O que é Regime de Caixa e Regime de Competência

Summary

TLDRThis video script explains the concept of 'competence date' versus 'cash basis' in accounting. It illustrates how a business's sales and expenses can occur at different times, emphasizing the importance of understanding both the 'accrual basis' (competence date) and 'cash basis' (actual payment) to analyze a company's operational results and cash flow. The speaker recommends using Granato, an accounting tool, to register transactions with both payment and competence dates, allowing for a clear visualization of cash flow and operational performance. The video concludes with an invitation to try Granato for free and stay updated with the channel's content.

Takeaways

- 📈 The script discusses the concept of 'competence date' and 'cash basis' in accounting, which are essential for understanding a business's financial activities.

- 📅 The 'competence date' is when the transaction or event occurs, while the 'cash basis' is when the payment is actually received or made.

- 💡 The month with the most sales is not necessarily the month with the most revenue received, highlighting the difference between the two accounting regimes.

- 📊 Analyzing the business by 'competence date' can help measure operational results and identify periods of seasonality in sales.

- 💼 Looking at the 'cash basis' provides insights into the company's cash flow, helping to determine the ability to make payments or investments.

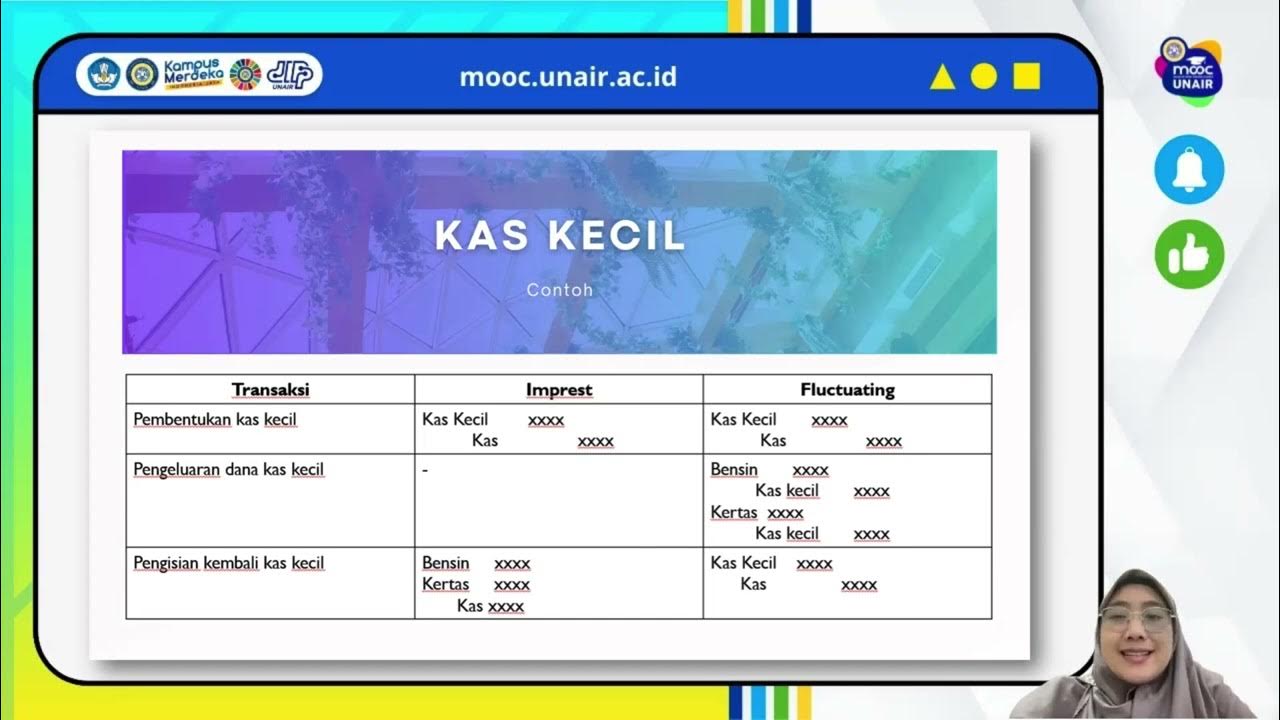

- 🛒 The script uses an example to illustrate how sales and purchases can be recorded at different times, affecting the timing of revenue recognition and payment obligations.

- 📝 The importance of registering both payment and receipt dates, as well as the competence date, is emphasized for accurate accounting.

- 📈 The Granato tool mentioned in the script allows users to register transactions with both payment and competence dates, facilitating a dual perspective analysis.

- 📊 Granato enables users to visualize their cash flow and operational results through reports that can be viewed by both accounting regimes.

- 🔗 The script encourages viewers to use the Granato tool for a free trial to better understand their business's financial situation.

- 👋 The video ends with an invitation for viewers to subscribe for notifications and to continue engaging with the channel for more business-related content.

Q & A

What is the main topic discussed in the video script?

-The main topic discussed in the video script is the concept of 'competence date' and 'cash basis' in accounting, and how they differ in terms of recording transactions over time.

What is the 'competence date' in the context of the video?

-The 'competence date' refers to the time when the events, such as sales or purchases, actually occurred, regardless of when the payment or receipt is made.

What is the difference between 'competence date' and 'cash basis'?

-The 'competence date' is when the transaction occurs, while the 'cash basis' is when the payment or receipt of money related to the transaction actually happens.

Why is it important to differentiate between 'competence date' and 'cash basis'?

-Differentiating between 'competence date' and 'cash basis' allows for a more accurate understanding of a company's operational results and cash flow, which can be crucial for financial planning and analysis.

How does the video script illustrate the concept of 'competence date'?

-The video script illustrates the concept of 'competence date' by using a timeline drawing to show when sales and purchases occur in relation to when payments are made or received.

What is the significance of understanding both 'competence date' and 'cash basis' for a business?

-Understanding both 'competence date' and 'cash basis' helps a business to measure its operational performance, identify periods of seasonality, and assess its cash flow situation, which is essential for making informed financial decisions.

How can the Granato tool mentioned in the video help with accounting for both 'competence date' and 'cash basis'?

-The Granato tool allows users to register transactions with both the payment and receipt dates, as well as the 'competence date', enabling them to visualize the information through both the 'cash basis' and 'competence date' perspectives.

What feature of the Granato tool allows users to view the cash flow report by 'competence date'?

-The Granato tool has a feature that enables users to click and view the cash flow report by 'competence date', providing a clear overview of the company's financial transactions.

What is the purpose of the link provided in the video script?

-The link provided in the video script is for users to sign up for a free trial of the Granato tool, allowing them to test its features and benefits for their business.

How does the video script suggest users stay updated with new content?

-The video script suggests users click on the bell icon to subscribe and receive notifications for new videos, ensuring they stay updated with the latest tips and insights.

What is the final message conveyed by the speaker in the video script?

-The final message conveyed by the speaker is a warm farewell, encouraging good business practices, and expressing hope that the viewers found the tips shared in the video helpful.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)