Yield to Maturity & Yield to Call - VALUASI OBLIGASI Part 2

Summary

TLDRThis video provides a comprehensive guide to understanding key concepts in bond valuation, including Yield to Maturity (YTM), Yield to Call (YTC), and Current Yield. The presenter explains how to calculate YTM using Excel functions or trial and error methods, with clear examples and illustrations. The video also covers the process of calculating YTC when a bond is called before maturity. Additionally, it explains how to calculate the actual yield an investor might receive, focusing on different bond metrics, and concludes with practical tips for assessing bond profitability.

Takeaways

- 😀 YTM (Yield to Maturity) is the return an investor earns if the bond is held until its maturity date.

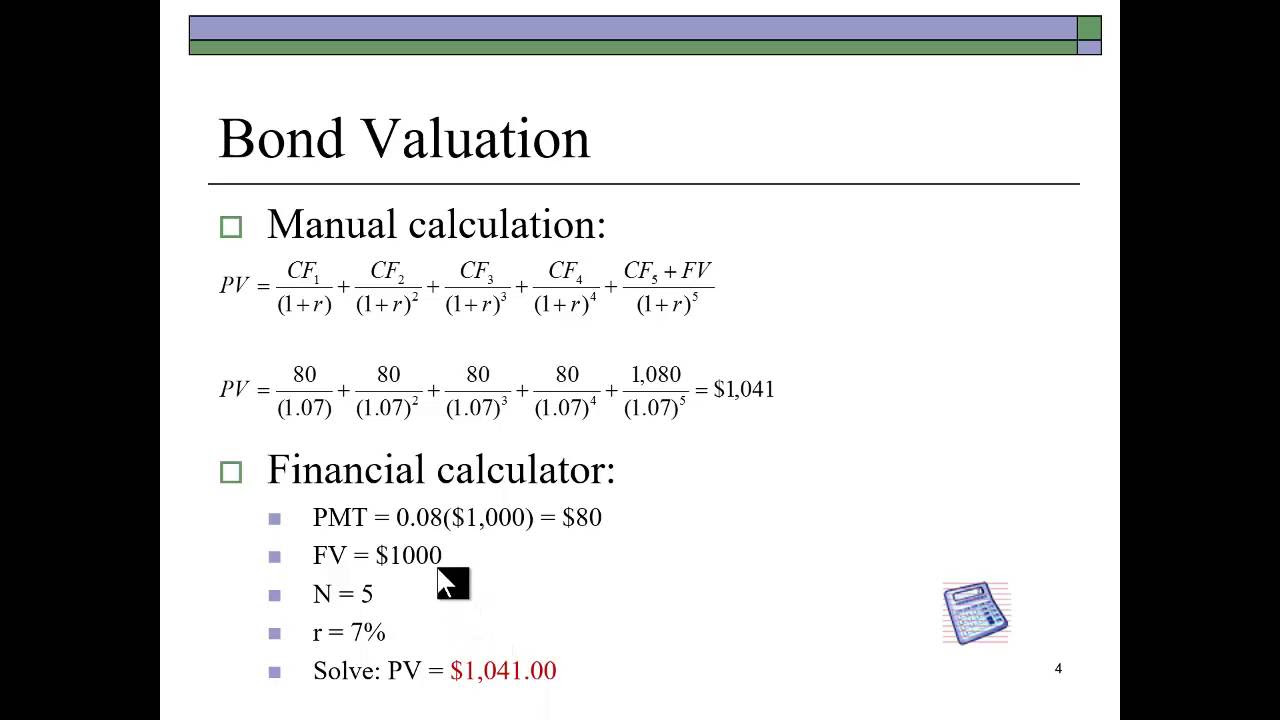

- 😀 YTM can be calculated using Excel functions or trial and error methods by adjusting the discount rate to match the bond's price.

- 😀 To calculate YTM, you need to know the bond's price, coupon payments, the number of periods, and the face value of the bond.

- 😀 The trial and error method involves testing various discount rates and comparing the resulting bond price with the offered price, adjusting until it matches.

