Sistem Uang Berbahaya: Fractional Reserve Banking System

Summary

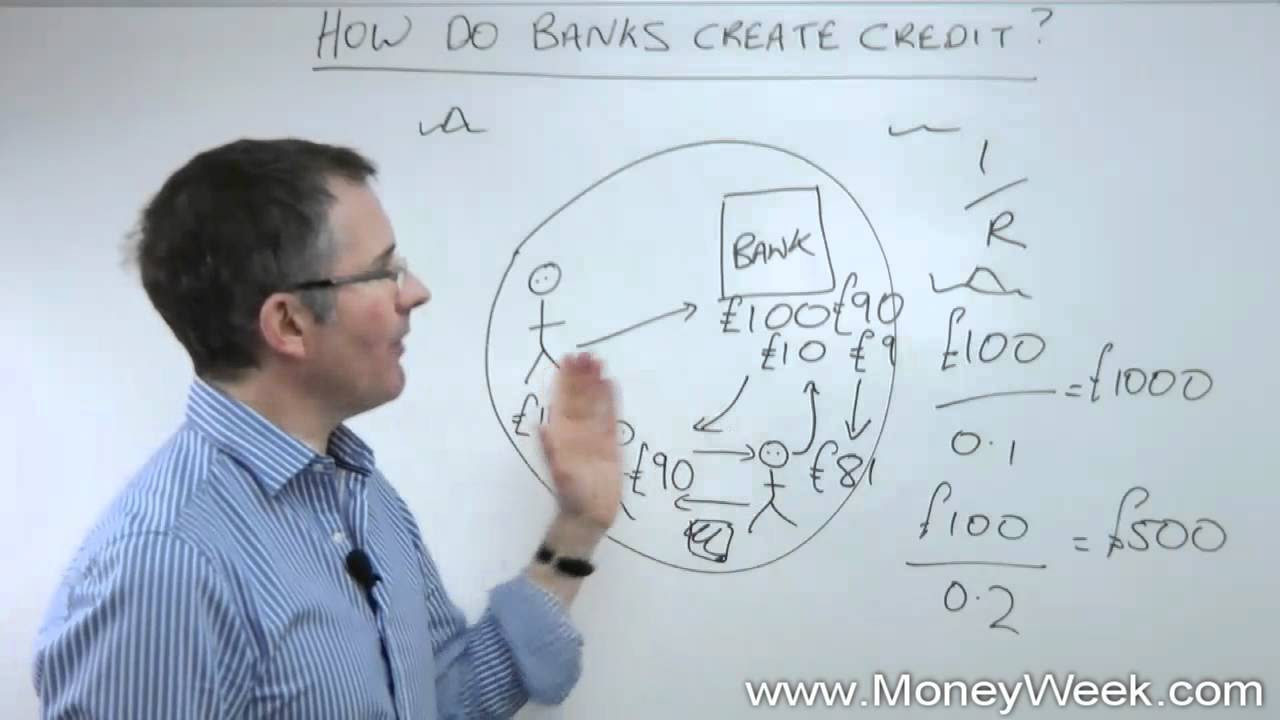

TLDRIn this video, the speaker explains the concept of fractional reserve banking, a system where banks are only required to keep a small portion of deposits in reserve while lending out the majority. This allows banks to 'create' money through lending. The speaker discusses how this system can be risky for depositors, especially if many people attempt to withdraw funds simultaneously, leading to a bank run. He also mentions that in the US, the reserve requirement was reduced to 0% during the pandemic, which raises further concerns about banking stability.

Takeaways

- 💼 Fractional reserve banking allows banks to only keep a small percentage (e.g., 10%) of customer deposits as reserves, lending out the rest to create more money.

- 💸 Banks can lend out 90% of a deposit, which results in money multiplying as the same deposit is loaned and re-loaned, creating more money in circulation than initially deposited.

- 💰 The profit of banks doesn't solely come from loans or services like credit cards, but also from trading and investments using customer deposits.

- ⚠️ Customer deposits in banks aren't fully secure because banks lend out a large portion of the money. If a bank makes a mistake, customers bear the risk.

- 🔄 The fractional reserve system can multiply deposits, meaning a deposit of 100 million can be expanded into billions through repeated lending, even though only a fraction is held as reserve.

- 🏦 In March 2020, during the pandemic, the US reduced the reserve requirement for banks to 0%, allowing them to lend out all deposits with no mandatory reserve.

- 🔥 With a 0% reserve requirement, banks can technically lend out all deposited money, which can potentially increase inflation due to more money circulating in the economy.

- 🏃♂️ A bank run occurs when too many people try to withdraw their money at the same time, potentially causing the bank to collapse due to lack of sufficient cash reserves.

- 💡 The speaker advises against storing all money in banks, instead keeping only what is needed for daily expenses, as banks might collapse if many customers withdraw simultaneously.

- 🔒 The speaker suggests storing money outside of banks for security, and hints that further details about this are too controversial to share publicly but may be discussed privately.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video is the 'fractional reserve banking system,' which is how banks create money by lending out most of the deposits they receive, only keeping a fraction in reserve.

What does the fractional reserve banking system allow banks to do?

-The fractional reserve banking system allows banks to lend out the majority of deposited funds, keeping only a small percentage (e.g., 10%) in reserve. This system enables banks to create money by lending out deposits multiple times, effectively multiplying the money supply.

How does the video explain the process of money creation through fractional reserve banking?

-The video explains that when someone deposits 100 million rupiah, the bank is legally required to keep only 10% (10 million rupiah) and can lend the remaining 90 million rupiah to others. The same process repeats with other borrowers, which leads to an increase in the total money supply, potentially turning the initial deposit into over a billion rupiah.

Why is fractional reserve banking described as controversial in the video?

-It is described as controversial because the system allows banks to create money from deposits that don't fully exist in physical form. If too many people try to withdraw their funds at once (a 'bank run'), the bank may not have enough cash on hand, putting depositors' money at risk.

What changes occurred in the US banking system in 2020, according to the video?

-The video mentions that in 2020, the Federal Reserve in the US reduced the reserve requirement ratio to 0%, meaning banks were no longer required to keep any portion of deposits as reserves. This policy change was made to ensure liquidity during the economic crisis caused by the COVID-19 pandemic.

What is a 'bank run,' and why is it a risk in fractional reserve banking?

-A 'bank run' occurs when a large number of depositors withdraw their money from a bank simultaneously due to concerns about the bank's solvency. In a fractional reserve system, banks may not have enough reserves to cover all withdrawals, which can lead to financial collapse.

How does the video explain the impact of the banking system on inflation?

-The video explains that as banks lend out more money through the fractional reserve system, the overall money supply increases. This can lead to inflation if there is too much money chasing too few goods, reducing the value of currency over time.

Why does the speaker in the video express concern about keeping all their money in the bank?

-The speaker expresses concern because, in a fractional reserve banking system, most of the deposited money is not actually held by the bank, making it vulnerable if many people withdraw funds at once. They prefer to keep only a small percentage of their money in the bank for daily needs.

What alternative to traditional banking does the speaker suggest?

-The speaker hints at keeping money in personal control rather than relying entirely on banks, although they do not go into specific details about the alternative. This implies a preference for more direct control over their financial assets.

Why does the speaker decide not to share further details publicly?

-The speaker chooses not to share further details publicly due to the potentially controversial nature of their opinions on the banking system. They fear that discussing such topics might cause disruptions or be misinterpreted, leading to unintended consequences like a bank run.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тариф5.0 / 5 (0 votes)