Best Pullback Trading Strategies In Forex - The Pullback Mastery Guide

Summary

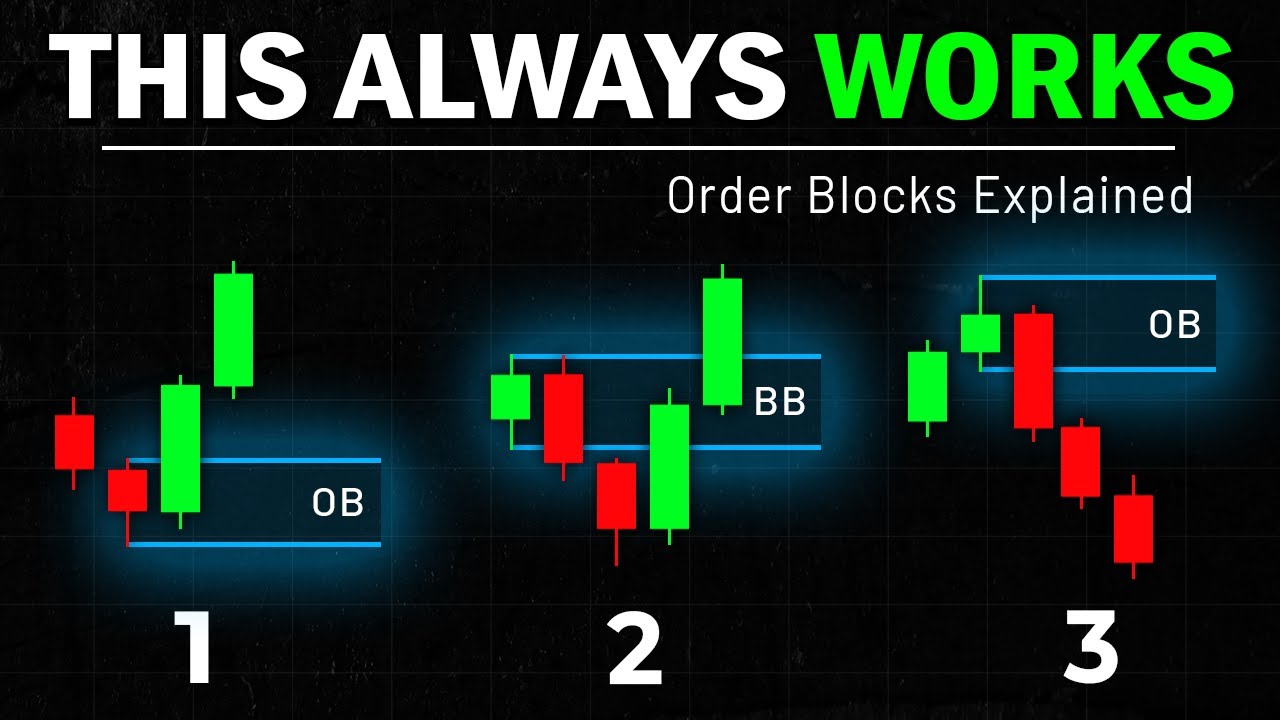

TLDRThis video offers traders an in-depth guide on identifying valid pullbacks in market structure analysis, a crucial skill for recognizing authentic order blocks and inducement zones. It explains the concept of pullbacks, their importance in price action, and how to discern them from corrective and continuation trends. The episode delves into different pullback types—aggressive, corrective, and sweeping—and outlines trading strategies associated with each. It emphasizes the importance of backtesting strategies and provides insights on using liquidity sweeps to enhance trading plans.

Takeaways

- 📈 Identifying valid pullbacks is crucial for market structure analysis and helps traders recognize authentic order blocks and inducement zones.

- 🔍 A pullback is a temporary reversal or pause in price action against the prevailing trend, often leading to a trending or impulsive movement.

- 💡 Price movements consist of impulse, corrective, and continuation sub-movements, and understanding these can help in identifying valid pullbacks.

