Reversal or Pullback? Using Market Structure To Determine Trend - ICT Concepts

Summary

TLDRThis video teaches viewers how to distinguish between a pullback and a trend reversal in trading. It emphasizes the importance of market structure shifts, particularly on the 5-minute and 15-minute time frames, for spotting potential trend changes. By identifying short-term lows and highs, traders can anticipate price movements and imbalances. The video also discusses the significance of displacement and fair value gaps in confirming trend directions. Overall, it provides a methodical approach to trading by analyzing market structure shifts and the associated imbalances.

Takeaways

- 😀 Understanding the difference between a pullback and a trend reversal is crucial for traders.

- 😀 Market structure shifts are essential in identifying whether the market is experiencing a pullback or a reversal.

- 😀 The 5-minute time frame is a useful tool for observing trends, but higher time frames (like the 15-minute chart) offer a clearer view with less noise.

- 😀 A market structure shift typically signals a trend change, and this can lead to price imbalances or fair value gaps.

- 😀 If price does not break structure, it's considered a pullback rather than a reversal.

- 😀 It's important to mark out short-term lows to see if they are broken, which can indicate a shift in the market trend.

- 😀 When trading counter-trend, focus on imbalances or fair value gaps to reload long positions.

- 😀 A market structure shift on a higher time frame, such as the 15-minute chart, offers more reliable indications of trends.

- 😀 Displacement (energetic price movement) is necessary to confirm a trend change, as it creates an imbalance in the market.

- 😀 By marking out short-term lows and observing whether they are taken with displacement, traders can better predict trend continuation or reversal.

Q & A

What is the main purpose of this video?

-The main purpose of the video is to help viewers differentiate between a pullback in a trend and a reversal in the trend, focusing on how to identify market structure shifts.

What time frame does the speaker recommend for analyzing trends?

-The speaker suggests using the 5-minute time frame for identifying trends, but also recommends the 15-minute chart or higher time frames for a clearer picture, as they tend to have less noise and are more reliable.

What is a market structure shift, and why is it important?

-A market structure shift occurs when the price breaks a short-term high or low, signaling a change in the direction of the market. It is important because it helps traders determine whether the market is reversing or just experiencing a pullback.

How does the speaker distinguish between a pullback and a reversal?

-The speaker explains that if the price does not break the structure (i.e., a short-term low or high), it is considered a pullback. However, if the structure is broken, it could indicate a trend reversal.

What role does the 15-minute chart play in identifying trends?

-The 15-minute chart is recommended for identifying trends as it offers a broader view of the market and reduces the noise that can occur on lower time frames like the 5-minute chart.

Why should traders be cautious when trading counter-trend?

-Traders should be cautious when trading counter-trend because it involves taking positions against the prevailing trend. To do so safely, they must look for imbalances or areas where the price could return, such as fair value gaps, and target them for potential reversals.

What is a fair value gap, and why is it significant in the video?

-A fair value gap is an imbalance in price action, where price has moved too quickly, leaving a gap that is likely to be filled later. These gaps are significant as they provide potential areas for price retracement, which traders can use for re-entering the market.

What does the speaker mean by 'displacement' in market structure?

-Displacement refers to an energetic move in price that breaks previous levels and creates a gap, signaling a shift in the market's direction. It is crucial for confirming market structure shifts and identifying potential reversals.

How does the speaker use the concept of 'lows' to track trends?

-The speaker tracks short-term lows to identify whether they are broken or not. If the lows are not broken, the trend is considered intact. If the lows are broken, it could signal a reversal or pullback.

What is the significance of the overnight session mentioned in the video?

-The speaker mentions that they do not focus on the overnight session, implying that the price action during this time may not be as reliable or relevant for making trading decisions.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

How to Spot Trend Reversals Using Powerful Indicator Combination Part 2

Don’t Buy Breakouts Without Proof - Jesse Livermore

It's Impossible to Lose with THIS Strategy! It Almost Always Wins!

Smart Money Concepts: Market Direction

MAKE $100 PER DAY ON BYBIT !!! (secret method)

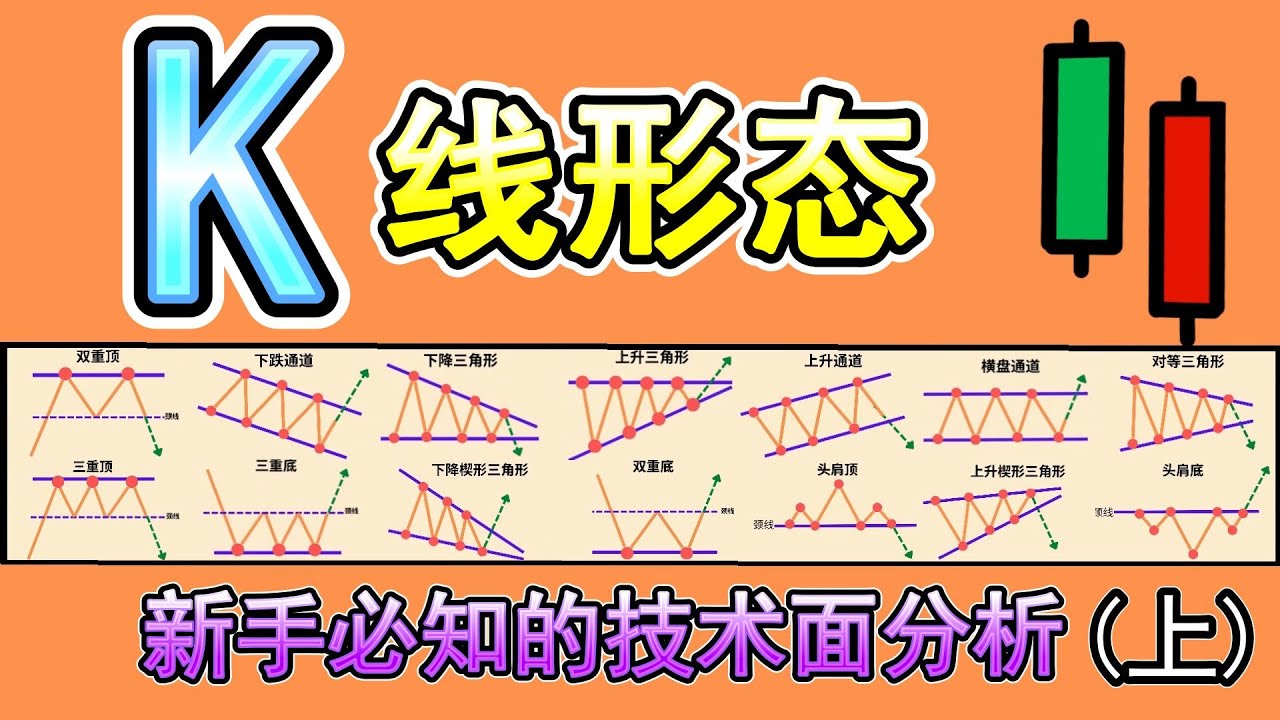

【K线形态 技术面分析】(上)你必知的18种K线形态完整教学|K线形态交易策略大公开|技术分析新手入门教学|专业交易员必备的K线形态技术分析|Chart Pattern Analysis

5.0 / 5 (0 votes)