How to Improve Cash Flow | A-Level, IB & BTEC Business

Summary

TLDRThis video explores key strategies for improving cash flow in a business. It highlights the significance of effective cash flow forecasting, controlling costs, and managing working capital, particularly through inventory and receivables management. The discussion includes debt factoring as a short-term solution and emphasizes the importance of maintaining good supplier relationships while extending payment terms. For long-term financial health, businesses may need to reassess their financing options, such as raising equity or securing loans. Overall, the video provides practical insights to help businesses enhance their liquidity and profitability.

Takeaways

- 💰 Understanding cash flow issues is crucial for business health, with poor profitability being a primary cause.

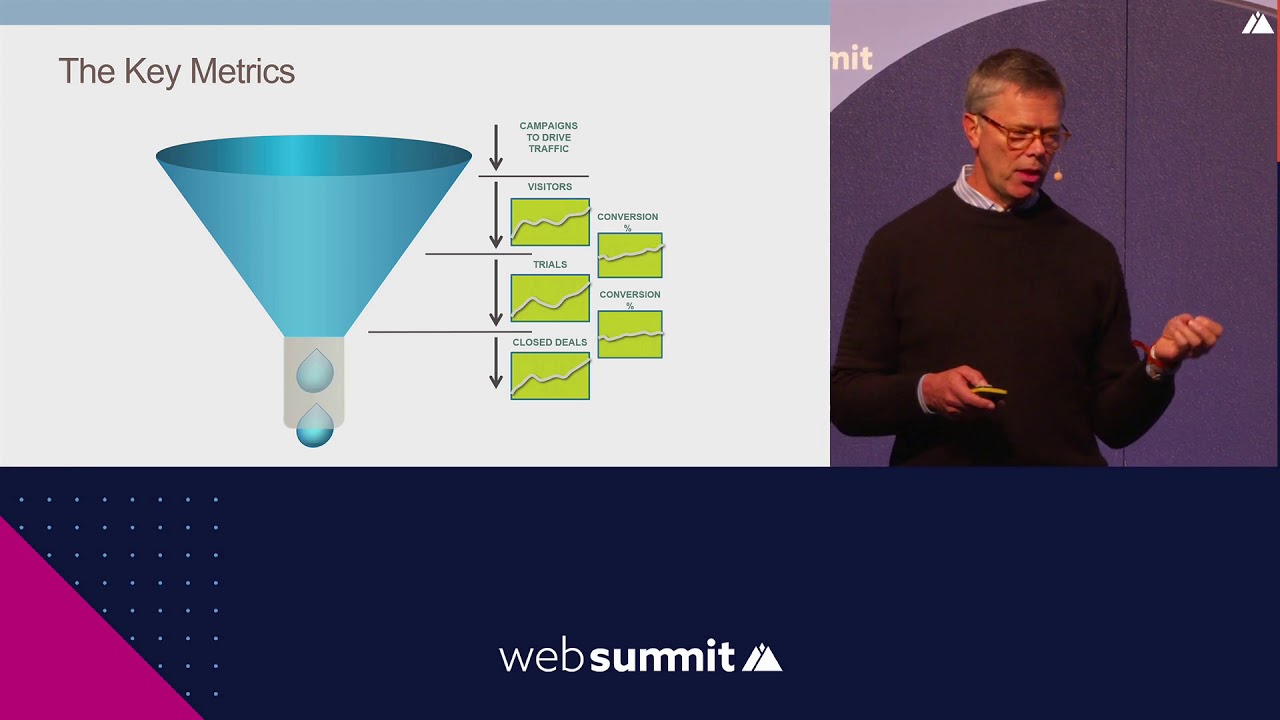

- 📊 Effective cash flow forecasting is essential for better cash flow management.

- ✂️ Keeping costs under control helps mitigate cash flow problems stemming from low profits or losses.

- 📦 Managing working capital effectively can provide short-term relief for cash flow issues.

- 🔄 Reducing excess inventory can free up cash and improve cash flow.

- 🕒 Implementing credit control can expedite payments from customers, improving cash flow.

- 💳 Debt factoring can be a quick way to improve cash flow by selling outstanding invoices to a third party.

- ⏳ Extending trade credit with suppliers can help retain cash for longer periods.

- 📉 Long-term cash flow issues may indicate poor capitalization and the need for a better mix of finance.

- 🏦 Exploring new equity financing or long-term loans can provide a more secure financial situation for the business.

Q & A

What are some key reasons for poor cash flow in businesses?

-Key reasons for poor cash flow include low profitability or losses, overexpansion, excess working capital, and delays in customer payments.

How can a business improve its cash flow forecasting?

-A business can improve cash flow forecasting by implementing reliable techniques to predict cash needs and identify potential cash shortages.

Why is cost control important for cash flow management?

-Cost control is crucial because losses or low profits are primary causes of poor cash flow; managing costs helps improve profitability and liquidity.

What is working capital and how does it affect cash flow?

-Working capital is the cash tied up in inventories, receivables, and payables. Effective management of working capital can improve cash flow by ensuring that less cash is tied up in these assets.

What strategies can be employed to manage inventory levels effectively?

-Businesses should regularly assess their inventory levels, aim to reduce excess stock, and ensure they maintain enough inventory to meet customer demand.

What is credit control and how can it improve cash flow?

-Credit control involves managing how much is owed by customers. Improved credit control can lead to faster payments and reduced outstanding debts, enhancing cash flow.

What are the benefits and costs associated with debt factoring?

-Debt factoring allows businesses to sell their outstanding invoices for immediate cash, providing quick liquidity. However, it often comes with significant fees or interest costs.

How can delaying supplier payments affect cash flow?

-Delaying supplier payments can improve cash flow by keeping more cash in the business for a longer period. However, this must be managed carefully to avoid damaging supplier relationships.

What long-term solutions can help address ongoing cash flow problems?

-Long-term solutions include reviewing the capital structure, raising new equity, securing long-term loans, and liquidating surplus assets to generate cash.

Why is it essential to maintain a good relationship with suppliers when managing cash flow?

-Maintaining good relationships with suppliers is crucial because delayed payments can lead to potential legal issues, loss of credit terms, and strained partnerships, which may adversely impact business operations.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)