The ICT Inversion Fair Value Gap Setup - Explained

Summary

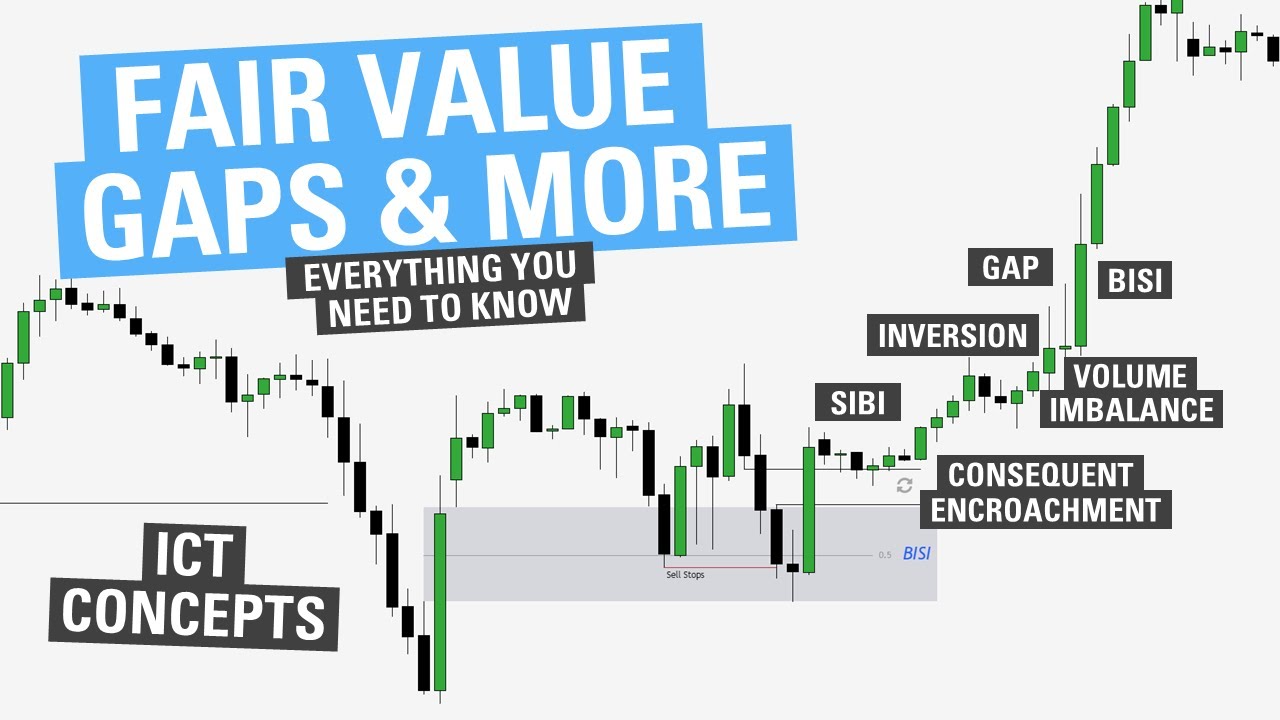

TLDRIn this video, the creator explains how to use inversion fair value gaps for high-quality trade setups. They demonstrate a live trade example, targeting a price drop and analyzing the market using key ICT concepts. The trader emphasizes the importance of higher time frame bias, liquidity, and fair value gaps. They show how price displaces higher after liquidity is taken out, breaking above a bearish fair value gap. The video explains entry points, stop loss placements, and why liquidity is essential for successful trades. Overall, the video offers a practical guide to using inversion fair value gaps in trading strategies.

Takeaways

- 😀 The speaker is demonstrating how to use inversion fair value gaps for high-quality setups in trading.

- 😀 The trade example is being shown live, with a target price of 49.50.

- 😀 The analysis begins with determining a higher time frame bias, using the 15-minute chart as the reference for price action.

- 😀 Inversion fair value gaps are formed when a price breaks above a bearish fair value gap and closes above it, signaling potential price movement.

- 😀 The speaker uses a paper trading account to demonstrate the strategy, focusing on understanding market behavior rather than actual profits.

- 😀 Liquidity is a critical factor in identifying potential price movements, with the speaker observing key liquidity zones such as previous lows and highs.

- 😀 A key concept in ICT trading is identifying whether price is delivering from liquidity, reversing, or expanding in a given scenario.

- 😀 A successful setup involves the price breaking above a bearish fair value gap, closing above it, and then re-pricing higher towards liquidity.

- 😀 The speaker shares insights on taking partial profits at specific levels, such as the breaker, and emphasizes using safer stop levels to manage risk.

- 😀 The speaker encourages observing and practicing these setups to understand how liquidity and price displacement work together in real-time trading.

Q & A

What is an inversion fair value gap (IFVG)?

-An inversion fair value gap occurs when price moves above a bearish fair value gap and closes above it, signaling a potential reversal. This is a key concept in ICT trading used to identify high-probability setups.

Why is liquidity important when using inversion fair value gaps?

-Liquidity is crucial because price needs to run liquidity (such as sell stops) and then displace higher. A valid IFVG setup is considered higher probability when price takes out liquidity before breaking above the bearish fair value gap.

How do you identify a bearish fair value gap?

-A bearish fair value gap is identified between the high of one candle and the low of another, where the wicks of the two candles do not overlap. This pattern suggests an imbalance where price could reverse or move in a certain direction.

What is the role of the 15-minute time frame in this strategy?

-The 15-minute time frame is used as the 'higher time frame' for the analysis, helping to identify potential key levels and liquidity areas where price might reverse. It is not necessary to use daily or weekly charts to get this higher time frame bias.

What is the significance of a 'breaker' in this context?

-A breaker is a key level that price has previously tested, such as a previous low or high, and it can act as a support or resistance level. In the example provided, price tapped into a breaker after taking out sell-side liquidity, which is crucial for setting up trades.

How do you determine your stop loss when trading with an inversion fair value gap?

-The stop loss should be placed below the fair value gap's low, ensuring the position is protected. For a safer stop, it's recommended to place it beneath the most recent low, acting as a 'protected low' until price reaches the targeted liquidity.

Why does the script recommend taking partial profits?

-Taking partial profits at different levels helps to lock in gains as price moves towards the liquidity target. This strategy is especially useful for managing risk and ensuring consistent returns, even if price doesn't reach the final liquidity target.

What does the term 'draw on liquidity' refer to in this context?

-A 'draw on liquidity' refers to the process of price targeting areas where there are concentrations of stop orders, such as sell stops or buy stops, to take out that liquidity before reversing or continuing in a direction.

How can you identify the best setups for trading inversion fair value gaps?

-The best setups occur when price runs liquidity, displaces higher, and breaks above a bearish fair value gap, closing above it. This signals a higher probability of price continuing towards liquidity targets, making it a higher-quality trade.

What are the key steps to take when entering a trade based on an inversion fair value gap?

-The key steps include: identifying liquidity to be run, confirming displacement away from liquidity, waiting for price to break and close above a bearish fair value gap, and then entering as price pulls back into the gap, targeting the nearest liquidity.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

ICT Concepts - The 9:30 AM FVG (New York Open Strategy) 🤫

Market Maker X Model For BEGINNERS

Understanding Fair Value Gaps (FVG) - ICT Concepts

Fair Value Gap (FVG) Explained: 3 Best Strategies Revealed

Fair Value Gap Strategy - Copy My $1K/Week Blueprint | Ultimate FVG Trading Course

ICT Charter Price Action Model 12 - Scalping Intraday Model

5.0 / 5 (0 votes)