UK Election: Can the Rich Protect Their Wealth?

Summary

TLDRIn the lead-up to the election, Britain's wealthy are reportedly concerned about potential tax increases under a Labour government. The conversation between Guy and John addresses the uncertainty surrounding tax policies, with both parties criticized for not being transparent about the need for higher taxes due to the poor state of the national balance sheet. The discussion highlights that taxes on pensions and inheritance are likely to rise, with some even speculating about changes to savings taxation. Wealth advisors are reportedly fielding concerns from clients, although many are not overly worried, suggesting the issue may be more about perception than immediate action.

Takeaways

- 🏁 The script discusses British wealthy individuals racing to protect their wealth ahead of an election.

- 🤔 John expresses concern and suggests that those with means should consider organizing their affairs to leave the UK if they wish to keep their wealth unprotected.

- 💼 There is a general worry about how the Labour Party's policies could impact wealth if individuals stay in the UK.

- 💬 Neither party has been transparent about the need to raise taxes, which is a necessity given the state of the national balance sheet.

- 📈 The national balance sheet is not in great condition, a fact that both parties have highlighted.

- 🔑 Taxes are expected to increase, but the specific tax areas have not been clearly outlined by the parties, causing uncertainty.

- 👴 The pension and inheritance taxes are mentioned as obvious areas that might be targeted for increases.

- 💼 There has been talk about possibly looking into the taxation of savings, which is considered an outside event.

- 🏛️ A think tank executive, now running for the Labour Party, has discussed the idea of taxing savings.

- 🚀 There is a question about whether the numbers of wealthy individuals leaving will accelerate after a Labour government comes into power.

- 🤷♂️ John's colleagues have spoken to advisors who report that many people are not overly worried, suggesting it's more about their attitude towards the situation.

Q & A

What is the main concern of Britain's wealthy regarding the upcoming election?

-Britain's wealthy are concerned about the potential impact of labor policies on their wealth and are considering organizing their affairs to leave the U.K. to protect their unexposed wealth.

What is the general sentiment about the honesty of political parties regarding taxation?

-Neither party has been very transparent about the necessity to increase taxes, as they prefer not to discuss this before an election, despite the national balance sheet being in poor condition.

What is the current state of the national balance sheet according to the discussion?

-The national balance sheet is not in great condition, and both parties have acknowledged this, albeit not to the extent they would like to.

Why is there a concern that taxes will have to increase in the UK?

-There is a concern that taxes will have to increase because the national balance sheet is not in good shape, and both parties have recognized the need for financial adjustments.

What are some of the potential areas for tax increases that are being discussed?

-Potential areas for tax increases include pensions and inheritance taxes, with some discussions even suggesting a possible review of savings taxation in the UK.

What is the context of the discussion about taxation as a 'set of savings thing' in the UK?

-The context is speculative, with a think tank executive running for the Labour Party having mentioned the possibility of looking into savings taxation, which is considered an outside event.

How might the wealthy's actions change if a Labour government comes into power?

-The wealthy might accelerate their efforts to protect their wealth, as there is an attitude of concern among many that a Labour government could bring about changes that affect their wealth.

What has been the reaction of advisors to the wealthy regarding the potential for tax increases?

-Advisors have been discussing with the wealthy team, and many people are not overly worried about the potential tax increases, suggesting it might be more of an attitude issue rather than a concrete concern.

What does 'unprotected wealth' refer to in the context of the discussion?

-'Unprotected wealth' refers to wealth that is not safeguarded against potential financial risks, such as changes in tax policies or economic downturns.

What is the implication of the wealthy organizing their affairs to leave the UK?

-The implication is that the wealthy might be considering relocating their assets or themselves to other jurisdictions to avoid potential negative impacts from the UK's political and economic policies.

What is the general view on the breathing room that the UK has in terms of financial adjustments?

-There is a view that the UK does have some breathing room for financial adjustments, but it is less than what they would like to acknowledge, indicating that taxes will likely have to increase.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

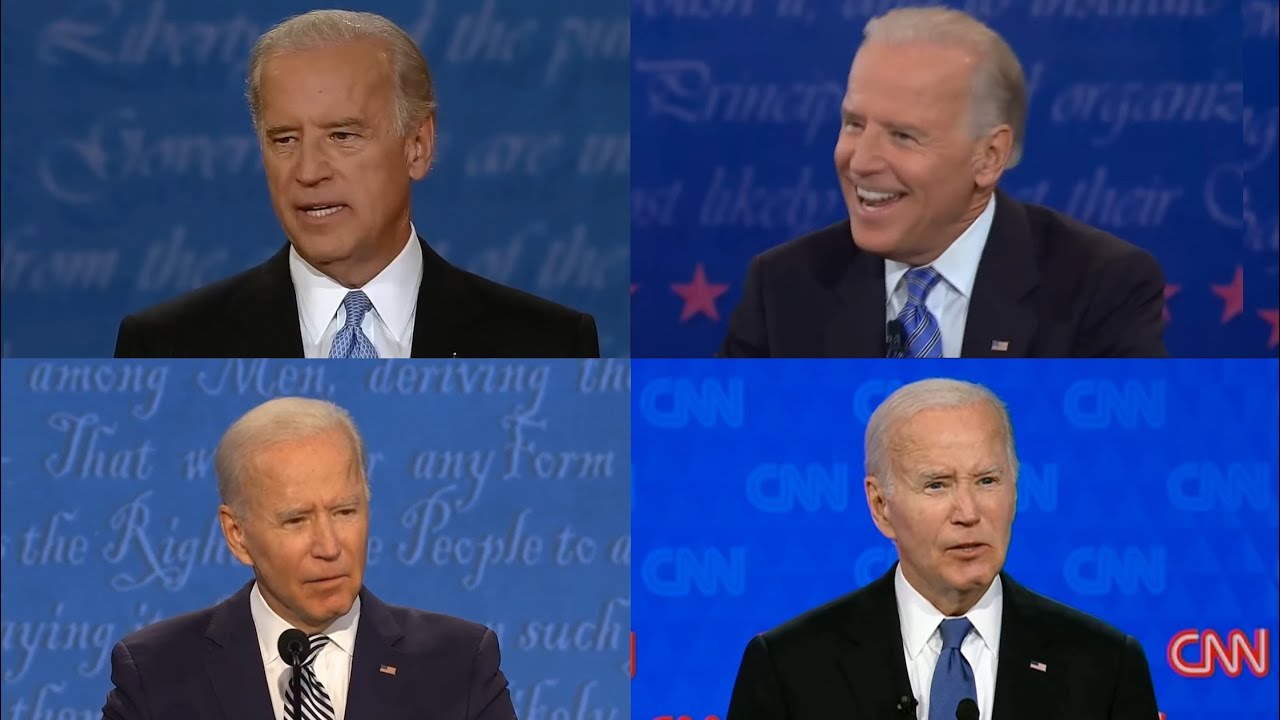

Joe Biden debating tax policy 2008–2024

The UK Election Results Explained

Will the UK Rejoin the EU?

12% VAT sa online shopping, streaming at iba pa na hatid sa PHL ng foreign companies,... | 24 Oras

"Robarle a la abuelita" por Alejandro Bercovich | Editorial en Pasaron Cosas

Angry Gov. Worker SNEAKILY EXPOSES ELON MUSK

5.0 / 5 (0 votes)