Stop freaking out about the debt

Summary

TLDRThe video discusses the U.S. national debt, explaining that while it seems alarming at $12.5 trillion, it's not an immediate concern. The U.S. government can never run out of dollars, as it controls the currency. The real issue to watch for is inflation—too much money chasing limited goods raises prices. The Federal Reserve controls this by adjusting interest rates. Although high deficits can lead to inflation and slow growth, inflation and interest rates are currently at record lows. Reducing debt by cutting spending or raising taxes might harm the economy more than help.

Takeaways

- 💰 The United States' national debt is $12.5 trillion, which is seen as a concern for many people.

- 📈 The national income, which is the total value of everything the U.S. makes annually, is also very large.

- 💵 The U.S. government can never technically run out of dollars because it prints its own currency, unlike individuals, businesses, or local governments.

- 🖥️ The Federal Reserve creates most of the money electronically, primarily through computers.

- ⚠️ The primary concern with printing too much money is inflation, which occurs when too much money is chasing a limited amount of goods, leading to higher prices.

- 📉 To control inflation, the Federal Reserve may raise interest rates, which would slow down the economy.

- 💼 Higher interest rates affect businesses as well, leading to reduced investment and slower economic growth.

- 💡 Deficits are a concern because they can lead to inflation and higher interest rates.

- 🕒 Currently, inflation is at a 30-year low, and interest rates are also near record lows, making debt less of an immediate problem.

- 🔄 Reducing debt through higher taxes or cutting benefits could harm the economy by reducing jobs and incomes, potentially worsening the debt situation.

Q & A

What is the current national debt of the United States according to the script?

-The current national debt of the United States is $12.5 trillion.

Why are some people concerned about the national debt?

-Many people are concerned about the national debt because it appears to be a large number, and they worry it could have negative consequences for the economy.

How does the national income compare to the national debt?

-The national income, which is the total value of everything the U.S. makes each year, is also very large, so the size of the debt is not necessarily alarming when viewed in that context.

Why can the U.S. government never run out of dollars?

-The U.S. government can never run out of dollars because it has the ability to print dollars, or more accurately, the Federal Reserve can create them digitally.

What is the main concern about having too much money in circulation?

-The main concern about having too much money in circulation is inflation, which happens when too much money is chasing a fixed amount of goods, leading to higher prices.

How does the Federal Reserve respond to rising inflation?

-The Federal Reserve responds to rising inflation by raising interest rates, which slows down the economy by making borrowing more expensive.

What effect do higher interest rates have on businesses?

-Higher interest rates lead to higher borrowing costs for businesses, which can result in less investment in the private economy and slower economic growth.

Why are deficits a concern in terms of economic growth?

-Deficits are a concern because they can lead to inflation and higher interest rates, which may slow down economic growth.

What is the current state of inflation and interest rates according to the script?

-Inflation is currently the lowest it has been in 30 years, and interest rates are near record lows.

What could be the downside of trying to reduce the national debt by raising taxes or cutting benefits?

-Raising taxes or cutting benefits could take money out of people's pockets, leading to fewer jobs, lower incomes, and potentially making the debt situation worse.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

Embedded Linux | Introduction To U-Boot | Beginners

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

FEDERALES TENIAN EN LA MIRA A CDOBLETA

Complements of Sets

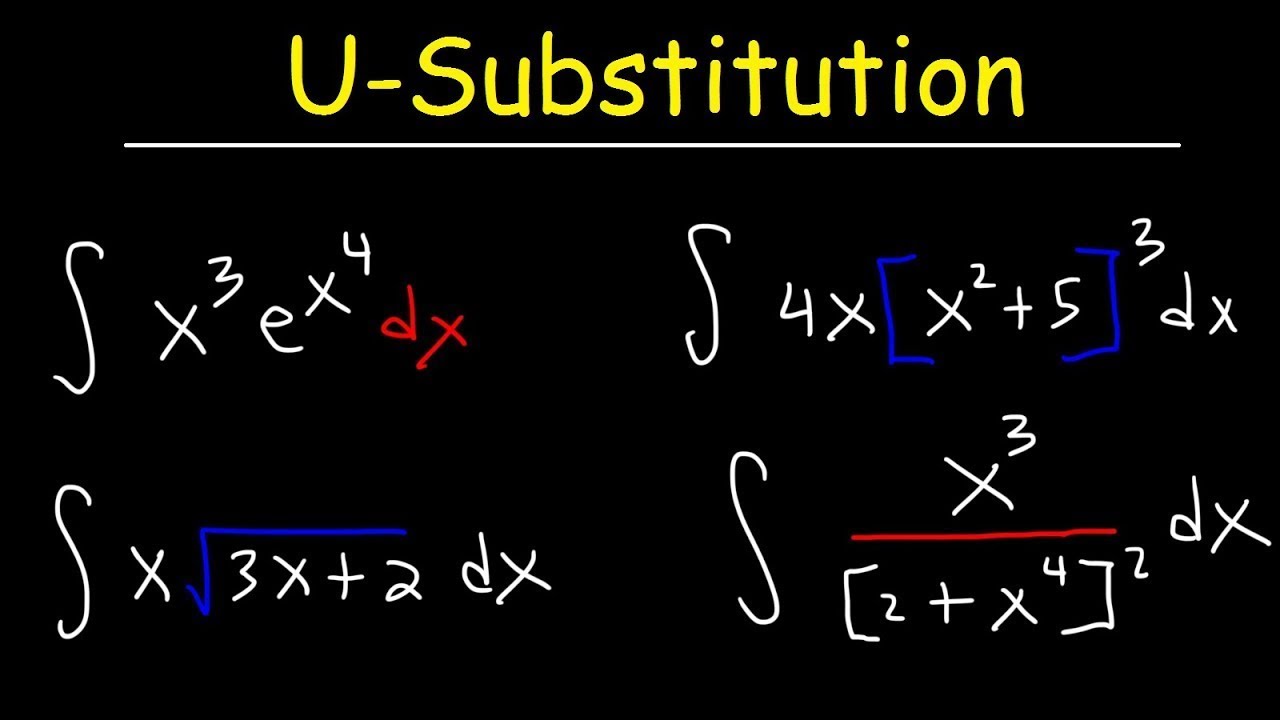

How To Integrate Using U-Substitution

5.0 / 5 (0 votes)