Fixed Income Markets for Corporate Issuers - Module 4 – FIXED INCOME– CFA® Level I 2025

Summary

TLDRThis video explores various debt instruments used by companies to finance their operations, ranging from short-term funding options like credit lines and commercial paper to long-term corporate debt such as investment-grade and high-yield bonds. It covers different tools, their pros and cons, and how they serve businesses, from banks' repo agreements to asset-backed commercial paper. With a focus on credit risk, bond features like callable options, and strategic uses, the video provides crucial insights into the financial tools that underpin corporate funding, essential for both CFA exams and real-world finance.

Takeaways

- 😀 Short-term funding options help companies manage day-to-day expenses, such as payroll and inventory. Choosing the right tool for the job is critical.

- 😀 External loan financing includes uncommitted lines of credit (flexible but not guaranteed) and committed lines of credit (more reliable but with fees).

- 😀 Revolving credit agreements (revolvers) are multi-year commitments offering flexibility and reliability, like a high-limit credit card.

- 😀 Secured loans, backed by collateral like real estate or inventory, are a good option for companies with less-than-perfect credit scores.

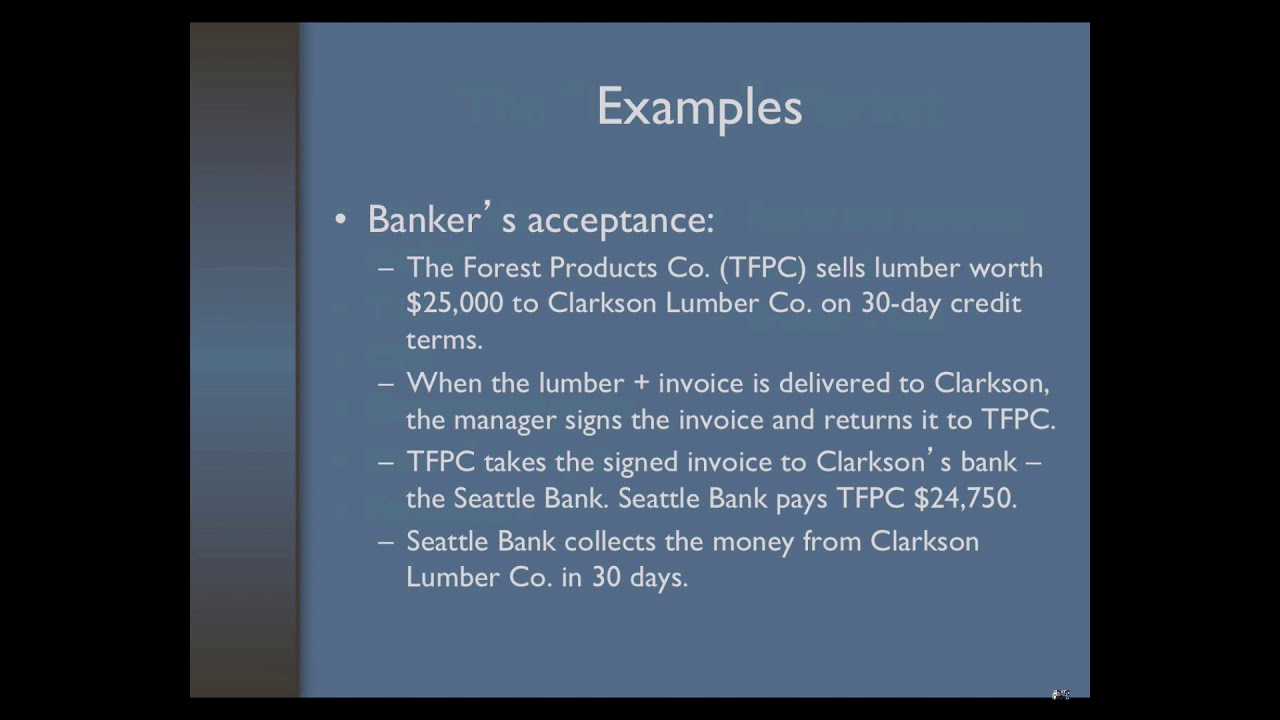

- 😀 Factoring allows companies to sell their receivables to a lender at a discount for quick cash, making it ideal for companies that can't qualify for unsecured loans.

