Greece and the Eurozone Crisis

Summary

TLDRIn this McMillan Report episode, Professor David Cameron discusses the ongoing Eurozone crisis, focusing on Greece's massive budget deficit and debt issues. He explains how Greece's deficit far exceeds EU limits and the difficulty of reducing it, both fiscally and politically. The interview touches on the potential for Greece to receive EU assistance and the broader implications for other southern European countries like Spain and Portugal. Cameron also highlights the challenges of the Eurozone's economic structure and the possibility of moving towards economic governance in the EU. This crisis, he argues, reveals deep-seated flaws in the EU's design.

Takeaways

- 😀 Greece's budget crisis emerged after the new government revealed that the deficit was not 5%, but 13% of GDP, significantly higher than initially reported.

- 😀 Greece's debt stands at around 300 billion EUR, and it faces a major challenge in raising 55 billion EUR this year to cover its financial needs.

- 😀 The Eurozone requires member states to maintain a deficit under 3% of GDP, but Greece's deficit far exceeds that threshold, leading to a fiscal crisis.

- 😀 The new Greek government is facing both fiscal and political challenges in attempting to reduce the deficit from 13% to 3% by 2013.

- 😀 To address its deficit, Greece must raise taxes on goods like alcohol, fuel, and cigarettes, as well as cut spending on pensions, healthcare, and public sector wages.

- 😀 The debt issue is exacerbated by Greece's large debt-to-GDP ratio, with a significant amount held by French and German banks, making a default potentially disastrous.

- 😀 The European Union has been reluctant to bail out Greece directly, instead opting to pressure Greece to implement austerity measures and commit to fiscal reforms.

- 😀 There are concerns about Greece's ability to remain in the Eurozone, but leaving the Euro would result in severe economic consequences, including a devaluation of the currency and increased debt burdens.

- 😀 Southern European countries like Portugal and Spain are also struggling with high deficits, but they are not in as dire a situation as Greece in terms of debt levels and fiscal credibility.

- 😀 The European Union faces broader challenges in creating a true economic government, as the crisis in Greece exposes deeper issues in competitiveness and coordination among member states in the Eurozone.

Q & A

Why did the crisis in Greece arise?

-The crisis arose due to the Greek government's revelation that the deficit was much higher than initially reported. Originally estimated at 5% of GDP, the new government found the deficit to be around 13% of GDP, due to falsified data from the previous government. This triggered concerns about Greece's ability to repay its debt, leading to a financial crisis.

What is the importance of the deficit issue for Greece and the Eurozone?

-The deficit is crucial because the Eurozone has strict rules requiring member states to keep their deficits under 3% of GDP. Greece's deficit was much higher, creating instability and raising concerns about the country's ability to remain financially stable within the Eurozone.

Why is it difficult for Greece to reduce its deficit?

-Reducing Greece's deficit is challenging due to the need for both fiscal and political actions. The government must raise taxes and cut public spending, which affects the country's workers, public sector employees, and unions. This has led to widespread protests and strikes.

What are the challenges Greece faces in managing its debt?

-Greece has a large debt, with about 300 billion euros owed. The country needs to raise 55 billion euros this year but faces high interest rates due to concerns about its ability to repay. The challenge will intensify in April and May when Greece needs to redeem significant amounts of debt.

What stance did the EU take on providing financial assistance to Greece?

-The EU leaders were reluctant to provide immediate assistance to Greece. They decided to hold Greece's government accountable by ensuring they follow through on promised fiscal measures before any aid is provided. EU leaders feared rewarding fiscal irresponsibility, but they also wanted to avoid allowing Greece to default.

Could Greece be forced to leave the Eurozone?

-It is unlikely that Greece will leave the Eurozone. Exiting would lead to severe economic consequences, such as a devalued currency and increased debt. Additionally, Greek debt is held by large French and German banks, who have a vested interest in maintaining the status quo.

How might the crisis in Greece affect other southern European countries?

-Countries like Portugal and Spain, which also have high deficits, could face similar challenges. While they don't have as much debt as Greece, they still need to reduce deficits. The political and economic pressure for austerity measures in these countries could lead to social unrest and increased unemployment.

What are the fundamental problems with the Eurozone's economic structure?

