The Fed JUST Flipped Housing | -33%

Summary

TLDRIn this video, the host discusses the current state of the U.S. real estate market, highlighting cooling areas like Palm Springs, Texas, and Florida, while emphasizing opportunities in high-demand regions like California. Key topics include interest rate trends, potential rate cuts, housing affordability, inventory levels, and the impact of Airbnb markets. The video also covers insights from Warren Buffett, Redfin, and Lowe's on housing demand, new construction, and home improvement. Additionally, the host shares updates on House Hack's investment opportunities, AI developments, and strategies for buying, renovating, and managing real estate, underscoring the importance of owning property amid rising prices.

Takeaways

- 😀 Real estate markets are highly localized, with significant price volatility in areas like Palm Springs due to shifts in demand and market bubbles.

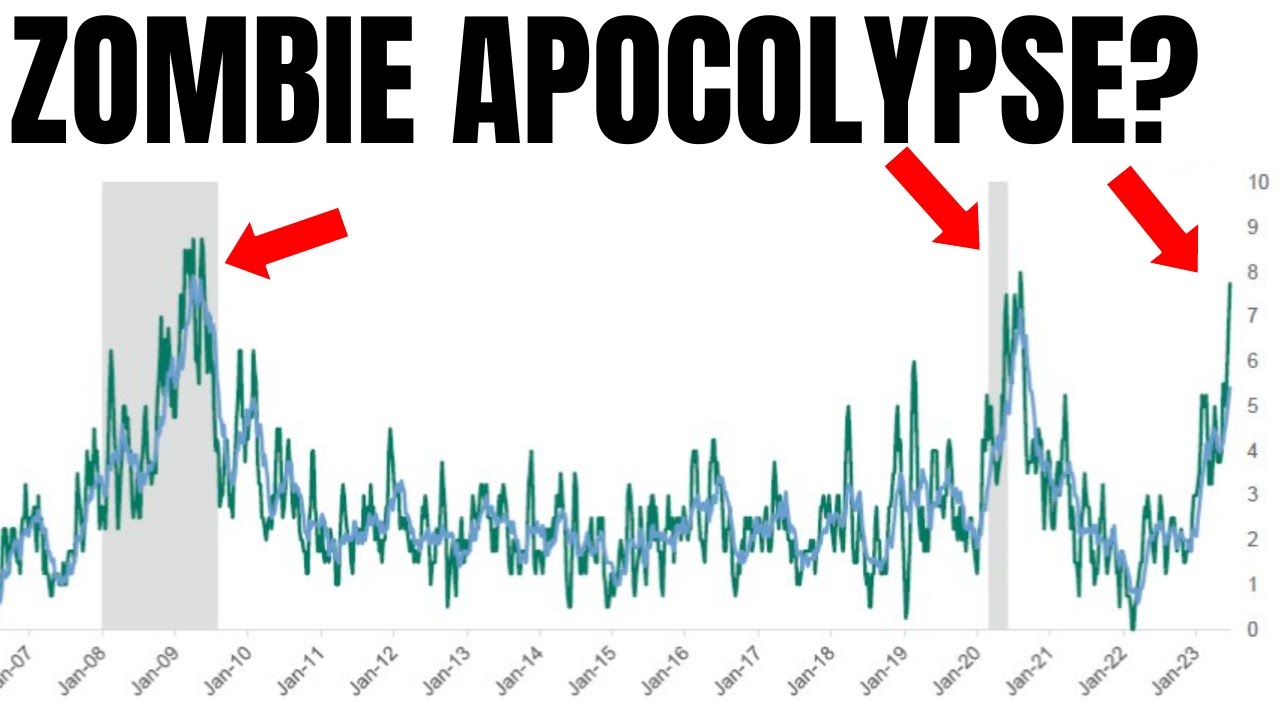

- 😀 The current high-interest rate environment has made it more challenging for buyers to enter the market, but it could also lead to a refinancing boom once rates stabilize.

- 😀 Inflation is impacting construction costs, with materials like wood, drywall, and appliances becoming increasingly expensive, which could continue to drive up housing prices.

- 😀 Areas with limited inventory, such as California, are likely to see sustained price increases, while overbuilt markets like Palm Springs and Orlando are experiencing corrections.

- 😀 The real estate bubble seen in markets with speculative investments, like Airbnb-heavy areas, is deflating, with some properties seeing major price cuts (up to 25%).

