Demystifying Investment Banking: What is Leverage Finance? (Part 1)

Summary

TLDRThis two-part miniseries on leveraged finance explores key concepts such as financing non-investment grade companies and the role of credit rating agencies. The first episode delves into leveraged finance products like high-yield bonds and leveraged loans, their role in riskier acquisitions and refinancing, and how big banks manage these deals. The episode also highlights the state of the leveraged finance market, including upcoming refinancing and m&a activity, as well as the rise of private credit. Real-world examples, like Air Baltic’s high-yield bond issuance, illustrate the relationship between risk and return in leveraged finance.

Takeaways

- 😀 Leveraged finance is a specialized area within investment banking that focuses on providing financing to non-investment grade companies, typically those with high levels of debt and higher risks.

- 😀 Credit ratings play a critical role in leveraged finance, with agencies like S&P, Moody's, and Fitch determining whether a company is investment grade (Triple B or higher) or speculative grade (below Triple B).

- 😀 The debt-to-EBITDA ratio is a key metric for assessing whether a company qualifies for leveraged finance, with ratios typically above 3 to 3.5 indicating high leverage.

- 😀 Leveraged finance includes two primary types of debt instruments: leveraged loans (term loans) and high-yield bonds, both of which offer higher returns due to their increased risk.

- 😀 Large investment banks like Morgan Stanley and JP Morgan are the primary players in leveraged finance, offering these products to companies and private equity firms that require debt financing.

- 😀 The fees associated with leveraged finance are higher than those of investment-grade debt issuance due to the complexity and risk of the transactions, but overall revenue is typically lower compared to debt capital markets due to fewer deals.

- 😀 The leveraged finance market is booming, with significant activity driven by refinancing and mergers & acquisitions (M&A), particularly in 2024 with the return of high-yield deals and M&A activity.

- 😀 Private credit (direct lending) is a growing alternative to traditional leveraged finance, with investors directly providing loans to companies, bypassing banks and increasing competition in the market.

- 😀 Economic growth, a return to M&A activity, and lower interest rates in certain countries are contributing to the optimism in the leveraged finance market, with a forecast for continued growth.

- 😀 The example of Air Baltic's €340 million bond issuance with a 14.5% coupon highlights the relationship between risk and return in leveraged finance—offering high returns to investors willing to take on higher risk, as reflected in the company's speculative-grade rating.

Q & A

What is leveraged finance?

-Leveraged finance involves providing financing to non-investment grade companies, which may have high debt levels, poor creditworthiness, or are yet to become profitable. It includes two primary debt instruments: leveraged loans (e.g., term loans) and high-yield bonds.

How do credit rating agencies determine whether a company is non-investment grade?

-Credit rating agencies, such as S&P, Moody’s, and Fitch, assign ratings based on a company's financial health. A key factor is the debt-to-EBITDA ratio, which compares a company's total debt to its earnings before interest, taxes, depreciation, and amortization. Companies with a ratio above 3.5 times debt-to-EBITDA are often considered non-investment grade.

What is the difference between investment grade and speculative grade (junk) bonds?

-Investment-grade bonds are considered lower-risk, typically rated BBB- or above, while speculative grade bonds, or junk bonds, are higher-risk investments, rated below BBB- (e.g., BB or lower). Speculative grade bonds offer higher yields to compensate for the increased risk of default.

Which banks typically handle leveraged finance deals?

-Leveraged finance deals are mainly handled by large, bulge bracket investment banks such as JP Morgan, Morgan Stanley, and other major financial institutions. Smaller banks may be involved by purchasing tranches of debt issued in these transactions.

How do fees in leveraged finance compare to those in debt capital markets (DCM)?

-Fees in leveraged finance tend to be higher than in DCM because the transactions are more complex and deal with riskier companies. However, DCM has a higher volume of issuances, especially from investment-grade companies, leading to higher overall revenue for DCM teams.

What role do credit rating agencies play in leveraged finance?

-Credit rating agencies provide ratings for both corporate issuers and their debt instruments. These ratings determine the cost of borrowing for companies in leveraged finance, influencing investor interest and the pricing of debt. Ratings below BBB- are considered speculative, and therefore, subject to higher yields.

Why is the leveraged finance market booming currently?

-The leveraged finance market is experiencing growth due to a combination of factors: tight risk premiums, economic stability, upcoming refinancing waves, and a resurgence of M&A activity. The private equity market also continues to drive demand for leveraged finance products.

