3 things day traders refuse to understand about quant trading

Summary

TLDRIn this video, Coding Jesus debunks three common misconceptions about quantitative trading, often held by day traders and retail traders. He clarifies that large trading firms aren't hunting individual traders' stop losses, highlights the complexity of quantitative trading which requires large teams and specialized expertise, and explains that successful quant firms like Jim Simons' Renaissance rely on machine learning and advanced statistics, not simple technical analysis. With over 100 PhDs, these firms use highly sophisticated models that go far beyond the methods promoted by retail trading gurus.

Takeaways

- 😌 **Misconception 1**: There's a cabal of quantitative trading firms and large institutions targeting individual day traders. The truth is, these firms don't care about individual traders; they're not hunting stop-losses or targeting small players.

- 🏦 **Market Data**: Trades are published on market data channels in an anonymized form, making it impossible to trace them back to individual traders.

- 🚫 **Stop-Loss Hunting**: Claims of being 'hunted' are often just a coping mechanism for traders who consistently lose money, not a reflection of reality.

- 💡 **Quantitative Trading Complexity**: It's a misconception that a single person can implement competitive quantitative strategies on their own, as it requires a team of specialists and significant resources.

- 👨💻 **Specialization**: Quantitative trading firms have teams of experts, each specializing in a subdomain, such as risk systems or market data, rather than being generalists.

- 🤝 **Teamwork**: Success in quantitative trading is often a result of collaboration among experts, not the work of a lone individual.

- 🧐 **Jim Simons' Perspective**: Contrary to popular belief, Jim Simons and similar firms do not use technical analysis in the traditional sense; they rely on machine learning and advanced statistical models.

- 📈 **Predictive Models**: Predictive power in quantitative trading comes from sophisticated models, not from simple technical analysis patterns.

- 🎓 **Expertise**: Quantitative trading firms employ highly educated professionals, including many PhDs, who specialize in areas like machine learning and statistics.

- 💼 **Hiring Strategy**: The key to success in quantitative trading is hiring smart people and allowing them to work together to develop effective trading strategies.

Q & A

What is the first misconception about quantitative trading discussed in the video?

-The first misconception is that there is a cabal of quantitative trading firms and large institutions that are out to get individual day traders by hunting their stop-losses and running algorithms to catch them.

What does the speaker, Coding Jesus, reveal as an industry insider about the first misconception?

-Coding Jesus reveals that nobody at quantitative trading firms, proprietary trading firms, hedge funds, or banks is looking for individual traders to target, as they don't move the market and are not significant enough to be targeted.

What does the speaker mean when he says 'nobody cares about you' in the context of trading?

-He means that individual traders are not significant enough to be noticed or targeted by large trading institutions, as their trades do not have a substantial impact on the market.

What is the second misconception about quantitative trading mentioned in the video?

-The second misconception is that a single person can implement and be competitive with quantitative trading strategies on their own, like a 'jack of all trades'.

Why does the speaker believe it's futile for a single person to compete with large quantitative trading firms?

-The speaker believes it's futile because these firms have teams of over 50 people each working full-time, with virtually unlimited resources, and each person specializes in a subdomain, making it highly unlikely for an individual to outpace them.

What is the third misconception discussed in the video about quantitative trading?

-The third misconception is that Jim Simons and quantitative trading firms use technical analysis in their trading strategies.

How does the speaker debunk the idea that quantitative trading firms use technical analysis?

-The speaker debunks this by showing a clip of Jim Simons discussing the use of machine learning and advanced statistical models, not technical analysis, for making predictive bets.

What does the speaker suggest is the composition of people working in quantitative trading?

-The speaker suggests that quantitative trading firms are composed of highly educated individuals, including many PhDs, who specialize in fields like computational models, markets, machine learning, and statistical techniques.

What does the speaker recommend for those interested in breaking into quantitative trading?

-The speaker recommends reaching out to him one-on-one for guidance, as he offers his time for consultation via Calendly, and also suggests becoming a patron for early access to videos and an exclusive Discord community.