- 😀 Commercial Paper (CP) is a short-term, unsecured debt instrument used by large, highly-rated companies to cover immediate financial needs, but carries rollover risk.

- 😀 Euro Commercial Paper (ECP) is a similar funding tool to CP, but operates on a smaller scale and is less liquid, often more challenging to use in international markets.

- 😀 Banks rely on deposits and interbank lending to manage their short-term funding needs, with savings accounts and certificates of deposit (CDs) providing stable, low-cost funding.

- 😀 Repurchase agreements (repos) allow institutions to use securities as collateral for short-term loans, often involving government bonds or corporate bonds.

- 😀 Asset-backed commercial paper (ABCP) allows banks to transfer short-term loans to special purpose entities (SPVs) and issue paper to investors, lowering capital costs for the bank.

- 😀 Long-term corporate debt is influenced by a company's credit rating, and the yield to maturity (YTM) typically increases with longer maturities due to higher risk and uncertainty.

- 😀 Investment-grade bonds are considered safe investments with smaller credit spreads and fewer covenants, while high-yield (junk) bonds carry higher default risks and offer higher yields to attract investors.

Q & A

What are short-term funding options available to companies?

-Companies have several short-term funding options, including uncommitted lines of credit, committed lines of credit, revolving credit agreements, secured loans, factoring, and commercial paper. These options help companies meet immediate cash needs, such as covering payroll or purchasing inventory.

What is the difference between uncommitted and committed lines of credit?

-Uncommitted lines of credit are flexible but not guaranteed; the bank can cancel them anytime. Committed lines of credit are more reliable as they come with a formal agreement, though they may include fees and other conditions.

What is a revolving credit agreement and how does it differ from a standard loan?

-A revolving credit agreement is a multi-year commitment from a bank, allowing the borrower to draw, repay, and reuse funds as needed. It offers flexibility, unlike a standard loan, which typically provides a lump sum for a set term.

What is factoring, and why do companies use it?

-Factoring is when a company sells its receivables to a lender, often at a discount, to get immediate cash. Companies use factoring to improve liquidity, especially if they cannot qualify for traditional loans.

What is commercial paper (CP), and how does it help companies with short-term funding?

-Commercial paper is a short-term, unsecured note issued by large, highly rated companies to cover immediate expenses. It is typically issued for periods of 30, 60, or 90 days, helping companies manage their cash flow, though it comes with rollover risk.

What is rollover risk in relation to commercial paper?

-Rollover risk refers to the risk that a company will not be able to issue new commercial paper to pay off maturing notes, potentially creating a liquidity problem.

What is the difference between U.S. commercial paper and Euro commercial paper?

-U.S. commercial paper (USCP) is more liquid and typically issued by larger corporations, while Euro commercial paper (ECP) caters to international markets but is less liquid and involves smaller transactions.

How do repurchase agreements (repos) work, and why are they important for financial institutions?

-In a repurchase agreement, one party sells a security to another with an agreement to buy it back later at a higher price. The difference represents the interest. Repos provide short-term financing for financial institutions and are widely used for liquidity management.

What are the risks associated with repurchase agreements (repos)?

-Risks associated with repos include default risk (if the counterparty defaults and collateral doesn’t cover the loan), collateral risk (if the collateral’s value drops), and margining risk (if the value of the collateral is insufficient and needs to be topped up).

What is the difference between investment grade bonds and high-yield bonds?

-Investment grade bonds are issued by companies with strong credit ratings and offer lower yields with fewer restrictions. High-yield bonds are riskier, with higher yields to compensate for the increased default risk. They often have stricter covenants to protect investors.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)