What is the difference between leveraged finance and private credit?

-Leveraged finance involves debt syndication, where banks originate and sell debt to investors, including high-yield bonds and leveraged loans. Private credit, on the other hand, is non-syndicated, with debt directly originated between companies and private investors, such as private equity firms.

What is the significance of Air Baltic's recent bond deal in the leveraged finance market?

-Air Baltic issued Europe's highest-yielding bond of the year, a €340 million junk bond with a 14.5% coupon. This deal highlights the ongoing investor interest in high-risk, high-yield bonds, even in a period of high interest rates. The order book for this deal was oversubscribed, indicating strong demand despite the company's speculative credit rating.

What factors are contributing to a positive outlook for leveraged finance in 2024?

-Factors contributing to a positive outlook include the expectation of a wave of refinancing in 2024, a resurgence of M&A activity, lower interest rates from central banks like Sweden, and growing confidence in the market as economic growth outpaces the risk of a recession.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Project finance – Prototypical structure

Fixed Income Markets for Corporate Issuers - Module 4 – FIXED INCOME– CFA® Level I 2025

Why MicroStrategy's Bitcoin Strategy is Reshaping the Entire Economy

Lembaga Keuangan Bank dan Bukan Bank | Perbankan Dasar Kelas X SMK

Credit Process: Credit Analysis

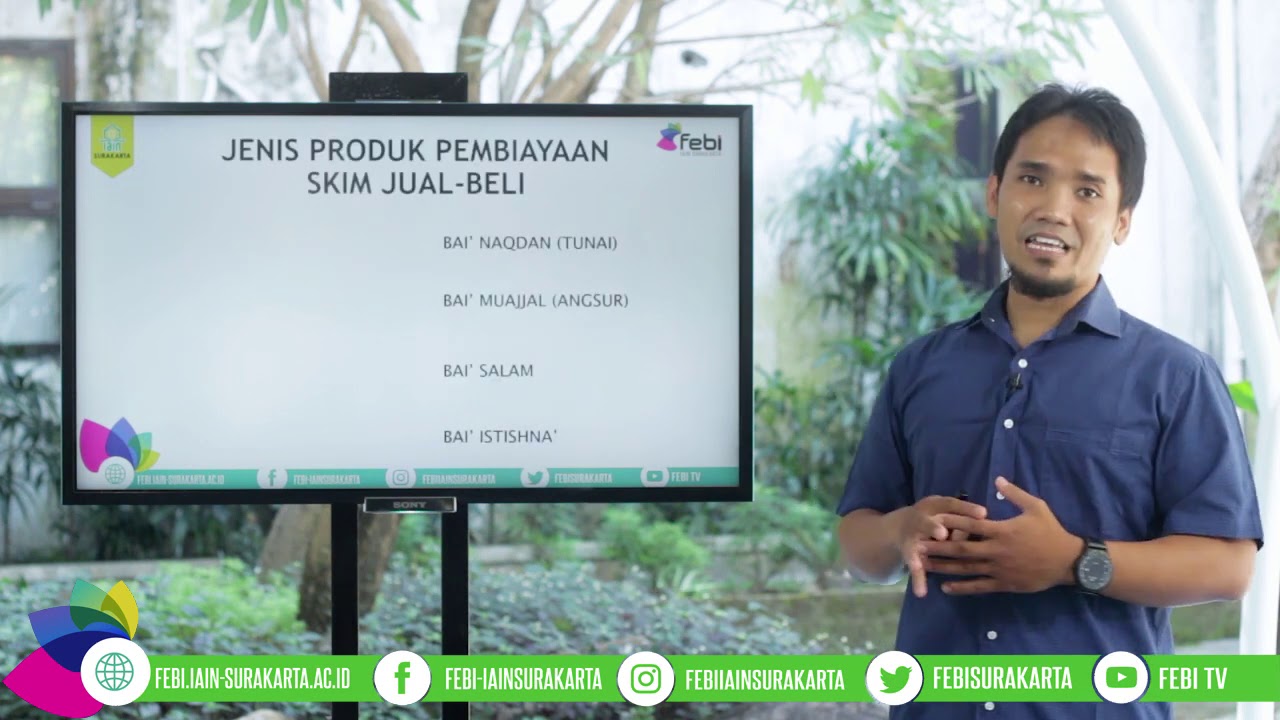

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

5.0 / 5 (0 votes)