"Robarle a la abuelita" por Alejandro Bercovich | Editorial en Pasaron Cosas

Summary

TLDRThe transcript discusses the Argentine government's proposed changes to pension adjustments, which would suspend quarterly adjustments and instead adjust pensions based on the previous month's inflation. Critics argue this will allow the government to skip over high inflation months, reducing pension increases. The plan also includes tax cuts for the wealthy, leading to accusations that the government is taking money from pensioners to fund tax breaks for the rich while claiming the need to reduce the deficit.

Takeaways

- 🔴 The government's response to opposition concerns includes a change in pension adjustment, initially planned to switch from the current mobility formula to inflation-based adjustments using the previous month's inflation rate.

- 💡 Critics argue this adjustment method could disadvantage pensioners, especially during periods of high inflation, like the anticipated inflation surge following a significant increase in the official dollar rate.

- 💰 President Javier Milei claimed that without the proposed adjustments, pensioners would lose two points of GDP, but with the changes, the loss would be limited to one and a half points.

- 📈 Milei's administration is criticized for its handling of inflation expectations and adjustments, with concerns that the new pension adjustment formula could lead to a reduction in pensioners' purchasing power.

- 🧹 Opposition and some government supporters express concerns over the potential impact of the proposed pension adjustments, highlighting that it could effectively "steal" a month of high inflation from pensioners.

- 📊 A report by Emmanuel Álvarez Agis suggests that the proposed adjustment scheme could result in a significant gap between actual inflation and pension increases, with a potential 76% inflation versus a 35% pension increase.

- 💵 The change from a quarterly to a monthly pension adjustment, starting in April, is criticized for potentially excluding January's high inflation from calculations, further disadvantaging pensioners.

- 🚫 Critics argue that the Omnibus law, which includes the pension adjustment change, also proposes tax cuts for the wealthy, effectively shifting financial burdens from the rich to pensioners.

- 💴 The government's fiscal strategy, including pension adjustments and tax cuts, is seen as a way to save funds (almost 1% of GDP) primarily to pay off debt, raising ethical and social equity concerns.

- 🤷♂️ The debate highlights a broader discussion on fiscal responsibility, social equity, and the distribution of economic burdens across different sectors of society, questioning the fairness of penalizing pensioners to benefit wealthier individuals.

Q & A

What change is proposed for pension adjustments in the omnibus law?

-The government proposed changing the current mobility formula and adjusting pensions based on monthly inflation instead of quarterly.

Why does Milei say this change would lead to 'stealing' inflationary months from pensioners?

-Because the highest inflation months of December, January and February would not be accounted for in the new formula, leading to lower adjustments.

How does Milei justify the lower pension adjustments?

-He argues that without any changes, pensioners would lose 2 GDP percentage points, and with the changes they would only lose 1.5 points - framing it as an improvement.

What critique does Manuel Álvarez Agis make of the proposed pension changes?

-He calculates pension increases would be 35% in the quarter while inflation could be 76%, meaning pensioners would lose purchasing power.

How much would the state save from lower pension adjustments according to Agis?

-Around 0.9-1% of GDP.

How does the government plan to use the savings from lower pension adjustments?

-Mainly to pay off debt according to Milei.

What tax cut for the wealthy is also proposed in the omnibus law?

-A reduction in the personal assets tax that would cost at least 0.25% of GDP per year.

How does the author summarize the omnibus law's effects?

-Taking money from pensioners to finance tax cuts for the wealthy.

What counterargument does the author make about lowering deficits?

-Deficits can be reduced by distributing the burden across social sectors, not taking from pensioners to cut taxes for the rich.

What past pension adjustment did the author say Macri 'stole'?

-When he first took office, Macri changed the mobility formula and 'stole' a quarter's adjustment from pensioners.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

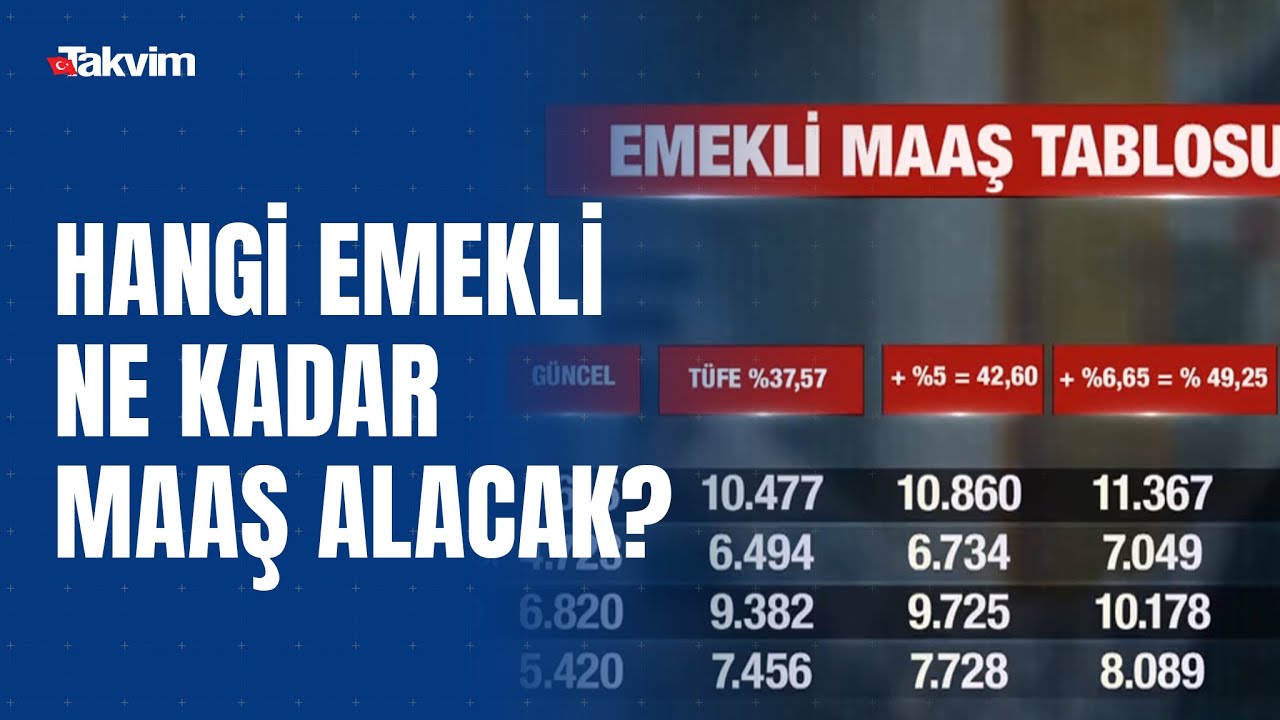

Yasanın onaylanmasının ardından hangi emekli ne kadar maaş alacak? İşte emekli maaşları...

SGK Uzmanı Tek Tek Hesapladı! En Düşük Emekli Aylığı ve Yeni Maaş Farkları

¿Qué significa que el Gobierno elimine el capítulo fiscal de la Ley Ómnibus?

Meer dan 34.000 Vlaamse leerkrachten voeren actie, "historisch" volgens vakbond

Llega más ayuda para los jubilados: ¿De cuánto será el bono?

Zam farkları ne zaman yatacak? Kimin maaşı ne kadar oldu?

5.0 / 5 (0 votes)