- 📊 In an uptrend, a valid pullback occurs when a candle breaks below the lowest point of the previous bullish candle, indicating a sweep of liquidity.

- 📉 Conversely, in a downtrend, a valid pullback is marked by a candle breaking above the highest point of the previous bearish candle.

- 🌐 The principles of identifying pullbacks apply across various time frames and can be used on any price action-based chart.

- 🔑 To confirm a valid pullback, the price must break or sweep the liquidity of the latest candle before a temporary pause in the trend.

- 🚀 Aggressive pullbacks are characterized by rapid retracements with strong candles and may not be suitable for immediate trading entry.

- 🛠 Corrective pullbacks are gradual retracements with multiple smaller candles, allowing for potential trading entries at identified demand or supply zones.

- 🌀 Sweeping pullbacks involve the creation of liquidity pools that are waiting to be swept, providing additional confirmation for potential price reversals.

- 📝 Backtesting trading strategies is essential before applying them to a live account, and platforms like Trader Edge can be used for this purpose.

Q & A

What is the main focus of the video on smart risk identifying a valid pullback?

-The video focuses on teaching traders how to identify valid pullbacks in market structure analysis, which is crucial for recognizing authentic order blocks and inducement zones, thus avoiding potential traps.

What is the definition of a pullback in the context of market trading?

-A pullback is a temporary reversal or pause in price action against the prevailing trend, occurring when buyers and sellers contend for dominance, leading to a trending or impulsive movement that creates internal or static liquidity.

Why is it important to identify a valid pullback?

-Identifying a valid pullback is important because it allows traders to recognize upcoming price movements such as continuation trends, valid breaks of structures, and reversal patterns, enhancing their trading strategies.

What are the three main sub-movements that make up price action?

-The three main sub-movements of price action are impulse, corrective, and continuation.

How can a trader identify a valid pullback in a bullish scenario?

-In a bullish scenario, a valid pullback occurs when a candle breaks below the lowest point of the previous candle, effectively sweeping its liquidity.

What is the significance of candlestick patterns in identifying uptrends and downtrends?

-Candlestick patterns help in identifying uptrends and downtrends by showing consecutive bullish or bearish candles, indicating strong upward or downward momentum, respectively.

What are the three distinct models of pullbacks mentioned in the video?

-The three distinct models of pullbacks mentioned are aggressive, corrective, and sweeping.

How does an aggressive pullback differ from a corrective pullback?

-An aggressive pullback is characterized by rapid and sharp retracement with large strong candles, while a corrective pullback is a more gradual retracement consisting of multiple smaller candles and forming several internal structures.

What is a liquidity sweep pattern, and why is it important in trading?

-A liquidity sweep pattern is when the price forms a static liquidity zone with equal highs or lows, indicating the presence of pending orders and stop losses. Recognizing this pattern is crucial as it confirms the strength of a supply or demand area and helps in identifying potential price reversals.

Why is backtesting a trading strategy recommended before applying it to a real account?

-Backtesting a trading strategy helps traders to verify the effectiveness of their strategies by simulating past market conditions, ensuring that they have a robust plan before risking real capital.

What is the Trader Edge platform mentioned in the video, and what is its purpose?

-The Trader Edge platform is a backtesting tool used for testing exclusive trading strategies. It allows traders to simulate their strategies multiple times to ensure reliability before live trading.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Order Blocks Explained: 3 Best Strategies Revealed

🔴 1-2-3 ORDER BLOCKS Trading Strategy Banks Don’t Want You To Know About

Order Block Trading Strategy | Smart Money Concept | Brain Titans

High Probability Order Blocks Secrets | ICT/SMC Concepts [Full In-Depth Guide]

How to Trade Breaker Blocks | 100% winrate | ICT Simplified

Brokers Will Hate You For Using This Liquidity Trading Strategy | Smart Money Concepts Course

5.0 / 5 (0 votes)