Lecture 05

Summary

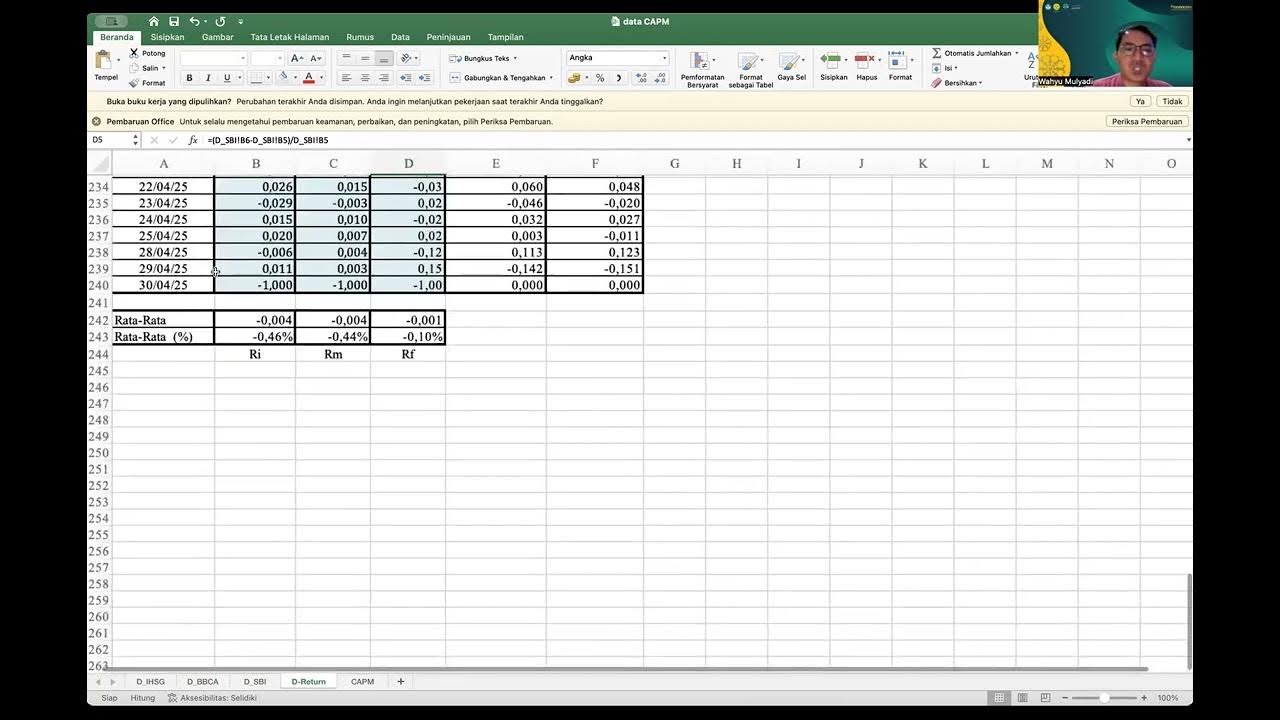

TLDRThe script delves into portfolio theory and the Capital Asset Pricing Model (CAPM), explaining the risk and return dynamics in stock investments. It discusses the concept of diversification, the role of beta in stock sensitivity to market movements, and the importance of the normal distribution in modeling security returns. The video also critiques CAPM, introducing alternative models like the Arbitrage Pricing Theory (APT) and the Fama-French 3-factor model, which consider additional risk factors beyond market volatility.

Takeaways

- 📈 The stock market is inherently risky due to multiple possible outcomes, and this risk is measured by variance or standard deviation.

- 🔍 Risk can be categorized into stock-specific (diversifiable) risk and market risk. Diversification can mitigate stock-specific risk, but not market risk.

- 🌐 Beta measures a stock's sensitivity to market movements and is a key determinant of a stock's contribution to the risk of a diversified portfolio.

- 📚 The Capital Asset Pricing Model (CAPM) is used to understand the relationship between risk and expected returns, with the market risk premium being a crucial component.

- 📊 Normal distribution is important in modeling security returns because it can be defined by just two parameters: mean and standard deviation.

- 🤔 Investors prefer securities that offer higher expected returns for a given level of risk, or lower risk for a given level of expected returns.