- 😀 Foreclosures are becoming more common as some property owners in speculative markets (like Palm Springs) face losses after buying at inflated prices during the market peak.

- 😀 Strategic investors are cautious about entering the market without thorough analysis of specific locations, as certain regions are experiencing price declines while others continue to appreciate.

- 😀 Technological innovations in AI and property management systems are shaping the future of real estate, potentially providing investors with better tools for market analysis and property management.

- 😀 Real estate is a long-term play, and while there are immediate challenges, there is potential for future growth once inflation and interest rates stabilize.

- 😀 The housing shortage is projected to continue, with an estimated 18 million new homes needed by 2033, but current construction efforts are not keeping up with this demand.

- 😀 The real estate market's fluctuations highlight the importance of understanding both macroeconomic trends and local market conditions to make informed investment decisions.

Q & A

What are the current economic conditions affecting the real estate market?

-The Federal Reserve is considering a 25 basis point rate cut, but it’s dependent on labor market conditions. If the jobs report shows strength, the cut may happen soon, but if not, it might be postponed. Meanwhile, inflation and high interest rates are creating mixed results across different markets.

Why are some markets, like Palm Springs, seeing drastic price cuts?

-Palm Springs and similar markets are experiencing significant price cuts due to a bubble burst from over-investment during the Airbnb boom. Properties purchased at high prices during this period are now facing reductions as demand wanes, and owners struggle to sell.

What does the 'bubble market' mean in the context of real estate?

-A bubble market refers to areas where real estate prices inflate rapidly due to speculative investments or external factors like Airbnb, only to crash when the market corrects itself. These areas can see steep declines in home prices once the demand that inflated the bubble evaporates.

How has the Airbnb market influenced home prices?

-In regions with high Airbnb activity, such as Palm Springs and Orlando, homes were bought at inflated prices during the boom. As the demand for short-term rentals has cooled, these areas are now seeing large price drops, showing how speculative demand can drive unsustainable price increases.

What is the outlook for real estate prices in Florida and Texas?

-In Florida and Texas, home prices are facing downward pressure, partly due to high insurance premiums and increasing HOA costs, which are making homes unaffordable for many buyers. These states are also experiencing a high number of purchase cancellations due to these factors.

Why are interest rates and insurance premiums critical in the real estate market?

-High interest rates increase mortgage costs, which makes housing less affordable, while rising insurance premiums (especially in disaster-prone areas like Florida) add significant financial burden to homeowners, making it more difficult to sell and buy properties.

What are some opportunities for real estate investors in the current market?

-Investors can capitalize on price reductions, especially in areas with overinflated property values or where the market is cooling. Long-term investments in regions with limited new construction and high demand, like California, may also provide opportunities for steady appreciation.

What does the concept of 'buying the dip' mean in real estate?

-'Buying the dip' refers to purchasing real estate during market corrections when prices have fallen, potentially securing a property at a lower price before the market rebounds. This strategy works best when the investor has confidence in long-term growth potential for the area.

What role does new construction play in the current real estate market?

-New construction is critical because there's a shortage of homes across the U.S. According to Lowe's, there’s a need for 18 million new homes by 2033. Builders are continuing to invest in high-margin, new homes as the supply of existing homes remains low, keeping prices high.

How are AI and tech influencing the future of real estate investments?

-AI and technology are being used to optimize real estate investment strategies, such as predicting the best markets to enter or identifying opportunities for value-added properties. Companies are leveraging AI to target housing affordability issues and help make strategic investments in high-demand areas.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Ohmsche Gesetz (URI) mit Beispielen | Physik | Lehrerschmidt

These 7 Crypto Coins Will 15x BEFORE Election (Last Chance)

BITCOIN: TRUMPS INSANE CRYPTO PLAN!!!! 🚨 (all holders must see this)

🚨THERE IS NO GOING BACK THE DAMAGE IS DONE - SUBWAY SANDWICH EMERGENCY MEETING

BITCOIN PUMP 112K: É MÁXIMA HISTÓRICA: VAMOS CONTINUAR? ARMADILHA? - Análise Técnica/Sentimento

ON THE CUSP OF TIME as Bitcoin Price Chart and Altcoin Market Cycle Decision, Necessary Ingredients

2024 Is Set To Break Another Stock Market Record...

5.0 / 5 (0 votes)