- 😀 The relationship between bond price and discount rate is inverse, meaning as the discount rate increases, the bond price decreases.

- 😀 The interpolation technique is used when two different discount rates give bond prices on either side of the actual price, helping to refine the YTM estimate.

- 😀 YTC (Yield to Call) is similar to YTM but applies when the bond is called (bought back) before the maturity date by the issuer.

- 😀 YTC is calculated when a bond is repurchased by the issuer before maturity, potentially offering the investor a different return than YTM.

- 😀 To calculate YTC, adjust the bond’s maturity date and coupon rate to reflect when the issuer will buy back the bond, and then use similar methods as for YTM.

- 😀 Yield to Call can be used to assess the return for bonds that may be repurchased before their maturity, providing insight into early redemption risks.

- 😀 YIELD refers to the actual return an investor earns from a bond, based on its market price, and can be calculated by dividing the coupon payment by the current bond price.

Q & A

What is Yield to Maturity (YTM) and how is it calculated?

-Yield to Maturity (YTM) refers to the total return an investor can expect to earn if a bond is held until its maturity. It is calculated by considering the bond's current price, the annual coupon payments, and the bond's face value. YTM can be calculated using Excel's `RATE` function or by using trial-and-error methods to adjust the discount rate until the bond's price is accurate.

How is the journey metaphor used to explain YTM?

-The journey metaphor describes YTM as a journey from Semarang to Jakarta. The total profit from the journey is similar to the total return from holding the bond until its maturity. Just like calculating the total profit from the journey, YTM accounts for the total returns an investor earns over the life of the bond.

What is the function of the `RATE` function in Excel for bond valuation?

-The `RATE` function in Excel is used to calculate the yield to maturity (YTM) or other similar rates of return for financial instruments like bonds. It takes inputs such as the bond’s price, coupon payments, and the number of periods (years), and returns the YTM or similar rates based on these values.

What does the trial-and-error method for YTM calculation involve?

-The trial-and-error method involves selecting a random discount rate, calculating the bond's price using that rate, and adjusting the rate up or down depending on whether the calculated price is higher or lower than the actual bond price. This process is repeated until the correct discount rate is found.

What does Yield to Call (YTC) refer to?

-Yield to Call (YTC) refers to the yield an investor would earn if the bond is called or repurchased by the issuer before its maturity date. It differs from YTM because it calculates returns assuming the bond is bought back early, typically when market conditions are favorable for the issuer.

How is YTC calculated, and how does it differ from YTM?

-YTC is calculated similarly to YTM but assumes that the bond will be called before maturity. The key difference is that the holding period is shortened to the call date instead of the maturity date. YTC can be calculated using the same methods as YTM, including Excel’s `RATE` function or trial-and-error, but the input periods and bond details are adjusted to reflect the early call.

What does the metaphor involving Semarang, Cirebon, and Jakarta illustrate about YTC?

-The metaphor compares the bond journey to traveling from Semarang to Jakarta, but instead of completing the journey, the bond is repurchased halfway through (at Cirebon). This illustrates how YTC calculates the yield when the bond is redeemed earlier than the maturity date, similar to cutting the journey short.

What is Current Yield (CY) and how is it calculated?

-Current Yield (CY) is a simple measure of the income return on a bond. It is calculated by dividing the bond’s annual coupon payment by its current market price. Unlike YTM, which includes the bond's price changes over time, CY focuses only on the income generated by the bond relative to its current price.

How do interpolation methods help in calculating YTM or YTC?

-Interpolation helps refine the calculated yield when using trial-and-error methods. After finding two discount rates that result in bond prices above and below the actual bond price, interpolation calculates a more accurate yield by finding the exact rate that balances the two results. This method is useful when manual adjustments are needed to fine-tune estimates.

What is the significance of a bond being 'called' or repurchased by the issuer?

-When a bond is 'called,' the issuer repurchases it before the maturity date, usually when interest rates fall. This allows the issuer to refinance at a lower rate. For the bondholder, the early repurchase can impact the expected return, which is why calculating YTC is important for understanding potential profits in case of early redemption.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード5.0 / 5 (0 votes)