-The Eurozone lacks an optimal currency area because its member states have different economic structures. The southern European countries, like Greece, have lower competitiveness and trade deficits, making it hard for them to meet the economic demands of a single currency system.

What role does the European Central Bank play in the Eurozone crisis?

-The European Central Bank controls monetary policy for the Eurozone, but individual countries still control fiscal policy. This has created coordination issues, as countries with fiscal problems like Greece have limited control over their monetary policies, exacerbating their economic challenges.

What is the possibility of the EU moving towards economic government as a result of this crisis?

-The crisis may push the EU towards a more coordinated economic government. Currently, the EU lacks the authority to enforce coordinated fiscal policies across all member states. However, the recent steps taken to examine Greece's financial situation suggest that there is growing interest in establishing more centralized economic governance.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Is Greece Suddenly Doing Really Well?

Defisit APBN Melebar Per-Agustus 2024 - [Metro Siang]

Abandoned After the Olympics: Greece's $11 Billion Mistake

Understanding the cycle of U.S. deficit spending and rising debt amid Trump budget push

Keseimbangan Primer - APBN | Susi Novalina

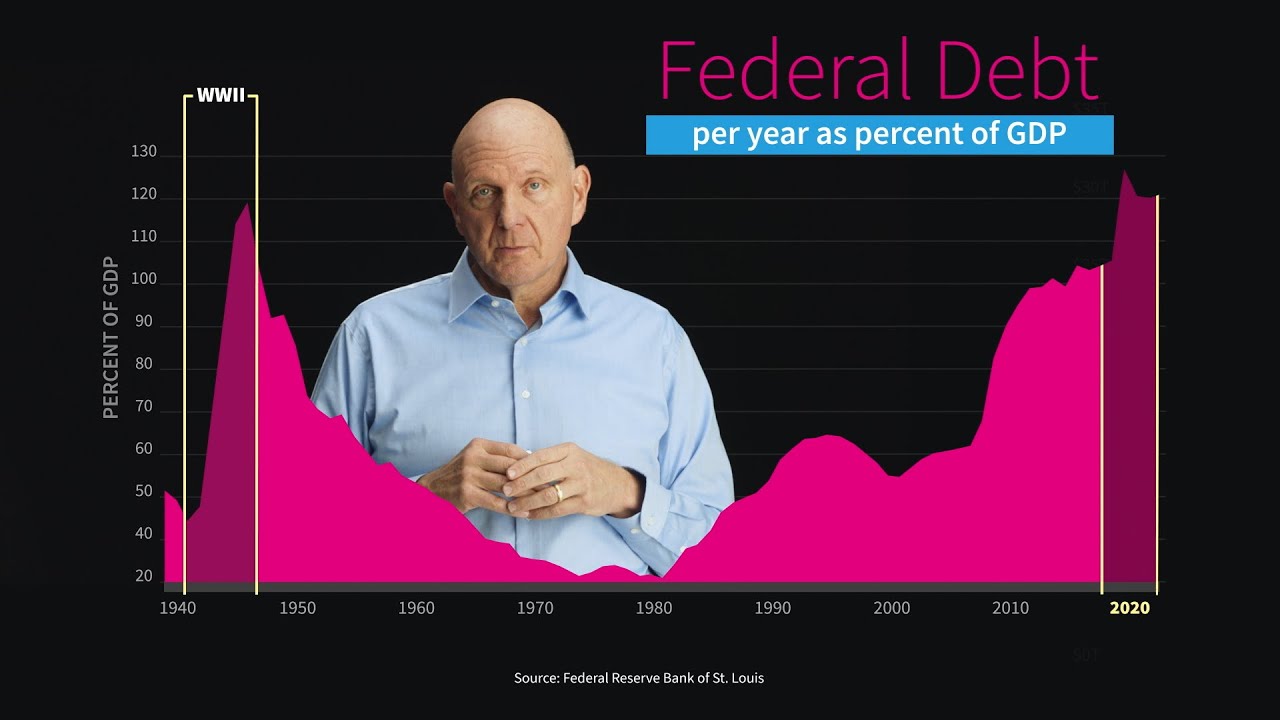

Just the Facts About the US Federal Budget: Steve Ballmer Talks Through the Numbers

5.0 / 5 (0 votes)