VIDEO TERBAIK - PENYUSUNAN LAPORAN BIAYA PRODUKSI - Metode Rata Rata dan FIFO - AKUNTANSI BIAYA

Summary

TLDRThis video, presented by Mohammad Hafiz from Universitas Negeri Semarang, explains the process costing method with a focus on 'Unbalanced Costing' and 'FIFO' (First-In, First-Out) methods. Hafiz introduces the concept of 'Work-in-Progress' products, which carry over production costs from previous periods. He then explores how to calculate equivalent units and production costs using two methods: weighted average and FIFO. Through a detailed example, Hafiz helps viewers understand the differences in cost calculation and production reporting, aiming to clarify the intricacies of the accounting processes involved.

Takeaways

- 😀 The video explains the concept of 'product in process' and its impact on cost accounting, focusing on how unfinished products from a previous period are carried over as 'beginning work-in-progress' in the next period.

- 😀 'Product in process' from the previous period contributes to the cost in the current period, which is necessary for completing the unfinished goods.

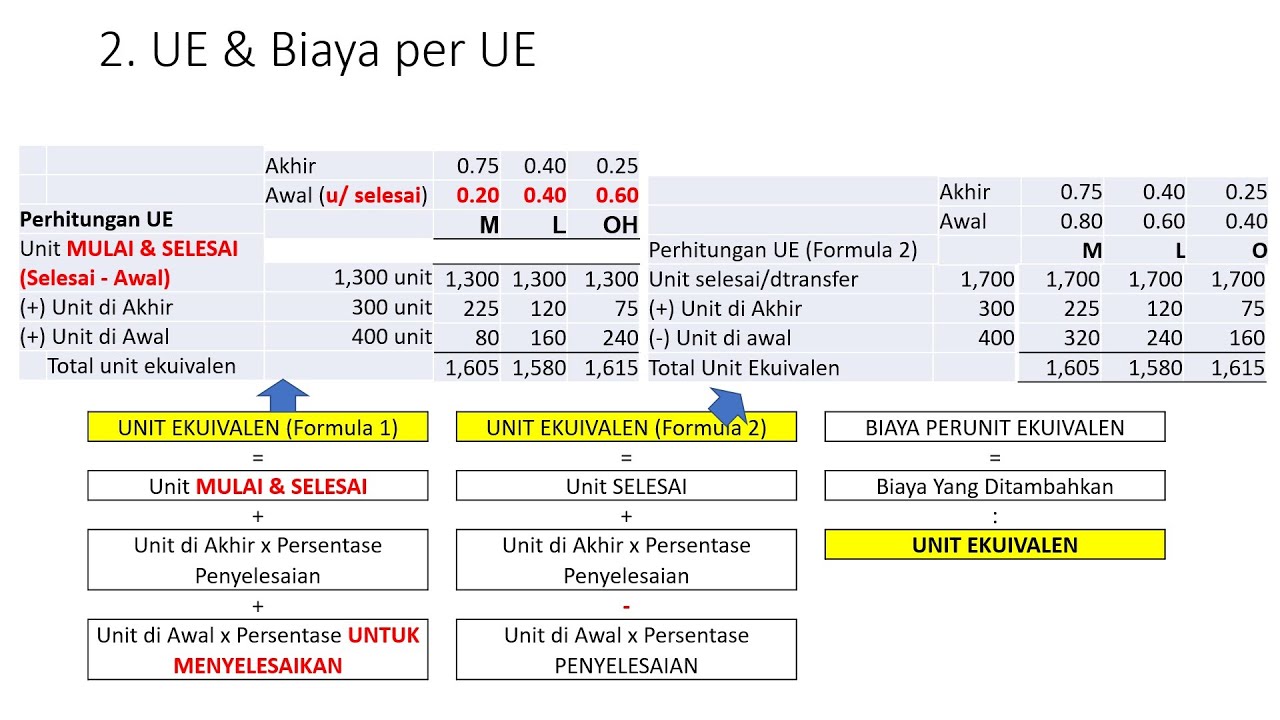

- 😀 The process of calculating equivalent units of production is essential for understanding costs, with different methods like Weighted Average and FIFO used to compute this.

- 😀 The video highlights that the 'FIFO' method prioritizes completing unfinished goods from the previous period before producing new items in the current period.

- 😀 In the FIFO method, costs related to unfinished goods are separated from new production costs, ensuring accurate allocation of costs in the next period.

- 😀 An illustration was provided to explain how units from the beginning work-in-process contribute to the final output, emphasizing the distinction between completed goods and ongoing production.

- 😀 The FIFO method involves calculating the equivalent units for both materials and conversion costs, taking into account the level of completion for the beginning work-in-process and ending work-in-process.

- 😀 Different cost accounting methods (Weighted Average vs. FIFO) affect how the costs are distributed and calculated for the units in process and those completed.

- 😀 The video clarifies that production costs for materials and conversion costs are calculated separately, and how they influence the overall cost per unit for both completed and in-process goods.

- 😀 The conclusion encourages viewers to understand both the theory behind the methods and the practical application through examples, ensuring a clear grasp of production cost allocation techniques.

Q & A

What is the main focus of the video transcript?

-The video primarily explains the unbalanced cost method in process costing, particularly how to handle beginning and ending work-in-process inventory in production accounting.

How does the video define 'beginning work-in-process' inventory?

-'Beginning work-in-process' inventory refers to products that were not completed in the previous accounting period and are carried over into the current period for further production.

What is the significance of the unbalanced cost method in the context of process costing?

-The unbalanced cost method is significant because it helps in allocating the costs of incomplete products from one period to the next. This ensures that the costs from the previous period are accurately applied to the current period's production process.

What is the relationship between beginning and ending work-in-process inventories?

-The beginning work-in-process inventory for a period is the same as the ending work-in-process inventory from the previous period. The ending work-in-process inventory for the current period will become the beginning inventory for the next period.

How are equivalent units of production calculated in this process?

-Equivalent units of production are calculated by adding the completed units to the partially completed units, where the partially completed units are multiplied by their percentage of completion.

What are the two inventory valuation methods discussed in the video?

-The two inventory valuation methods discussed are the weighted average method and the FIFO (First In, First Out) method. The video clarifies that these methods are used for accounting purposes, not production processes.

What key distinction is made between FIFO and average cost methods in inventory accounting?

-In the FIFO method, the first products entering production are the first to be completed, while in the average cost method, the costs of all units are averaged to calculate the cost per unit, regardless of when they were produced.

How does the FIFO method impact the completion of beginning work-in-process inventory?

-In FIFO, the beginning work-in-process inventory must be completed first, before production on new products for the current period begins. The costs of completing these units are calculated based on their percentage of completion from the previous period.

What is meant by the term 'production costs' in the context of the video?

-Production costs in the video refer to the costs associated with producing both completed products and work-in-process inventory. These include costs for raw materials, labor, and overhead, applied to products that are being worked on during the current accounting period.

What is the importance of understanding the cost allocation between products in process costing?

-Understanding the cost allocation is crucial because it ensures that the costs incurred during the production of both completed and unfinished goods are correctly attributed to each category. This is important for accurate financial reporting and inventory management.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード5.0 / 5 (0 votes)