothers play in the financial crisis?

-Lehman Brothers was a major investment bank that heavily invested in mortgage-backed securities. Its eventual bankruptcy in 2008 marked a significant point in the financial crisis, leading to widespread panic in financial markets.

Who is Michael Burry, and what was his prediction regarding the housing market?

-Michael Burry was an investor who predicted the collapse of the housing market by identifying the weaknesses in the subprime mortgage sector. He took a contrarian position by buying credit default swaps to bet against these securities.

What was the impact of rising mortgage defaults on the housing market?

-As mortgage defaults increased, properties flooded the market, leading to a sharp decline in housing prices and creating an oversupply of homes that could not be sold, further destabilizing the market.

What does MBS stand for, and why is it significant in this context?

-MBS stands for mortgage-backed securities. They are significant because they were heavily marketed as safe investments during the housing boom, but their value plummeted when the housing market collapsed.

What was the effect of the financial crisis on the global economy?

-The financial crisis had a profound effect on the global economy, leading to increased unemployment, economic downturns in multiple countries, and a significant reduction in consumer and business confidence worldwide.

What does the term 'credit default swap' refer to?

-A credit default swap is a financial derivative that allows an investor to 'swap' or transfer the credit risk of fixed income products between parties. In this context, it was used by investors like Michael Burry to bet against the risk of mortgage-backed securities.

How long did it take for the US economy to recover from the 2008 financial crisis?

-It took about ten years for the US economy to fully recover from the 2008 financial crisis, with significant changes in financial regulations and economic policies implemented to prevent a similar crisis in the future.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

For Oom Piet - Poem Analysis

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

Embedded Linux | Introduction To U-Boot | Beginners

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

Complements of Sets

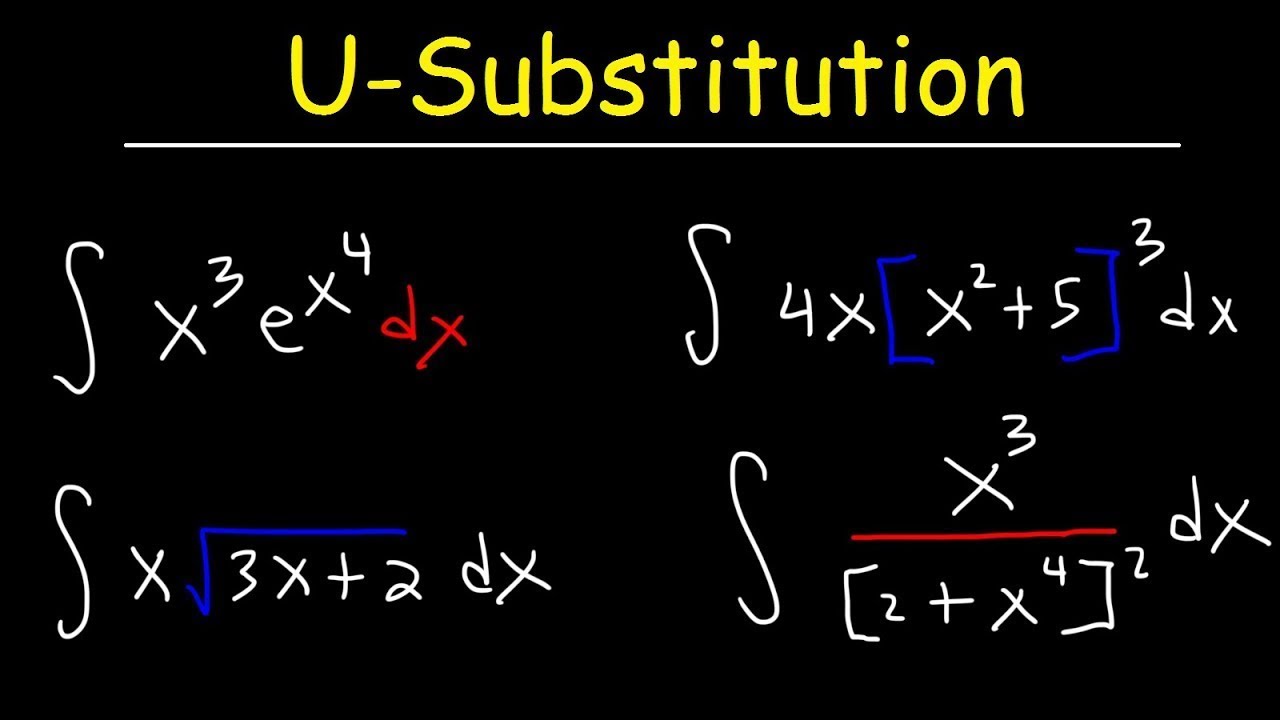

How To Integrate Using U-Substitution

5.0 / 5 (0 votes)