ICT Mentorship Core Content - Month 1 - Elements Of A Trade Setup

Summary

TLDRThe video teaches traders how to utilize specific market conditions and ICT tools to identify high-probability trade setups. It outlines four key market contexts: expansion, retracement, reversal, and consolidation. Each context is coupled with a corresponding ICT concept - order blocks, liquidity gaps/voids, liquidity pulls, or equilibrium. By correctly identifying the current market condition and applying the paired ICT tool, traders can anticipate market maker intentions and pinpoint impending moves with greater accuracy. Consistent practice identifying trade setup elements across various pairs and timeframes builds skills for consistent profitability.

Takeaways

- 😀 The four key market conditions are: expansion, retracement, reversal, and consolidation

- 🔎 Specific ICT tools correspond to each market condition

- 📈 Expansion indicates a willingness for market makers to reveal their intended re-pricing model

- 📉 Retracement indicates a willingness for market makers to re-price to levels not efficiently traded

- ↩️ Reversal indicates market makers have run stops and a significant move in the new direction should unfold

- ⏸️ Consolidation indicates market makers are allowing orders to build on both sides of the market

- 🎯 Learning one consistent setup based on a specific market condition and ICT tool can lead to consistency

- 🧠 Understanding market conditions and ICT tools leads to anticipatory skills for market movements

- 📊 Studying past price action through the lens of these frameworks builds skill in setup discovery

- 😊 Consistency comes from repeating daily analysis using this conceptual framework

Q & A

What are the four market conditions that price action falls under?

-The four market conditions are: expansion, retracement, reversal, and consolidation.

What ICT tool couples directly with the market condition of expansion?

-The ICT tool that couples directly with expansion is order blocks.

What ICT tool do we look for when the market is in a retracement condition?

-When the market is in a retracement condition, we look for liquidity gaps and liquidity voids.

What indicates the market makers have run in a level of stops when the market reverses direction?

-When the price reverses direction, it indicates the market makers have run in a level of stops and a significant move should unfold in the new direction.

What ICT tool corresponds to consolidation market conditions?

-The ICT tool associated with consolidation is equilibrium.

What are the two primary concerns when referring to elements of a trade setup?

-The two primary concerns are: (1) context/framework surrounding the idea and (2) using the framework conditions to identify specific reference points in institutional order flow.

What are the specific reference points looked at in institutional order flow?

-The reference points are: order blocks, fair value gaps, liquidity voids/pools, stop runs, and equilibrium.

Why is it important to understand the four market conditions?

-Understanding the four conditions gives traders a framework to analyze the market, determine which condition it is in, and decide which ICT tool to apply based on the condition.

What is indicated when price consolidates?

-When price consolidates, it indicates the market makers are allowing orders to build on both sides of the market and expect a new expansion near term.

What clue signals the direction the market will likely move after consolidation?

-The impulse move or swing in price away from the equilibrium level signals the likely direction the market will move after consolidation.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

2023 ICT Mentorship - ICT Silver Bullet Time Based Trading Model

(Technical Research) - 01. Cara Melakukan Trend Analysis

Best Top Down Trading Strategy Simplified

ICT Forex - Trading The Key Swing Points

High-Quality Order Blocks: 3 Rules to Trade Like a Pro #orderblock

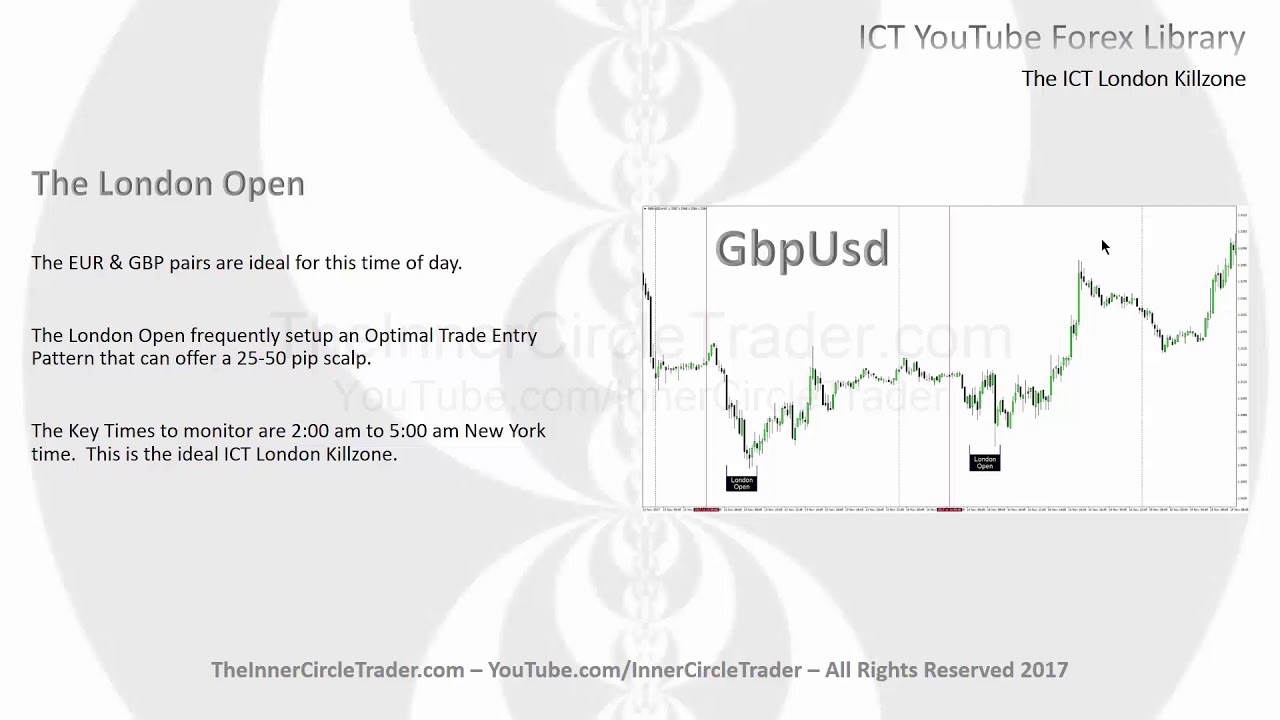

ICT Forex - The ICT London Killzone

5.0 / 5 (0 votes)