What is the speaker's stance on the idea that day traders can consistently make money by blaming losses on being 'hunted'?

-The speaker believes that blaming losses on being 'hunted' is a coping mechanism and an excuse for day traders who consistently lose money, rather than a reflection of reality.

What does the speaker imply about the role of specialization in the success of quantitative trading firms?

-The speaker implies that specialization is crucial for the success of quantitative trading firms, as each team member focuses on a specific subdomain, contributing to the firm's overall trading strategy.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

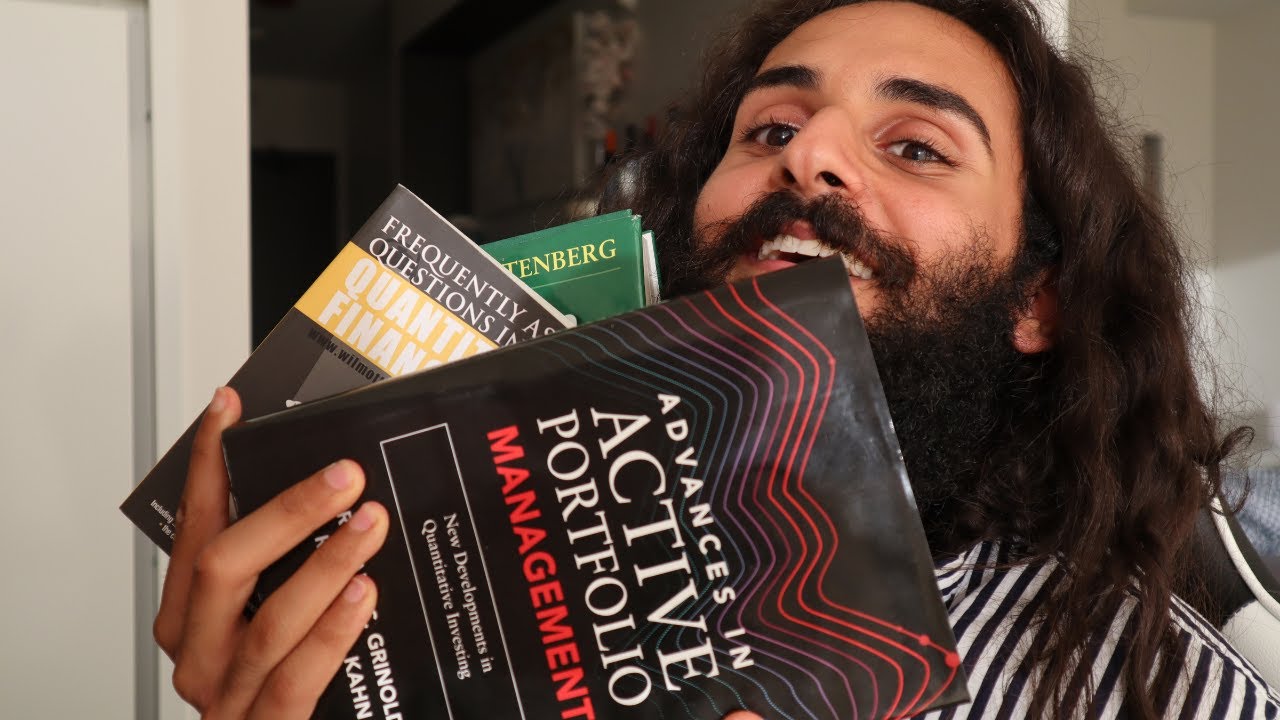

Everything you need to know to become a quant trader (top 5 books)

How to Trade Like an Institutional Trader

Everything you need to know to become a quant trader (in 2024) + sample interview problem

Kaya Dari Trading?Jangan Percaya Sebelum Lihat Ini”

How to Use Pivots for Profitable Trading | Day Trading Secrets

나의 스탑로스가 자꾸만 터지는 이유를 인터뷰

5.0 / 5 (0 votes)