- 💼 Diversification can reduce the risk of a portfolio, and the concept of efficient portfolios helps identify the best combinations of risk and return.

- 📉 The correlation between stocks plays a significant role in the effectiveness of diversification; low correlation enhances the benefits of diversification.

- 💡 The Sharpe ratio, which measures the risk-adjusted performance, is a key metric for investors and is maximized in the best efficient portfolio.

- 🏦 The concept of risk-free lending and borrowing allows investors to create a portfolio that offers any combination of risk and return along a line connecting the risk-free rate and the market portfolio.

- 🌟 The Fama-French three-factor model extends the CAPM by including factors such as size (small minus big) and book-to-market (high minus low) to better explain asset pricing.

Q & A

What is the main idea behind portfolio theory?

-The main idea behind portfolio theory is to manage risk and return through diversification. It suggests that investors can reduce their overall risk by holding a well-diversified portfolio of assets rather than individual stocks.

What is the difference between stock-specific risk and market risk?

-Stock-specific risk, also known as diversifiable risk, is the risk associated with an individual stock that can be eliminated through diversification. Market risk, on the other hand, is the risk inherent to the entire market and cannot be eliminated by diversification alone.

How is the sensitivity of a stock to market movements measured?

-The sensitivity of a stock to market movements is measured by its beta. A beta of 1 indicates that the stock is as risky as the market, a beta less than 1 suggests below-average market risk, and a beta greater than 1 indicates above-average market risk.

What is the Capital Asset Pricing Model (CAPM) and its purpose?

-The Capital Asset Pricing Model (CAPM) is a model that establishes a theoretical relationship between the expected return of an asset and its risk, as measured by beta. Its purpose is to determine the required rate of return on an investment, given the risk-free rate, the expected market return, and the asset's beta.

Why is the normal distribution important in modeling security returns?

-The normal distribution is important in modeling security returns because it allows financial analysts to easily define the distribution of returns using just two parameters: the mean (expected return) and the standard deviation (risk). This simplifies the analysis and helps in making investment decisions.

How does diversification affect the risk of a portfolio?

-Diversification reduces the risk of a portfolio by spreading it across multiple assets, which may not all move in the same direction at the same time. This reduces the overall risk more than the simple weighted average of the individual asset risks, especially when the assets have low correlations.

What are the characteristics of an efficient portfolio?

-An efficient portfolio, as defined by Harry Markowitz, is one that offers the highest expected return for a given level of risk or the lowest risk for a given level of expected return. It represents the best combination of risk and return for investors.

What is the Sharpe ratio and why is it important for investors?

-The Sharpe ratio is a measure of risk-adjusted performance, defined as the difference between the return of an investment and the risk-free rate, divided by the standard deviation of the investment's returns. It is important for investors as it helps them understand the return of an investment per unit of risk.

How does the possibility of lending and borrowing at a risk-free rate affect portfolio selection?

-The possibility of lending and borrowing at a risk-free rate allows investors to create a portfolio that combines a risk-free asset with a common stock portfolio, offering any combination of risk and return along a straight line joining the risk-free rate and the market portfolio. This can lead to a portfolio with the highest Sharpe ratio, which is optimal for investors.

What are the limitations of the CAPM?

-While CAPM is widely used, it has limitations. It assumes that investors are rational and solely concerned with expected return and risk, and it does not account for factors such as investor behavior, market imperfections, or additional risk factors beyond beta that may affect asset pricing.

What alternative theories have been proposed to address the limitations of CAPM?

-Alternative theories to CAPM include the Arbitrage Pricing Theory (APT), which considers multiple macroeconomic factors affecting stock returns, and the Fama-French three-factor model, which includes factors for market returns, firm size, and book-to-market ratios.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Risk and Return: Capital Asset Pricing Model (CAPM) 【Dr. Deric】

Sharpe ratio, Treynor Ratio, M Squared and Jensens Alpha - Portfolio Risk and Return : Part Two

Teori Portofolio dan Analisis Investasi sesi 12 ( Menghitung Capital Aset Pricing Model)

CAPM - What is the Capital Asset Pricing Model

Capital Market Line (CML) vs Security Market Line (SML)

Markowitz Model and Modern Portfolio Theory - Explained

5.0 / 5 (0 votes)